Refresh

526596 LIBERTSHOE Group (T)

Liberty Shoes Ltd. LIVE on BSE (View NSE)

Add to watchlist

313.05

-3.25

-1.03%

| Volume | Prev close | Day's H/L (Rs.) | 52wk H/L (Rs.) | Mkt Cap (Rs. Cr) |

| 1,097 | 316.30 | 319.90 - 309.25 | 413.05 - 216.90 | 532.19 |

|

Day

Wk

Mn

6Mn

Yr

|

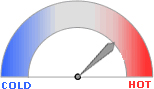

HOW HOT IS THIS STOCK?  Last 15 days data © Rediff.com |

Zoom

Zoom