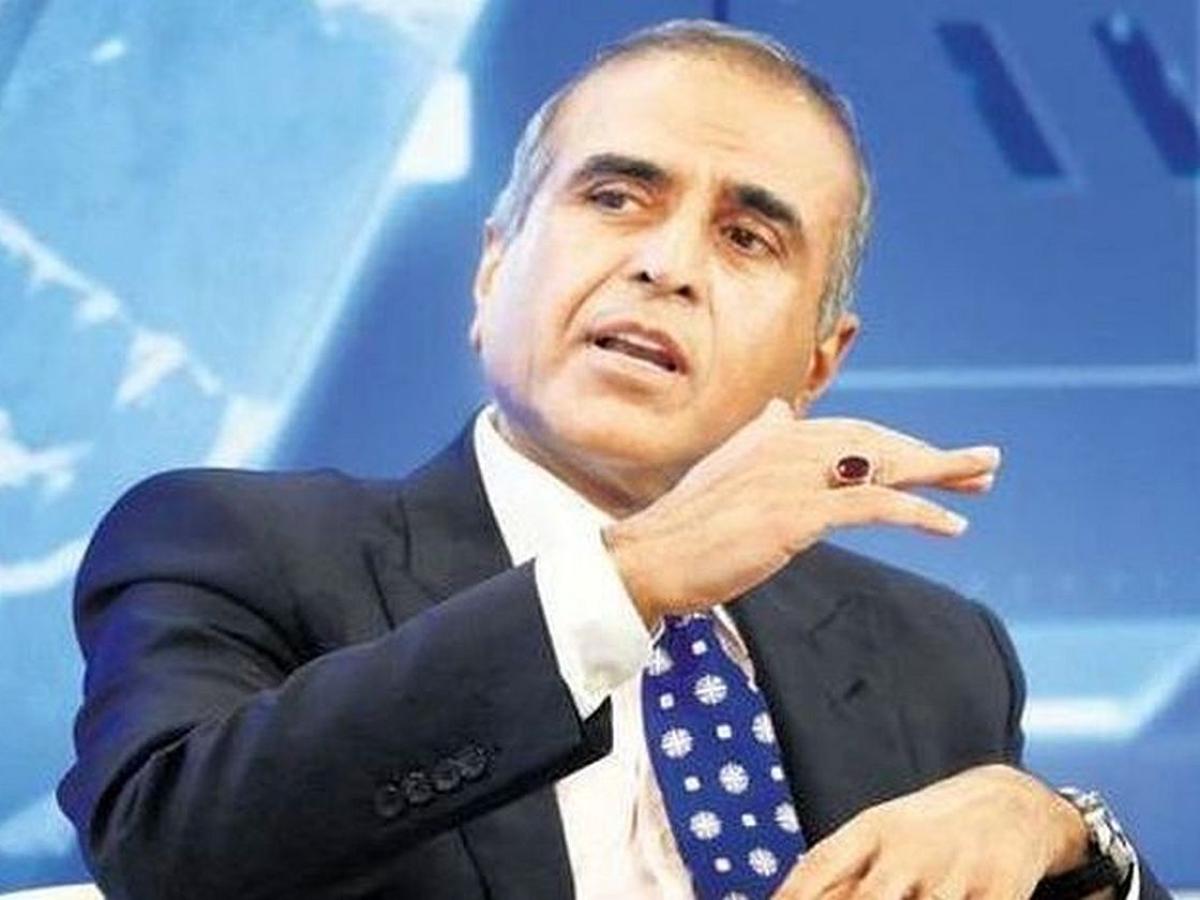

Sunil Mittal's ICIL Sells Airtel Shares Worth Rs 8,485 Cr

Bharti Airtel's promoter firm, Bharti Telecom -- a joint venture between Sunil Mittal family's investment arm and Singapore telecom major Singtel -- has acquired about 1.2 crore shares, or about 24 per cent, of the total sale by Indian Continent Investment Ltd (ICIL) in the block deal.

With this acquisition of Airtel shares, Bharti Telecom's stake in Bharti Airtel has increased to 40.47 per cent from 40.33 per cent in November.

"ICIL has today sold around 0.84 per cent shareholding (around 5.11 Cr. shares) in Airtel through a market transaction, for an aggregate amount of around Rs 8,485.11 Cr. Bharti Telecom Limited, the promoter of Airtel, anchored the trade by acquiring around 1.20 crore shares (around 24 per cent of ICIL's sale of today), helping the overall book to be allocated only to key marquee long only names, both global and domestic," Airtel said in the filing.

Bharti Telecom had acquired around 1.2 per cent stake (about 7.31 crore shares) in Airtel from ICIL in November 2024.

"With this, Bharti Telecom now holds around 40.47 per cent of Airtel, reinforcing its previously stated intent of strengthening its position as the principal vehicle to hold controlling stake in Airtel, remaining focused on gradually increasing its stake while maintaining a prudent leverage profile as it does so," the filing said.

The shares were picked up by a clutch of domestic mutual funds (MFs), foreign investors and an insurance company.

WhiteOak Capital Mutual Fund (MF), ICICI Prudential MF, Goldman Sachs, GQG Partners, Abu Dhabi Investment Authority, Fidelity Investments, International Bank for Reconstruction and Development, Nordea Funds, JP Morgan, and National Pension System Trust were the buyers of Bharti Airtel's shares.

Melbourne-based AustralianSuper, Vanguard, Reliance Trust Company and SBI Life Insurance Company, among others were also entities who have picked up shares of Gurugram-headquartered Bharti Airtel, according to the block deal data on the NSE.

You May Like To Read

MORE NEWS

Indian fruit exports have increased by 47.5% in the last five years, driven by free...

INOX Air Products commissions its first green hydrogen plant at Asahi India Glass...

Sebi has extended the deadline for regulated entities to adopt a cybersecurity...

Sebi postpones penalties for breaching intra-day position limits for index derivatives,...

Nayara Energy, India's largest private fuel retailer, has appointed Deepesh Baxi as its...

Get the latest bullion rates for gold and silver in India. Check today's prices for...

Federal Bank has signed an agreement to acquire an additional 4% stake in Ageas Federal...

India imported gold from 48 countries in 2023-24. Learn about import duties, FTA...

India's proposed free trade agreement with the UK is expected to significantly boost...

Indian stock markets surged over 5% in FY25, boosting investor wealth by Rs 25.90 lakh...