Corporate Earnings & Global Trends Drive Market This Week - Analysts

By Rediff Money Desk, New Delhi May 05, 2024 11:15

Analysts expect Q4 earnings, global factors and macroeconomic data to guide equity markets this week. Focus on Hero MotoCorp, Larsen & Toubro, BPCL, SBI, Eicher Motors and Tata Motors results. PMI and industrial production data also key.

Photograph: Uttam Ghosh/Rediff.com

New Delhi, May 5 (PTI) The ongoing fourth quarter earnings season, global factors and macroeconomic data would guide the trends in the equity markets this week, analysts said.

Markets would also take cues from trading activity of foreign investors, rupee-dollar trend and movement of global oil benchmark Brent crude.

"Domestically, the next batch of Q4 earnings reports will drive stock-specific movements, Hero MotoCorp, Larsen & Toubro, BPCL, State Bank of India, Eicher Motors and Tata Motors are some of the big names in the list and the next phase of voting," said Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd.

PMI data for the services sector will also influence trading in the equity markets.

Industrial production data for March is scheduled to be announced on Friday.

"On Monday markets will react to the US employment data and Q4 results of companies like Dmart and Kotak Bank," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd, said.

"Moving forward, the ongoing results season will be a key detrimental factor for investors to align their portfolios. The market will also remain vigilant about the BoE (Bank of England) policy and GDP data from the euro zone.

"We expect a degree of consolidation in the market due to expensive valuations and any election-led jitters," said Vinod Nair, Head of Research, Geojit Financial Services.

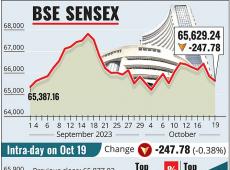

Last week, the BSE benchmark climbed 147.99 points or 0.20 per cent. The NSE Nifty advanced 55.9 points or 0.24 per cent.

Ajit Mishra, SVP - Research, Religare Broking Ltd, said, "Looking ahead, attention will be on earnings reports and global market performance, particularly the US."

The 30-share BSE Sensex dropped 732.96 points or 0.98 per cent to settle at 73,878.15 on Friday. The NSE Nifty also declined 172.35 points or 0.76 per cent to 22,475.85.

"As valuation discomfort rises, investors are becoming choosy and taking select bets. Uncertainty over interest rate, gloomy geopolitical scenario and FII fund outflows have prompted investors to book profits at regular intervals," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

Markets would also take cues from trading activity of foreign investors, rupee-dollar trend and movement of global oil benchmark Brent crude.

"Domestically, the next batch of Q4 earnings reports will drive stock-specific movements, Hero MotoCorp, Larsen & Toubro, BPCL, State Bank of India, Eicher Motors and Tata Motors are some of the big names in the list and the next phase of voting," said Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd.

PMI data for the services sector will also influence trading in the equity markets.

Industrial production data for March is scheduled to be announced on Friday.

"On Monday markets will react to the US employment data and Q4 results of companies like Dmart and Kotak Bank," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd, said.

"Moving forward, the ongoing results season will be a key detrimental factor for investors to align their portfolios. The market will also remain vigilant about the BoE (Bank of England) policy and GDP data from the euro zone.

"We expect a degree of consolidation in the market due to expensive valuations and any election-led jitters," said Vinod Nair, Head of Research, Geojit Financial Services.

Last week, the BSE benchmark climbed 147.99 points or 0.20 per cent. The NSE Nifty advanced 55.9 points or 0.24 per cent.

Ajit Mishra, SVP - Research, Religare Broking Ltd, said, "Looking ahead, attention will be on earnings reports and global market performance, particularly the US."

The 30-share BSE Sensex dropped 732.96 points or 0.98 per cent to settle at 73,878.15 on Friday. The NSE Nifty also declined 172.35 points or 0.76 per cent to 22,475.85.

"As valuation discomfort rises, investors are becoming choosy and taking select bets. Uncertainty over interest rate, gloomy geopolitical scenario and FII fund outflows have prompted investors to book profits at regular intervals," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.