India's GDP to Grow 6.6% in FY25: RBI Report

The Reserve Bank has released the December 2024 issue of the Financial Stability Report (FSR), which reflects the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC) on the resilience of the Indian financial system and risks to financial stability.

"The soundness of scheduled commercial banks (SCBs) has been bolstered by strong profitability, declining non-performing assets and adequate capital and liquidity buffers. Return on assets (RoA) and return on equity (RoE) are at decadal highs, while the gross non-performing asset (GNPA) ratio has fallen to a multi-year low," the report said.

It also said that macro stress tests demonstrate that most SCBs have adequate capital buffers relative to the regulatory minimum threshold even under adverse stress scenarios. Stress tests also validate the resilience of mutual funds and clearing corporations.

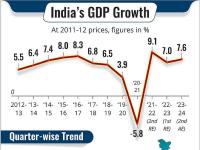

On the economy, FSR said during the first half of 2024-25, real GDP growth (y-o-y) moderated to 6 per cent from 8.2 per cent and 8.1 per cent growth recorded during H1 and H2 of 2023-24, respectively.

"Despite this recent deceleration, structural growth drivers remain intact. Real GDP

growth is expected to recover in Q3 and Q4 of 2024-25 supported by pick up in domestic drivers, mainly public consumption and investment, strong service exports and easy financial conditions," the RBI said.

On inflation, the report said that going forward, the disinflationary effect of a bumper kharif harvest and the rabi crop prospects are expected to soften prices of foodgrains.

On the flipside, the rising frequency of extreme weather events continues to pose risks for food inflation dynamics.

Persisting geopolitical conflicts and geo-economic fragmentation can also impose upside pressures on global supply chain and commodity prices.

You May Like To Read

MORE NEWS

TCS announced Sudeep Kunnumal as the new Chief Human Resources Officer, succeeding...

The ICAI may review IndusInd Bank's financial statements after discrepancies in...

India's commerce ministry has assured exporters of protection against US tariff...

HDFC Mutual Fund has increased its stake in IndusInd Bank to over 5%, buying 15.92 lakh...

Tamil Nadu Finance Minister Thangam Thennarasu will present the fifth Budget of the DMK...

Citi report analyzes Starlink's tie-ups with Jio and Bharti, suggesting satcom services...

Ajay Singh, SpiceJet's MD, has sold nearly 1% stake in the budget airline for Rs 52...

LG Electronics India gets Sebi's nod to float a Rs 15,000 crore IPO, marking the second...

Patanjali Ayurved and DS Group will acquire Magma General Insurance from Sanoti...

Canara Bank proposes to raise up to Rs 4,000 crore through Basel III compliant Tier II...