Birla Corporation Q2 Loss: Weak Cement Prices & Demand Down

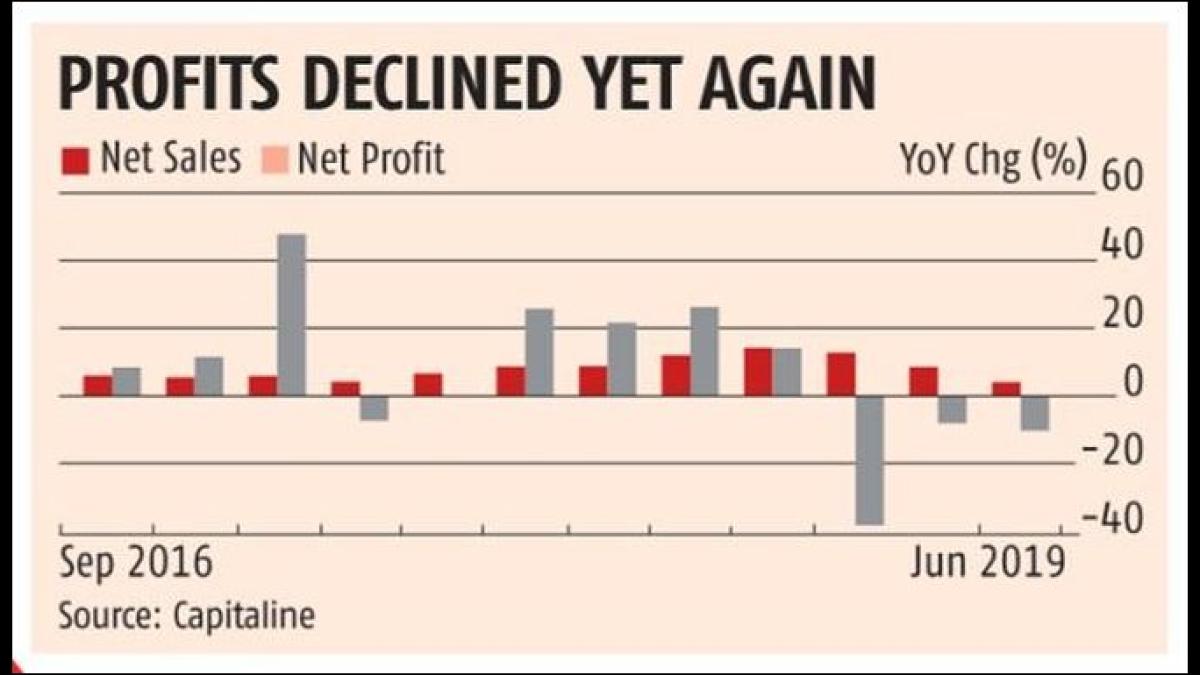

Birla Corporation reported a net loss of Rs 25.2 crore in Q2 due to weak cement prices, sluggish demand, and a downturn in the jute business. Revenue fell 14.5% to Rs 1,952.56 crore.

New Delhi, Oct 23 (PTI) M P Birla Group firm Birla Corporation Ltd on Wednesday reported a net loss of Rs 25.2 crore for the second quarter ended in September 2024 due to weak cement prices, sluggishness in demand and downturn in the jute business.

It had posted a net profit of Rs 58.37 crore in the July-September period a year ago, according to a regulatory filing from Birla Corporation.

Birla Corporation's revenue from operations was down 14.52 per cent to Rs 1,952.56 crore during the September quarter. It was at Rs 2,284.34 crore in the corresponding period a year ago.

Total expenses of Birla Corporation declined 10.24 per cent in the September quarter to Rs 2,005.47 crore.

Birla Corporation's revenue from the cement business was down 13.88 per cent to Rs 1,874.68 crore.

"In the traditionally weak monsoon quarter, cement demand was sluggish and prices plummeted to record lows in all key markets. The company's EBITDA per ton from cement sales for the September quarter was at Rs 461 compared to Rs 683 in the same period last year," said an earning statement.

Revenue from the jute segment was down 27.18 per cent to Rs 78.35 crore.

Jute Division reported a cash loss of Rs 2 crore for the September quarter against a cash profit of Rs 4 crore a year ago.

Production during the quarter was cut from standard 77 days to 57 days, leading to a decline in production from 8,738 tons a year ago to 6,592 tons in the September quarter, it added.

Shares of Birla Corporation Ltd on Wednesday settled at Rs 1,135.20 on BSE, down 1.16 per cent.

It had posted a net profit of Rs 58.37 crore in the July-September period a year ago, according to a regulatory filing from Birla Corporation.

Birla Corporation's revenue from operations was down 14.52 per cent to Rs 1,952.56 crore during the September quarter. It was at Rs 2,284.34 crore in the corresponding period a year ago.

Total expenses of Birla Corporation declined 10.24 per cent in the September quarter to Rs 2,005.47 crore.

Birla Corporation's revenue from the cement business was down 13.88 per cent to Rs 1,874.68 crore.

"In the traditionally weak monsoon quarter, cement demand was sluggish and prices plummeted to record lows in all key markets. The company's EBITDA per ton from cement sales for the September quarter was at Rs 461 compared to Rs 683 in the same period last year," said an earning statement.

Revenue from the jute segment was down 27.18 per cent to Rs 78.35 crore.

Jute Division reported a cash loss of Rs 2 crore for the September quarter against a cash profit of Rs 4 crore a year ago.

Production during the quarter was cut from standard 77 days to 57 days, leading to a decline in production from 8,738 tons a year ago to 6,592 tons in the September quarter, it added.

Shares of Birla Corporation Ltd on Wednesday settled at Rs 1,135.20 on BSE, down 1.16 per cent.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 8.10 (+ 18.94)

- 352104789

- GTL Infrastructure

- 1.50 (+ 7.14)

- 20981605

- G G Engineering

- 0.90 (+ 11.11)

- 20091512

- AvanceTechnologies

- 0.54 ( -8.47)

- 18780688

- YES Bank Ltd.

- 17.33 (+ 2.61)

- 14468022

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.