Alternative Assets Surge: PMS & AIFs Outpace Mutual Funds

By Rediff Money Desk, NEWDELHI Nov 01, 2023 16:23

India's alternative investment industry, comprising PMS and AIFs, has surged twice as fast as mutual funds in the past 5 years, reaching Rs 13.74 lakh crore AUM. Learn more about the growth drivers and future prospects.

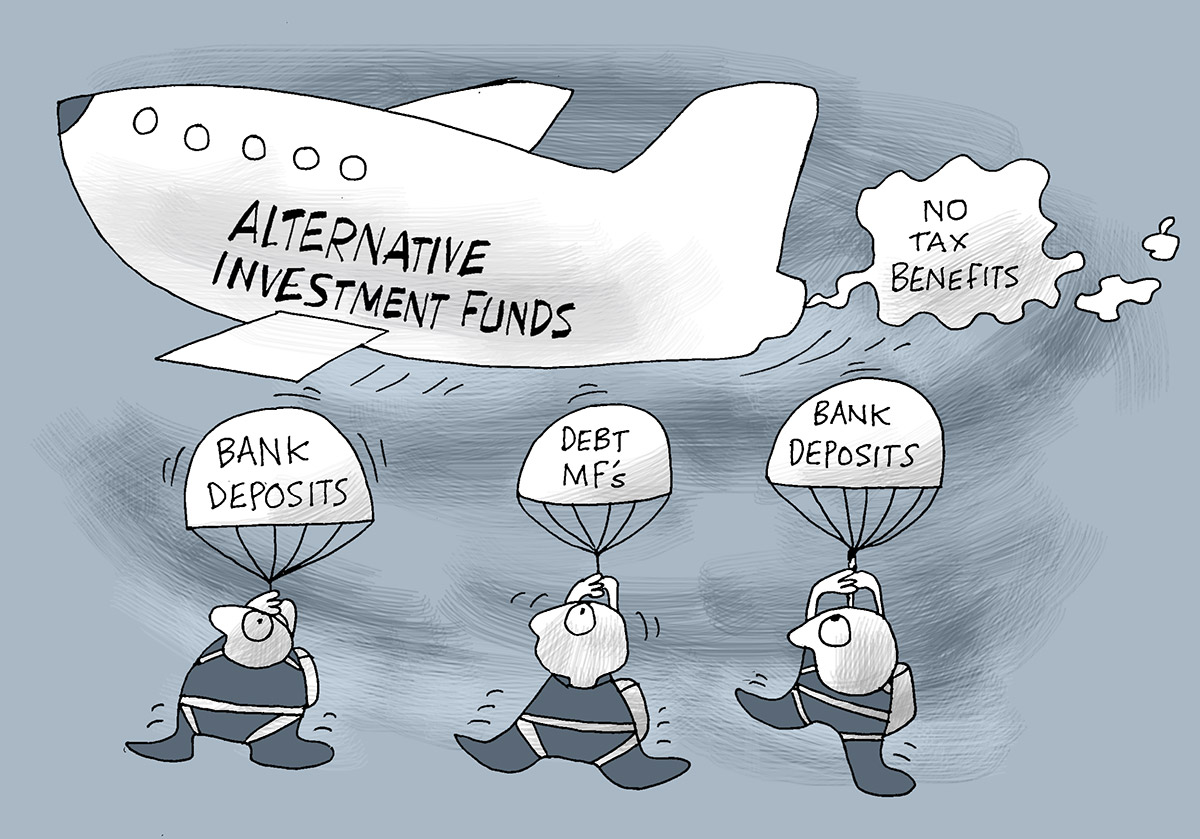

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Nov 1 (PTI) The country's alternative investment industry, comprising Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs), has witnessed remarkable growth in the last five years, outpacing traditional mutual funds, the latest revealed data by PMS Bazaar on Wednesday.

Over the past five years (from June FY19 to June FY24), the alternative investment industry has witnessed a Compound Annual Growth Rate (CAGR) of 26 per cent, with assets under management (AUM) reaching Rs 13.74 lakh crore as of June FY24, according to the data.

This growth rate is more than double that of the mutual fund industry, which recorded a CAGR of 13 per cent with an AUM of Rs 46.63 lakh crore as of August 2023.

The PMS Bazaar said that the surge in the alternative investment industry could be attributed to several factors such as rising income levels that have broadened accessibility to alternative investments, catering to a diverse range of High-Net-Worth Individuals (HNIs) and Ultra-High-Net-Worth Individuals (UHNIs).

Additionally, the proliferation of comprehensive information about alternate investments and the appeal of diversification and higher returns has driven the industry's rapid expansion, it added.

PMS Bazaar is a platform for investors and intermediaries looking for PMS and AIF information, analytics, and comparisons to help investors create wealth using this wealth-building medium.

PMS and AIF structures are gaining massive traction and the assets base of these products is expected to grow to Rs 43.64 lakh crore by 2028.

Pallavarajan R, Founder & Director, PMS Bazaar said that India's rising affluence is driving HNIs to alternative investments --PMSs and AIFs-- which offer lucrative opportunities, customized solutions, and transparent structures.

