India Data Center Market Attracts USD 60 Billion Investment - CBRE

By Rediff Money Desk, New Delhi Dec 11, 2024 14:52

India's data center market has attracted USD 60 billion investment in the past six years, driven by rising digital consumption and government initiatives. CBRE forecasts cumulative investment to surpass USD 100 billion by 2027.

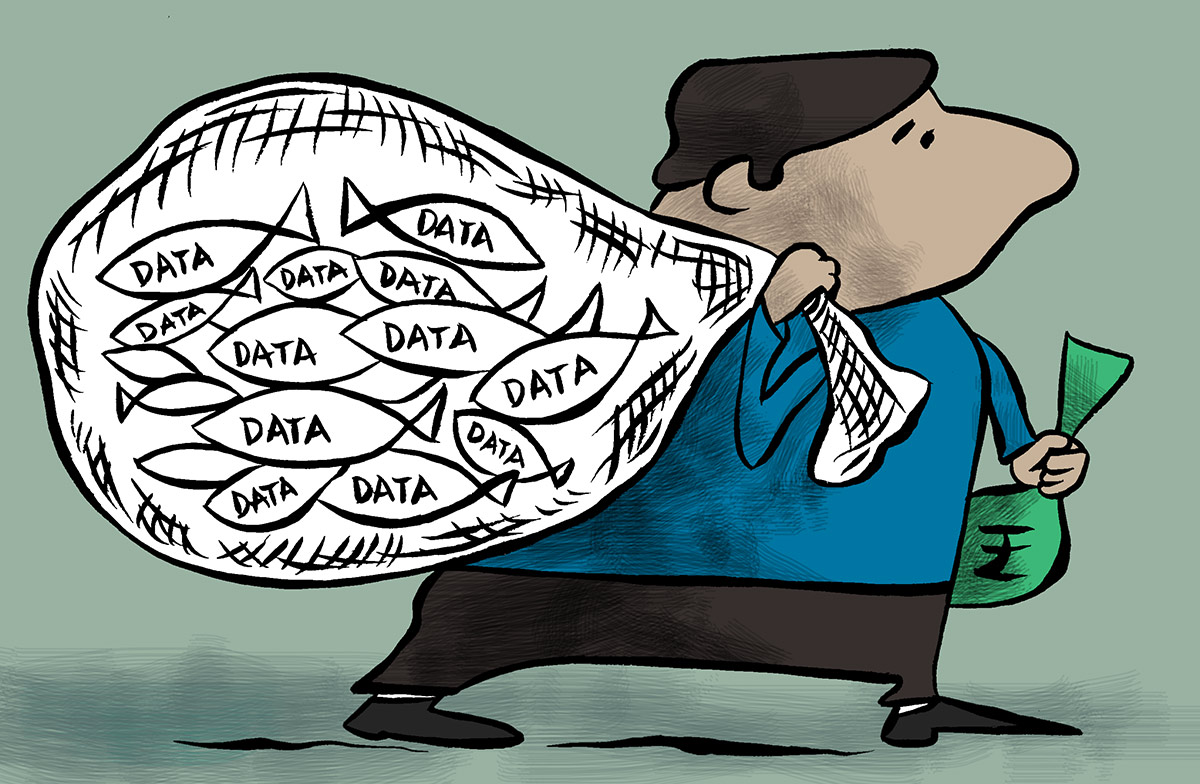

Photograph: Uttam Ghosh/Rediff.com

New Delhi, Dec 11 (PTI) India's data centre market has attracted investment commitment of USD 60 billion in the last six years and the cumulative inflow is estimated to surpass USD 100 billion by 2027-end, according to CBRE.

Real estate consultant CBRE South Asia on Wednesday released report '2024 India Data Centre Market Update'.

"The Data Centre (DC) market in India has experienced substantial investment from global operators, real estate developers, and private equity funds seeking to capitalise on the country's burgeoning market," the consultant said.

Between 2019 and 2024, India attracted investment commitments totalling more than USD 60 billion from both domestic and international investors, it added.

Maharashtra, Tamil Nadu, Telangana, Uttar Pradesh and West Bengal emerged as the leading states in terms of cumulative investment commitments.

