CREDAI Demands Tax Breaks to Boost Housing Demand

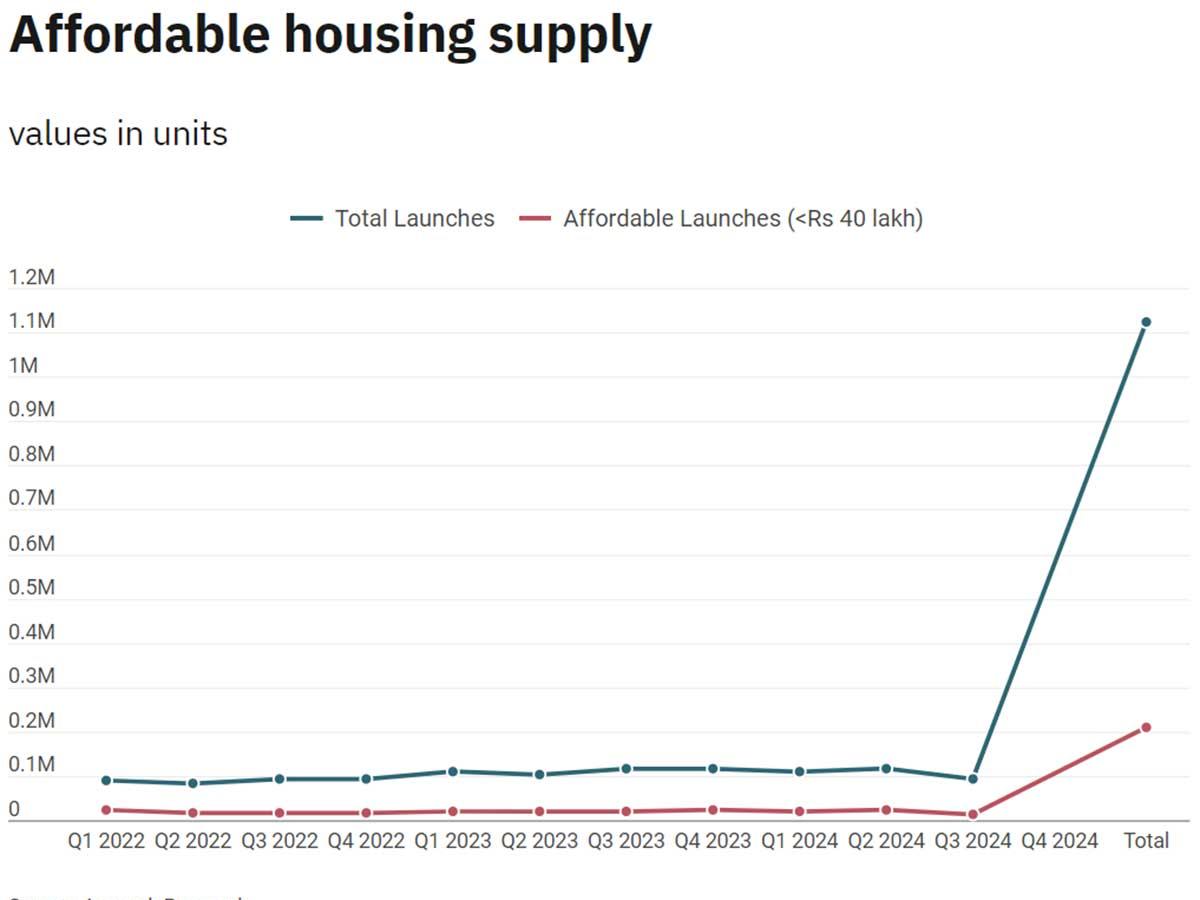

CREDAI, which is celebrating 25th foundation day, also demanded that the definition of affordable housing should be revised, increasing the cap from Rs 45 lakh to at least Rs 75-80 lakh.

Addressing a press conference here, CREDAI President Boman Irani suggested that the government should charge 1 per cent GST on under-construction housing properties, costing up to Rs 75-80 lakh each, to boost demand for affordable and mid-income housing.

At present, there is 1 per cent GST on under-construction affordable homes priced up to Rs 45 lakh each.

Under-construction homes costing above Rs 45 lakh per unit attract 5 per cent GST. Developers can not avail of input tax credit.

"Affordable housing definition came up in 2017 which put a cap of Rs 45 lakh. If we just consider annual inflation since 2017, this cap needs to be revised upwards to Rs 75-80 lakh," he said.

Irani said prospective homebuyers will get benefit of lower GST if the affordable housing definition is changed.

The CREDAI President said the government should consider another option and completely do away with the price cap in definition of affordable housing and the only criteria should be the existing carpet area of 60 metres in metros and 90 metres in non-metros.

Irani also stressed on "putting more money in the hands of people by reducing the taxes".

CREDAI's President-Elect Shekhar Patel said there should be a 100 per cent deduction on interest paid on home loans instead of the current exemption of Rs 2 lakh.

Irani said the 100 per cent deduction will accelerate demand in a big way.

Under Section 24 of the Income Tax Act, the deduction allowed on interest on loans for self-occupied property is limited to Rs 2 lakh.

CREDAI Chairman Manoj Gaur pointed out that builders devote 12-18 months to obtaining various government approvals to develop real estate projects.

"There is a need to improve ease of doing business," he added.

Established in 1999, Confederation of Real Estate Developers' Associations of India (CREDAI) has more than 13,000 members from across the country.

You May Like To Read

MORE NEWS

Wipro restructures its Global Business Lines to cater to client needs, emphasizing AI,...

The Madras Chamber of Commerce welcomes the Tamil Nadu budget, highlighting its...

Tamil Nadu's 2025-26 Budget includes a Rs 20,000 subsidy for 2,000 gig workers to buy...

Tripura government signs MoU with IHCL to convert Pushpabanta Palace into a 5-star Taj...

Brigade Enterprises launches 'Brigade Eternia' in Yelahanka, Bengaluru, aiming for Rs...

Signature Global plans to invest Rs 4,000 crore in two new housing projects in...

Get the latest commodity prices in India for rice, jowar, jaggery, spices, potatoes,...

A R Unnikrishnan, Managing Director of Saint-Gobain India, has been elected as the...

Grundfos Pumps India commends the Tamil Nadu budget's emphasis on water security and...

Drone maker ideaForge plans to increase R&D spending this fiscal year, as it develops...