"AUM in these products (PMSs and AIFs) has grown more than three times in five years, twice as fast as mutual funds. If the same pace of investments continues, in a favourable market, we anticipate the PMS & AIF industry to grow to Rs 43.64 lakh crore by 2028," he added.

Alternative products are becoming an essential part of the investment portfolios of India's wealthy.

Among alternative investments, AIFs have emerged as trailblazers, boasting a CAGR of 36 per cent over the last five years.

Category II AIFs, including venture capital, private equity, real estate funds, and private credit, have experienced robust growth, fueled by heightened interest from HNIs and UHNIs.

Despite regulatory changes, including an increase in the minimum investment requirement, the PMS industry exhibited resilience, showcasing a strong CAGR of 16 per cent.

According to the industry data, the PMS industry's AUM stood at Rs 5.29 lakh crore (excluding EPFO/PF/Advisory figures) as of July 2023.

Sunil Rohokale, MD and CEO, of ASK Group said, "The opportunity for alternates is untapped and is at a very nascent stage, with the potential to grow beyond USD 300 billion. Investors will favour reputed, well-established, and institutionalized players with a good track record to be a part of their growth journey. "

Looking ahead, PMS Bazaar said that the PMS and AIFs industry is expected to continue its growth at a rapid pace in the coming years.

Further, the recent changes in the tax rules in debt mutual funds (where the indexation benefit of LTCG was removed) and insurance (where maturity proceeds on life insurance policies with over Rs 5 lakh as premium will be taxed) are likely to play a vital role in propelling the growth in the alternative assets industry.

Further, as HNI investors become more aware of the potential of alternate investments in diversification across asset classes and wealth creation, the demand for such products is expected to rise.

Over the past five years (from June FY19 to June FY24), the alternative investment industry has witnessed a Compound Annual Growth Rate (CAGR) of 26 per cent, with assets under management (AUM) reaching Rs 13.74 lakh crore as of June FY24, according to the data.

This growth rate is more than double that of the mutual fund industry, which recorded a CAGR of 13 per cent with an AUM of Rs 46.63 lakh crore as of August 2023.

The PMS Bazaar said that the surge in the alternative investment industry could be attributed to several factors such as rising income levels that have broadened accessibility to alternative investments, catering to a diverse range of High-Net-Worth Individuals (HNIs) and Ultra-High-Net-Worth Individuals (UHNIs).

Additionally, the proliferation of comprehensive information about alternate investments and the appeal of diversification and higher returns has driven the industry's rapid expansion, it added.

PMS Bazaar is a platform for investors and intermediaries looking for PMS and AIF information, analytics, and comparisons to help investors create wealth using this wealth-building medium.

PMS and AIF structures are gaining massive traction and the assets base of these products is expected to grow to Rs 43.64 lakh crore by 2028.

Pallavarajan R, Founder & Director, PMS Bazaar said that India's rising affluence is driving HNIs to alternative investments --PMSs and AIFs-- which offer lucrative opportunities, customized solutions, and transparent structures.

"AUM in these products (PMSs and AIFs) has grown more than three times in five years, twice as fast as mutual funds. If the same pace of investments continues, in a favourable market, we anticipate the PMS & AIF industry to grow to Rs 43.64 lakh crore by 2028," he added.

Alternative products are becoming an essential part of the investment portfolios of India's wealthy.

Among alternative investments, AIFs have emerged as trailblazers, boasting a CAGR of 36 per cent over the last five years.

Category II AIFs, including venture capital, private equity, real estate funds, and private credit, have experienced robust growth, fueled by heightened interest from HNIs and UHNIs.

Despite regulatory changes, including an increase in the minimum investment requirement, the PMS industry exhibited resilience, showcasing a strong CAGR of 16 per cent.

According to the industry data, the PMS industry's AUM stood at Rs 5.29 lakh crore (excluding EPFO/PF/Advisory figures) as of July 2023.

Sunil Rohokale, MD and CEO, of ASK Group said, "The opportunity for alternates is untapped and is at a very nascent stage, with the potential to grow beyond USD 300 billion. Investors will favour reputed, well-established, and institutionalized players with a good track record to be a part of their growth journey. "

Looking ahead, PMS Bazaar said that the PMS and AIFs industry is expected to continue its growth at a rapid pace in the coming years.

Further, the recent changes in the tax rules in debt mutual funds (where the indexation benefit of LTCG was removed) and insurance (where maturity proceeds on life insurance policies with over Rs 5 lakh as premium will be taxed) are likely to play a vital role in propelling the growth in the alternative assets industry.

Further, as HNI investors become more aware of the potential of alternate investments in diversification across asset classes and wealth creation, the demand for such products is expected to rise.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Cipla Faces Rs 773 Crore I-T Demand: Details -...

Cipla receives a Rs 773.44 crore demand notice from the income tax department for...

EV Segment Growth Needs Long-Term Policy...

Lohia CEO Ayush Lohia emphasizes the need for long-term policy support, including FAME...

Gold Price Rises Rs 550, Silver Jumps Rs 400 |...

Gold prices surged by Rs 550 to Rs 75,700 per 10 grams on Tuesday, driven by strong...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.