CBRE report anticipates "India surpassing USD 100 billion in cumulative investment commitments by the end of 2027".

India's data centre market is experiencing unprecedented growth, driven by a combination of rising digital consumption, government initiatives and significant investments from both domestic and international players, said Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE.

"The demand from BFSI, technology and telecommunications sector, combined with state-level policy incentives, will continue to fuel this growth, making India one of the most attractive destinations for data centre operators in the coming years," he said.

The consultant said India's data centre capacity is projected to reach about 2,070 MW by the end of 2025. India's current data centre capacity stands at around 1,255 MW, and it is projected to further expand to around 1,600 MW by the end of 2024.

Mumbai continues to dominate data centre stock, followed by Chennai, Delhi-NCR and Bengaluru, accounting for 90 per cent of the country's total data centre stock as of September 2024.

The country's accelerated technology proliferation, digital transformation, increased internet penetration, policy enablers and growth in AI-generated data workload will pivot this growth, CBRE said.

One of the key growth drivers identified by the report is the infrastructure status accorded to the data centre sector, coupled with the 2020 Draft Data Centre Policy, which has fostered a conducive environment for operators and developers.

Furthermore, the implementation of the Digital Personal Data Protection Act (DPDPA) in 2023 has facilitated cross-border trade, and legitimate data processing and built stakeholder trust, propelling India and the digital innovation ecosystem.

Real estate consultant CBRE South Asia on Wednesday released report '2024 India Data Centre Market Update'.

"The Data Centre (DC) market in India has experienced substantial investment from global operators, real estate developers, and private equity funds seeking to capitalise on the country's burgeoning market," the consultant said.

Between 2019 and 2024, India attracted investment commitments totalling more than USD 60 billion from both domestic and international investors, it added.

Maharashtra, Tamil Nadu, Telangana, Uttar Pradesh and West Bengal emerged as the leading states in terms of cumulative investment commitments.

CBRE report anticipates "India surpassing USD 100 billion in cumulative investment commitments by the end of 2027".

India's data centre market is experiencing unprecedented growth, driven by a combination of rising digital consumption, government initiatives and significant investments from both domestic and international players, said Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE.

"The demand from BFSI, technology and telecommunications sector, combined with state-level policy incentives, will continue to fuel this growth, making India one of the most attractive destinations for data centre operators in the coming years," he said.

The consultant said India's data centre capacity is projected to reach about 2,070 MW by the end of 2025. India's current data centre capacity stands at around 1,255 MW, and it is projected to further expand to around 1,600 MW by the end of 2024.

Mumbai continues to dominate data centre stock, followed by Chennai, Delhi-NCR and Bengaluru, accounting for 90 per cent of the country's total data centre stock as of September 2024.

The country's accelerated technology proliferation, digital transformation, increased internet penetration, policy enablers and growth in AI-generated data workload will pivot this growth, CBRE said.

One of the key growth drivers identified by the report is the infrastructure status accorded to the data centre sector, coupled with the 2020 Draft Data Centre Policy, which has fostered a conducive environment for operators and developers.

Furthermore, the implementation of the Digital Personal Data Protection Act (DPDPA) in 2023 has facilitated cross-border trade, and legitimate data processing and built stakeholder trust, propelling India and the digital innovation ecosystem.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.99 (+ 1.52)

- 58018780

- Mishtann Foods L

- 9.17 ( -5.17)

- 27555831

- Shree Securities

- 0.42 ( -6.67)

- 27309223

- AvanceTechnologies

- 0.90 ( -4.26)

- 25537567

- Rajnish Wellness

- 1.69 ( -2.87)

- 19267607

MORE NEWS

Zepto Cuts Losses, Revenue Doubles in FY24

Quick commerce firm Zepto narrowed its losses to Rs 1,248.6 crore in FY24, while...

KKR Sells 2.6% Stake in India Grid Trust for Rs...

Private equity firm KKR has sold a 2.6% stake in India Grid Trust for Rs 277 crore...

MFN Clause Suspension: India Needs Strategic...

Switzerland's suspension of the MFN clause in its tax treaty with India highlights the...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.