Emkay Launches New AIF, Targets Rs 500 Crore

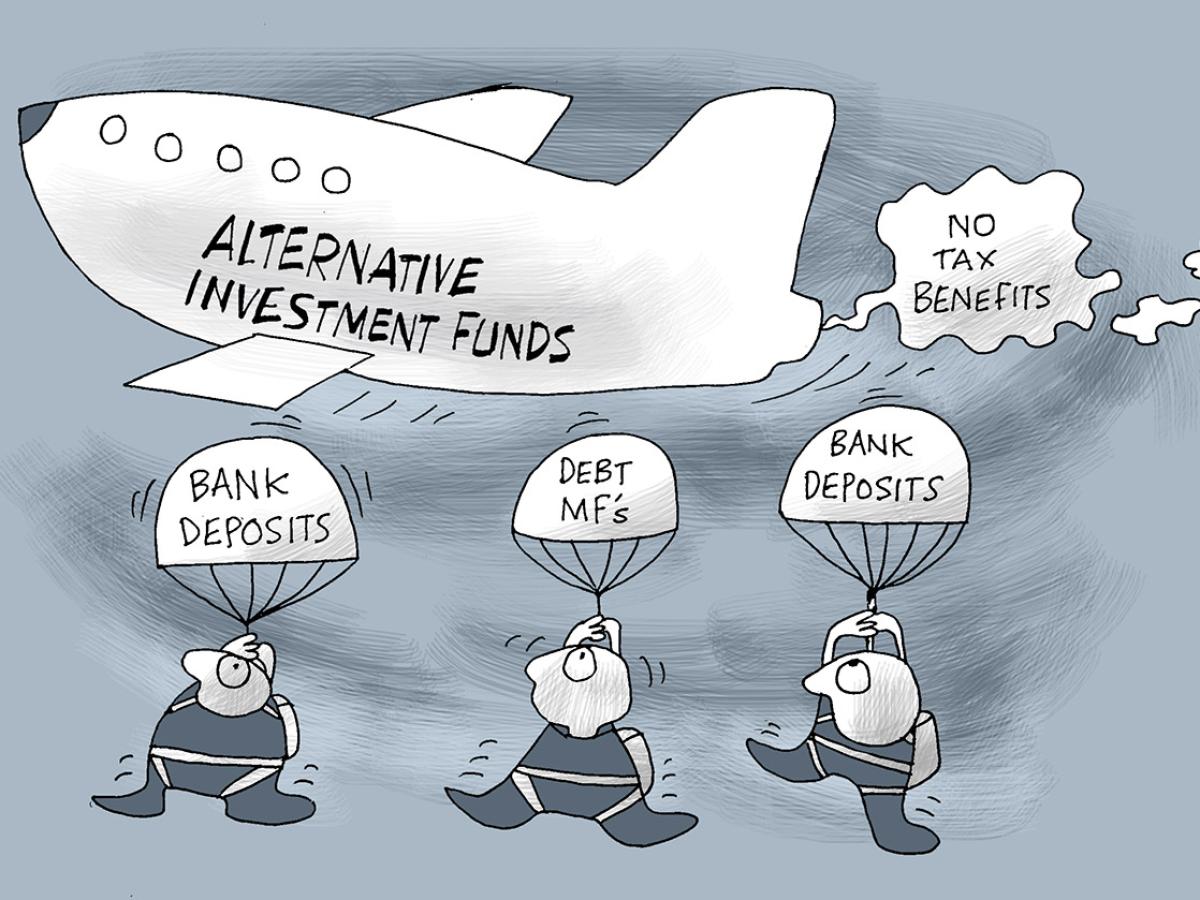

The open-ended category III Alternative Investment Fund (AIF) -- Emkay Capital Builder Fund-- is hoping to generate long-term capital appreciation for investors from a portfolio of equity and equity-related securities. This will be a multi-cap portfolio of around 20-25 stocks.

"Emkay Capital Builder AIF caters to the growing preference for Alternative Investment Funds as an investment avenue amongst UHNIs in India. Our bottom-up stock-picking strategy will help in formulating a winning AIF portfolio backed by the robust E-Qual model to mitigate risks related to management quality," Sachin Shah, Executive Director and Fund Manager, Emkay Investment Managers Ltd, said.

In a webinar on opportunities in AIFs, the portfolio management firm said," EIML is aiming to raise Rs 500 crore from the latest AIF in the coming 6 to 8 months".

Earlier, Emkay Investment Managers, the asset management arm of Emkay Global Financial Services, raised over Rs 450 crore with the four previous series of its close-ended AIFs and returned more than Rs 740 crore to the investors before the stipulated time.

EIML has a portfolio management strategy under the name of Emkay Capital Builder PMS which is similar to the AIF offering. The average market capital of the existing PMS strategy is Rs 2.7 lakh crore and about 60 per cent of the PMS' portfolio is currently formulated of stocks from the financial services, pharmaceuticals, and IT sectors. Currently, 70 per cent of the strategy's composition is large-caps.

Over the past 11 years, since its inception in April 2013, Emkay Capital Builder PMS has consistently achieved a compounded annual growth rate (CAGR) of 16.75 per cent.

You May Like To Read

MORE NEWS

The benchmark Sensex plummeted 1,235 points on Tuesday, hitting a seven-month low due...

apna.co partners with Chhattisgarh government to launch a career portal connecting...

The World Economic Forum has announced the Schwab Foundation Awards, recognizing 18...

WedMeGood founder Mehak Shahani calls for regulations in the wedding industry,...

The Indian rupee closed lower against the US dollar on Tuesday, impacted by a sell-off...

Waaree Energies has supplied 132.3 MWp of solar modules to Radiance Renewables for a...

Greenpeace calls for taxing the super-rich to fund a just and green future at the World...

India's civil aviation ministry is exploring a regulatory sandbox for advanced air...

JetSetGo collaborates with SkyDrive and Eve Air Mobility to launch urban air mobility...

SEBI chair Madhabi Puri Buch proposes pre-listing trading for IPO shares to regulate...