China Economy Grows 5.2% in 2023, Hitting Target

By Rediff Money Desk, HONGKONG Jan 17, 2024 17:12

China's economy expanded 5.2% in 2023, meeting the government's target despite uneven recovery. Growth was fueled by domestic demand and infrastructure investments, but trade data and consumer prices remain weak.

Photograph: China Daily/Reuters

Hong Kong, Jan 17 (AP) China's economy for the October-December quarter grew at a quicker rate, allowing the Chinese government to hit its target of about 5% annual growth for 2023 even though trade data and the economic recovery remain uneven.

Official data released Wednesday showed that the Chinese economy grew 5.2% for 2023, surpassing the target of about 5%' that the government had set.

The growth for 2023 is likely helped by 2022's GDP of just 3% as China's economy slowed due to COVID-19 and nationwide lockdowns during the pandemic.

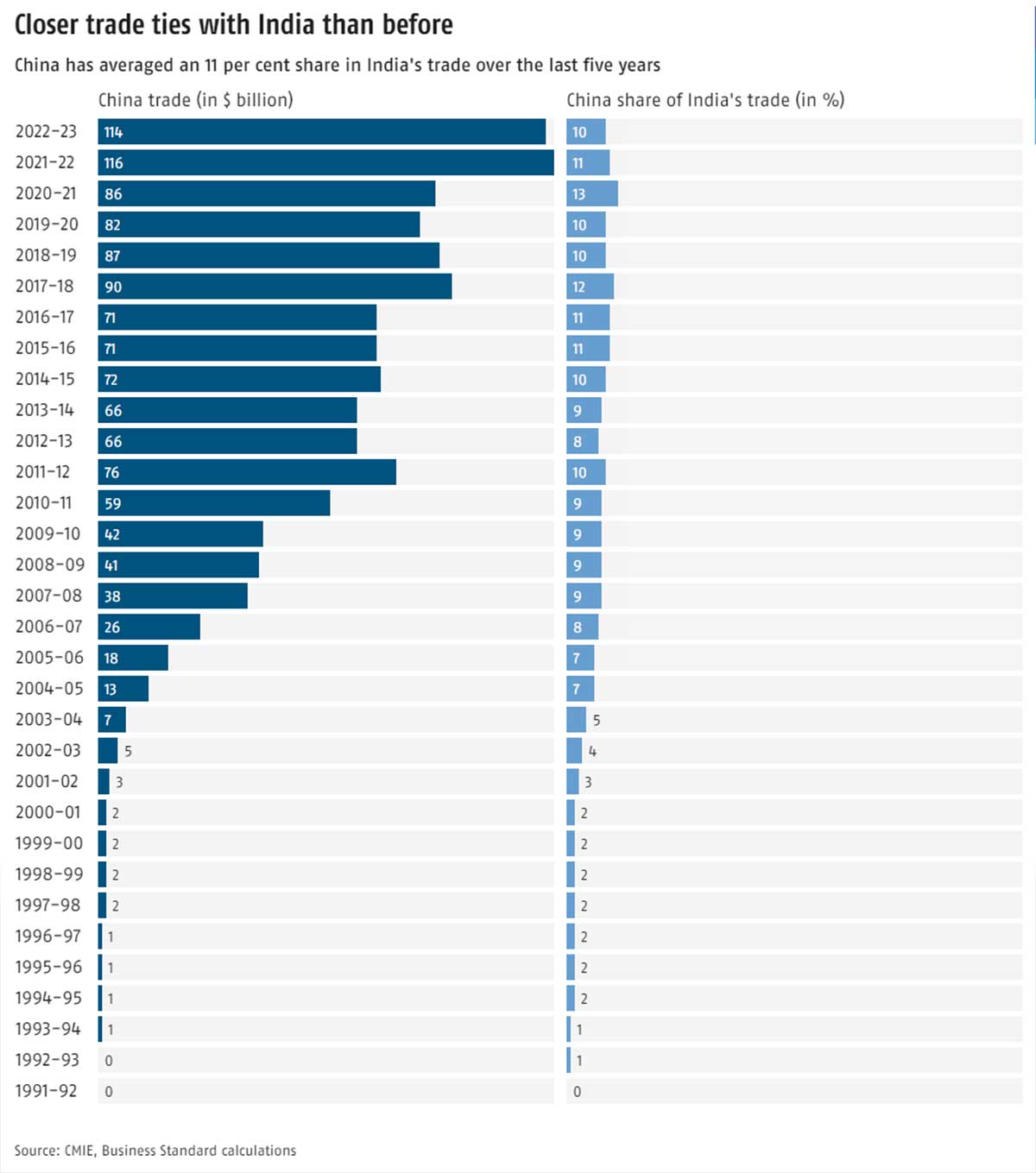

China is the second-biggest economy behind the US and has been a key driver of global economic growth. Its economic slowdown has sparked concern of spillover effects to other economies that count China as a key trading partner, such as South Korea and Thailand.

For the fourth quarter, China's gross domestic product also grew at 5.2% compared to the same time last year. On a quarterly basis, the economy rose 1% in Q4, slowing from the expansion of 1.3% in the July-September quarter.

Officials from China's National Bureau of Statistics said that measures including strengthened macro regulation, and redoubled efforts to expand domestic demand, optimize structure, boost confidence and prevent and defuse risks had helped improve the momentum of recovery, supply and demand.

