Ambuja Cements Q3 Profit Doubles to Rs 1,089 cr

By Rediff Money Desk, NEWDELHI Jan 31, 2024 14:52

Ambuja Cements Q3 profit surged to Rs 1,089.55 crore, driven by higher sales and lower costs. Revenue rose 2.8% to Rs 8,128.80 crore. The company is expanding its capacity to 110 MTPA by 2028.

New Delhi, Jan 31 (PTI) Ambuja Cements Ltd on Wednesday reported nearly a two-fold rise in its consolidated net profit to Rs 1,089.55 crore for the third quarter ended December 2023, helped by higher sales and lower fuel and raw material costs.

The company had clocked a net profit of Rs 487.88 crore in the October-December quarter a year ago, according to a regulatory filing by Ambuja Cements, now a part of the Adani Group.

Its consolidated revenue from operations increased 2.8 per cent to Rs 8,128.80 crore during the quarter under review. It was Rs 7,906.74 crore in the corresponding period last fiscal.

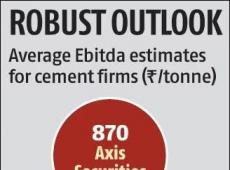

"The business has seen notable progress in every financial matrix. EBITDA (earnings before interest, taxes, depreciation, and amortisation), EBITDA PMT and EBITDA margins have grown higher than revenue growth given the sharp improvement in operating costs. EBITDA margin at 21.3 per cent for Q3 FY24 is the highest in the last 10 quarters," said an earning statement from Ambuja Cements.

During the quarter, its kiln fuel cost was "down by 25 per cent", it added.

The consolidated results of Ambuja Cements include the financial performance of its step-down firm ACC Ltd, where it owns around 51 per cent stake.

Ambuja Cements' total expenses fell 5.24 per cent to Rs 6,884.54 crore from Rs 7,265.75 crore a year ago.

Its total consolidated revenue in the December quarter rose 3.72 per cent to Rs 8,322.45 crore.

On a standalone basis, Ambuja Cements reported an increase of 39.21 per cent in its net profit to Rs 513.68 crore for the December quarter. It was Rs 368.99 crore in the year-ago quarter.

Its standalone revenue from operations increased 7.53 per cent to Rs 4,439.52 crore against Rs 4,128.52 crore earlier.

Ambuja Cements consolidated sales volume, which also includes ACC, inched up 2.9 per cent to 14.1 million tonnes (MT).

On a standalone basis, Ambuja Cements' own sales volume increased 6.5 per cent to 8.2 MT in the December quarter.

Ambuja Cements Whole Time Director and CEO Ajay Kapur said: "Our performance is a reflection of our resilience and focused efforts. Our pursuit of excellence continues to propel us towards setting new benchmarks in our steady growth".

Over the expansion, the Adani group firm said 32 MTPA additional cement capacity is under implementation at various stages, which will take the total capacity to 110 MTPA after completion. It will be 80 per cent of 140 MTPA (million tonnes per annum) of the targeted capacity by FY2028 by the company.

During the December quarter, Ambuja Cements completed the acquisition of Sanghi Industries and Asian Concretes and Cements by its subsidiary ACC.

"These acquisitions reinforce the Adani Group's market leadership and take its cement capacity to 77.4 MTPA, a jump of 15 per cent from last year," it said.

Adani Cement is the second largest player in the segment, with Aditya Birla group firm UltraTech leading the sector with a consolidated capacity of 138.39 MTPA.

Shares of Ambuja Cements on Wednesday were trading at Rs 570.75 apiece on BSE, up 0.04 per cent from the previous close.

The company had clocked a net profit of Rs 487.88 crore in the October-December quarter a year ago, according to a regulatory filing by Ambuja Cements, now a part of the Adani Group.

Its consolidated revenue from operations increased 2.8 per cent to Rs 8,128.80 crore during the quarter under review. It was Rs 7,906.74 crore in the corresponding period last fiscal.

"The business has seen notable progress in every financial matrix. EBITDA (earnings before interest, taxes, depreciation, and amortisation), EBITDA PMT and EBITDA margins have grown higher than revenue growth given the sharp improvement in operating costs. EBITDA margin at 21.3 per cent for Q3 FY24 is the highest in the last 10 quarters," said an earning statement from Ambuja Cements.

During the quarter, its kiln fuel cost was "down by 25 per cent", it added.

The consolidated results of Ambuja Cements include the financial performance of its step-down firm ACC Ltd, where it owns around 51 per cent stake.

Ambuja Cements' total expenses fell 5.24 per cent to Rs 6,884.54 crore from Rs 7,265.75 crore a year ago.

Its total consolidated revenue in the December quarter rose 3.72 per cent to Rs 8,322.45 crore.

On a standalone basis, Ambuja Cements reported an increase of 39.21 per cent in its net profit to Rs 513.68 crore for the December quarter. It was Rs 368.99 crore in the year-ago quarter.

Its standalone revenue from operations increased 7.53 per cent to Rs 4,439.52 crore against Rs 4,128.52 crore earlier.

Ambuja Cements consolidated sales volume, which also includes ACC, inched up 2.9 per cent to 14.1 million tonnes (MT).

On a standalone basis, Ambuja Cements' own sales volume increased 6.5 per cent to 8.2 MT in the December quarter.

Ambuja Cements Whole Time Director and CEO Ajay Kapur said: "Our performance is a reflection of our resilience and focused efforts. Our pursuit of excellence continues to propel us towards setting new benchmarks in our steady growth".

Over the expansion, the Adani group firm said 32 MTPA additional cement capacity is under implementation at various stages, which will take the total capacity to 110 MTPA after completion. It will be 80 per cent of 140 MTPA (million tonnes per annum) of the targeted capacity by FY2028 by the company.

During the December quarter, Ambuja Cements completed the acquisition of Sanghi Industries and Asian Concretes and Cements by its subsidiary ACC.

"These acquisitions reinforce the Adani Group's market leadership and take its cement capacity to 77.4 MTPA, a jump of 15 per cent from last year," it said.

Adani Cement is the second largest player in the segment, with Aditya Birla group firm UltraTech leading the sector with a consolidated capacity of 138.39 MTPA.

Shares of Ambuja Cements on Wednesday were trading at Rs 570.75 apiece on BSE, up 0.04 per cent from the previous close.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.