Debt Recovery Tribunals: 2.15 Lakh Cases Pending - India News

India's Debt Recovery Tribunals face a backlog of over 2.15 lakh cases. Learn about the reasons behind the delays and steps taken by the government to address the issue.

New Delhi, Feb 5 (PTI) About 2.15 lakh cases are pending before Debt Recovery Tribunals (DRTs) as on January 24, Parliament was informed on Monday.

Out of 2,15,431 cases, the Original Applications (OAs) filed under Section 19 of the Recovery of Debts and Bankruptcy Act (RDB Act), 1993, is 1,62,317 and Securitization Applications (SAs) filed under Section 17 of Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002, is 53,114, Minister of State for Finance Bhagwat K Karad said in a written reply to Lok Sabha.

As per the Recovery of Debts and Bankruptcy (RDB) Act, cases should be dealt expeditiously and every possible effort should be made to complete the proceedings in two hearings and to dispose of the application finally within 180 days from the date of receipt of the application.

As on January 24, 2024, he said, the total number of cases which are pending for more than 180 days before the DRTs is 1,85,076.

Out of these pending cases, 1,42,187 cases are OAs and 42,889 cases are SAs, he added.

Pendency of cases is analysed from time to time, he said, adding that pendency of cases has been mainly on account of the strategy of litigants in the form of non

compliance with the summons issued by the DRTs, seeking intervention of the

High Courts in DRT proceedings, choosing not to appear before the Tribunal

and then challenging the ex-parte orders passed against them etc.

Pendency is also caused sometimes by the absence of lawyers either of one side or both sides or requesting adjournments, he said.

To reduce pendency, the government has taken a number of steps, he said.

All vacancies of Presiding Officers (POs) except one are filled up and steps are underway to fill the said vacancy and other anticipated vacancies occurring up to September 30, 2024, he said.

All possible steps for facilitating easy access to DRTs for litigants and advocates

are also being taken such as providing video conferencing facilities for case hearings.

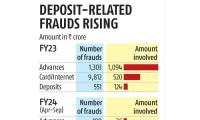

Replying to another question, Karad said Rs 36.26 crore loss was recorded in the first half of 2023-24 due to financial frauds.

To help customers recover loss on account of fraudulent transactions, he said, Reserve Bank of India has issued instructions on limiting the liability of customers in cases of unauthorised electronic banking transactions.

In cases where the deficiency lies with the bank, the customer will not bear any loss if the customer reports such an incident to the bank within three working days, he said.

However, he said, customers will have to bear the loss where the deficiency lies with them.

In cases where the deficiency lies neither with the bank nor with the customer but elsewhere in the system and the customer reports it to the bank within three working days of receiving information about the unauthorised electronic transaction, customer will not bear any loss.

Replying to a separate question, Karad said insurance penetration is measured as the percentage of insurance premium to GDP.

As per the sector regulator, Insurance Regulatory and Development Authority

of India (IRDAI), insurance penetration in India stands at 4 per cent in 2022-23, he said.

IRDAI has been taking various steps to promote health insurance and increase

insurance penetration to bridge the protection gap, he said.

In another reply, Karad said National Payments Corporation of India (NPCI) has informed that the UPI facility is presently allowed for countries such as Australia, Canada, France, Hong Kong, Malaysia, Oman, Qatar, Saudi Arabia, Singapore, the United Arab Emirates, the UK, and the US.

Out of 2,15,431 cases, the Original Applications (OAs) filed under Section 19 of the Recovery of Debts and Bankruptcy Act (RDB Act), 1993, is 1,62,317 and Securitization Applications (SAs) filed under Section 17 of Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002, is 53,114, Minister of State for Finance Bhagwat K Karad said in a written reply to Lok Sabha.

As per the Recovery of Debts and Bankruptcy (RDB) Act, cases should be dealt expeditiously and every possible effort should be made to complete the proceedings in two hearings and to dispose of the application finally within 180 days from the date of receipt of the application.

As on January 24, 2024, he said, the total number of cases which are pending for more than 180 days before the DRTs is 1,85,076.

Out of these pending cases, 1,42,187 cases are OAs and 42,889 cases are SAs, he added.

Pendency of cases is analysed from time to time, he said, adding that pendency of cases has been mainly on account of the strategy of litigants in the form of non

compliance with the summons issued by the DRTs, seeking intervention of the

High Courts in DRT proceedings, choosing not to appear before the Tribunal

and then challenging the ex-parte orders passed against them etc.

Pendency is also caused sometimes by the absence of lawyers either of one side or both sides or requesting adjournments, he said.

To reduce pendency, the government has taken a number of steps, he said.

All vacancies of Presiding Officers (POs) except one are filled up and steps are underway to fill the said vacancy and other anticipated vacancies occurring up to September 30, 2024, he said.

All possible steps for facilitating easy access to DRTs for litigants and advocates

are also being taken such as providing video conferencing facilities for case hearings.

Replying to another question, Karad said Rs 36.26 crore loss was recorded in the first half of 2023-24 due to financial frauds.

To help customers recover loss on account of fraudulent transactions, he said, Reserve Bank of India has issued instructions on limiting the liability of customers in cases of unauthorised electronic banking transactions.

In cases where the deficiency lies with the bank, the customer will not bear any loss if the customer reports such an incident to the bank within three working days, he said.

However, he said, customers will have to bear the loss where the deficiency lies with them.

In cases where the deficiency lies neither with the bank nor with the customer but elsewhere in the system and the customer reports it to the bank within three working days of receiving information about the unauthorised electronic transaction, customer will not bear any loss.

Replying to a separate question, Karad said insurance penetration is measured as the percentage of insurance premium to GDP.

As per the sector regulator, Insurance Regulatory and Development Authority

of India (IRDAI), insurance penetration in India stands at 4 per cent in 2022-23, he said.

IRDAI has been taking various steps to promote health insurance and increase

insurance penetration to bridge the protection gap, he said.

In another reply, Karad said National Payments Corporation of India (NPCI) has informed that the UPI facility is presently allowed for countries such as Australia, Canada, France, Hong Kong, Malaysia, Oman, Qatar, Saudi Arabia, Singapore, the United Arab Emirates, the UK, and the US.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.94 ( -1.00)

- 53169786

- GTL Infrastructure

- 1.61 (+ 6.62)

- 32431916

- Spicejet Ltd.

- 53.52 (+ 9.09)

- 18083686

- G G Engineering

- 0.81 ( -3.57)

- 15819052

- Reliance Power L

- 44.37 (+ 1.88)

- 14874542

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.