Industrial output, which measures activity in the manufacturing, mining and utilities sectors, rose 4.6% in 2023 compared to a year earlier, while retail sales of consumer goods grew 7.2%.

Fixed-asset investment spending on factory equipment, construction and other infrastructure projects to drive growth grew 3% year on year in 2023.

China on Wednesday also resumed releasing official data on its youth unemployment rate after a five-month suspension. Under a new methodology which excludes students from the jobless rate, unemployment for those aged between 16 and 24 stood at 14.9% for December, an improvement from the record-high youth jobless rate of 21.3% in June using the previous methodology.

Officials said that the new methodology's exclusion of current students will more accurately reflect employment of young people entering society.

However, indicators point to a largely uneven recovery for China. Trade data for December, released earlier this month, showed a slight growth in exports for a second straight month as well as a slight increase in imports. Consumer prices however fell for a third consecutive month as deflationary pressures persisted.

Julian Evans-Pritchard from Capital Economics said China's recovery clearly remains shaky.

And while we still anticipate some near-term boost from policy easing, this is unlikely to prevent a renewed slowdown later this year, Evans-Pritchard wrote in a note, adding that it will be a lot more challenging for China to achieve the same pace of expansion in 2024.

Chinese premier Li Qiang said at the World Economic Forum on Tuesday that China had achieved its economic target without resorting to massive stimulus.

He said that China had good and solid fundamentals in its long-term development and despite some setbacks, the positive trend for the economy will not change.

The ruling Communist Party has in the past decade deliberately sought to shift away from a reliance on government-led investment in massive infrastructure projects to one that is driven more by consumer demand as is typical of other major economies.

Slowing growth reflects that effort to attain a more sustainable path to affluence, but the disruptions from the pandemic and a crackdown on excessive borrowing by property developers have accentuated underlying weaknesses.

Official data released Wednesday showed that the Chinese economy grew 5.2% for 2023, surpassing the target of about 5%' that the government had set.

The growth for 2023 is likely helped by 2022's GDP of just 3% as China's economy slowed due to COVID-19 and nationwide lockdowns during the pandemic.

China is the second-biggest economy behind the US and has been a key driver of global economic growth. Its economic slowdown has sparked concern of spillover effects to other economies that count China as a key trading partner, such as South Korea and Thailand.

For the fourth quarter, China's gross domestic product also grew at 5.2% compared to the same time last year. On a quarterly basis, the economy rose 1% in Q4, slowing from the expansion of 1.3% in the July-September quarter.

Officials from China's National Bureau of Statistics said that measures including strengthened macro regulation, and redoubled efforts to expand domestic demand, optimize structure, boost confidence and prevent and defuse risks had helped improve the momentum of recovery, supply and demand.

Industrial output, which measures activity in the manufacturing, mining and utilities sectors, rose 4.6% in 2023 compared to a year earlier, while retail sales of consumer goods grew 7.2%.

Fixed-asset investment spending on factory equipment, construction and other infrastructure projects to drive growth grew 3% year on year in 2023.

China on Wednesday also resumed releasing official data on its youth unemployment rate after a five-month suspension. Under a new methodology which excludes students from the jobless rate, unemployment for those aged between 16 and 24 stood at 14.9% for December, an improvement from the record-high youth jobless rate of 21.3% in June using the previous methodology.

Officials said that the new methodology's exclusion of current students will more accurately reflect employment of young people entering society.

However, indicators point to a largely uneven recovery for China. Trade data for December, released earlier this month, showed a slight growth in exports for a second straight month as well as a slight increase in imports. Consumer prices however fell for a third consecutive month as deflationary pressures persisted.

Julian Evans-Pritchard from Capital Economics said China's recovery clearly remains shaky.

And while we still anticipate some near-term boost from policy easing, this is unlikely to prevent a renewed slowdown later this year, Evans-Pritchard wrote in a note, adding that it will be a lot more challenging for China to achieve the same pace of expansion in 2024.

Chinese premier Li Qiang said at the World Economic Forum on Tuesday that China had achieved its economic target without resorting to massive stimulus.

He said that China had good and solid fundamentals in its long-term development and despite some setbacks, the positive trend for the economy will not change.

The ruling Communist Party has in the past decade deliberately sought to shift away from a reliance on government-led investment in massive infrastructure projects to one that is driven more by consumer demand as is typical of other major economies.

Slowing growth reflects that effort to attain a more sustainable path to affluence, but the disruptions from the pandemic and a crackdown on excessive borrowing by property developers have accentuated underlying weaknesses.

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Srestha Finvest

- 0.66 (+ 4.76)

- 32896927

- Vodafone Idea L

- 8.45 (+ 4.06)

- 28557277

- Standard Capital

- 1.14 (+ 0.88)

- 17361276

- Alstone Textiles

- 0.83 (+ 5.06)

- 14796552

- AvanceTechnologies

- 0.89 (+ 4.71)

- 10049569

MORE NEWS

ACI Appoints SGK Kishore as APAC, Middle East...

SGK Kishore, a GMR Group executive, has been appointed President of ACI-APAC & MID,...

Bengaluru & Mangaluru Markets Closed on...

Bengaluru and Mangaluru commodity markets remain closed on Saturday, November 2nd, due...

ADB Praises India's Fossil Fuel Subsidy Reforms

The Asian Development Bank (ADB) commends India's progress on fossil fuel subsidy...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.