Bajaj Housing Finance IPO Oversubscribed 63.60 Times

By Rediff Money Desk, New Delhi Sep 11, 2024 19:23

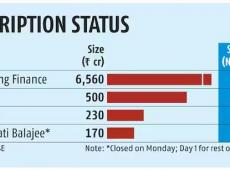

Bajaj Housing Finance's Rs 6,560 crore IPO was oversubscribed 63.60 times, driven by strong institutional demand. QIBs portion saw a staggering 209 times subscription.

Illustration: Dominic Xavier/Rediff.com

New Delhi, Sep 11 (PTI) The Rs 6,560-crore initial public offer of Bajaj Housing Finance Ltd received 63.60 times subscription on Wednesday, the last day of bidding, amid overwhelming participation from institutional buyers.

The initial share sale got bids for 46,27,48,43,832 shares against 72,75,75,756 shares on offer, according to NSE data.

The Qualified Institutional Buyers (QIBs) part fetched subscribed a staggering 209.36 times while the non-institutional investors quota received 41.50 times subscription. The category for Retail Individual Investors (RIIs) obtained 7.02 times subscription.

The initial public offer (IPO) of Bajaj Housing Finance got fully subscribed within hours of opening for bidding on Monday and ended the day with 2 times subscription.

Bajaj Housing Finance on Friday said it has collected Rs 1,758 crore from anchor investors.

The price band for the offer is Rs 66-70 per share.

The IPO has a fresh issue of equity shares of up to Rs 3,560 crore and an offer-for-sale (OFS) of equity shares to the tune of Rs 3,000 crore by parent Bajaj Finance.

The share sale is being conducted to comply with the Reserve Bank of India's (RBI) regulations, which require upper-layer non-banking finance companies to be listed on stock exchanges by September 2025.

Proceeds from the fresh issue will be used to augment the company's capital base to meet future capital requirements.

It is a non-deposit-taking housing finance company registered with the National Housing Bank in September 2015. The firm offers financial solutions for purchasing and renovating residential and commercial properties.

It has been identified and categorised as an "upper layer" NBFC by the RBI in India and its comprehensive mortgage products include home loans, loans against property, lease rental discounting and developer financing.

Aadhar Housing Finance and India Shelter Finance are the two housing finance companies that have been listed on the stock exchanges in recent months.

Kotak Mahindra Capital Company Ltd, BofA Securities India Ltd, SBI Capital Markets Ltd, Goldman Sachs (India) Securities Private Ltd, Axis Capital and JM Financial Ltd are the book-running lead managers to the offer.

The initial share sale got bids for 46,27,48,43,832 shares against 72,75,75,756 shares on offer, according to NSE data.

The Qualified Institutional Buyers (QIBs) part fetched subscribed a staggering 209.36 times while the non-institutional investors quota received 41.50 times subscription. The category for Retail Individual Investors (RIIs) obtained 7.02 times subscription.

The initial public offer (IPO) of Bajaj Housing Finance got fully subscribed within hours of opening for bidding on Monday and ended the day with 2 times subscription.

Bajaj Housing Finance on Friday said it has collected Rs 1,758 crore from anchor investors.

The price band for the offer is Rs 66-70 per share.

The IPO has a fresh issue of equity shares of up to Rs 3,560 crore and an offer-for-sale (OFS) of equity shares to the tune of Rs 3,000 crore by parent Bajaj Finance.

The share sale is being conducted to comply with the Reserve Bank of India's (RBI) regulations, which require upper-layer non-banking finance companies to be listed on stock exchanges by September 2025.

Proceeds from the fresh issue will be used to augment the company's capital base to meet future capital requirements.

It is a non-deposit-taking housing finance company registered with the National Housing Bank in September 2015. The firm offers financial solutions for purchasing and renovating residential and commercial properties.

It has been identified and categorised as an "upper layer" NBFC by the RBI in India and its comprehensive mortgage products include home loans, loans against property, lease rental discounting and developer financing.

Aadhar Housing Finance and India Shelter Finance are the two housing finance companies that have been listed on the stock exchanges in recent months.

Kotak Mahindra Capital Company Ltd, BofA Securities India Ltd, SBI Capital Markets Ltd, Goldman Sachs (India) Securities Private Ltd, Axis Capital and JM Financial Ltd are the book-running lead managers to the offer.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 13.14 ( -2.88)

- 33337289

- GACM Technologies

- 1.59 (+ 2.58)

- 31438119

- YES Bank Ltd.

- 23.83 (+ 3.70)

- 28312544

- GTL Infrastructure

- 2.61 (+ 4.82)

- 27648993

- Rajnish Wellness

- 3.45 ( -3.36)

- 16876969

MORE NEWS

Karnataka Seeks Central Support for Industrial...

Karnataka seeks Centre's support for key projects to accelerate industrial and...

US Wants India as 'BFF', Ties Won't Change: Envoy

US Ambassador Eric Garcetti says US wants a 'BFF' relationship with India, with no...

Shubhshree Biofuels IPO Oversubscribed 120 Times

Shubhshree Biofuels Energy's IPO was oversubscribed by 120 times on the final day,...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.