Delhivery Q2 Loss Narrows to Rs 103 cr - PTI

By Rediff Money Desk, NEWDELHI Nov 04, 2023 17:25

Delhivery's consolidated net loss narrowed to Rs 103 crore in Q2 FY24, with total income rising to Rs 2,042.98 crore. Read more about the company's financial performance and leadership changes.

New Delhi, Nov 4 (PTI) Logistics company Delhivery on Saturday said its consolidated net loss narrowed to Rs 103 crore in the second quarter ended September 30, 2023.

The company had reported a net loss of Rs 254 crore for the year-ago period, it said in a regulatory filing.

Total income rose to Rs 2,042.98 crore from Rs 1,883.38 crore in the year-ago period.

Total expenses fell to Rs 2,148.18 crore from Rs 2,157.79 crore earlier.

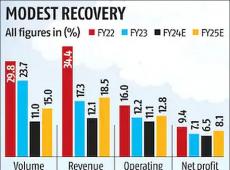

The company in a statement said its express parcel shipment volumes grew 12 per cent year-on-year to 181 million in Q2 FY24 from 161 million in Q2 FY23.

MD & CEO Sahil Barua said," We are pleased with H1 operating and financial performance, and volume levels at our mega-facilities have also been consistently high."

The company further announced that effective January 15, 2024, Suraj Saharan, co-founder of Delhivery, would take over as Chief People Officer. Varun Bakshi would be Head of Business Development, Part Truckload Freight business effective January 9 next year.

Vivek Pabari, SVP of Corporate Finance, will take up additional responsibilities of Investor Relations & Treasury.

These leadership appointments are aimed at creating experienced long-term leaders for key functions and business roles, Barua said.

Saharan is an alumnus of IIT Mumbai and prior to founding Delhivery, worked as a management consultant at Bain and Company.

Bakshi is an alumnus of IIT Delhi and IIM Bangalore with almost 10 years of sales experience at Deutsche Bank apart from stints with Invest India and as a fintech entrepreneur.

Pabari is an alumnus of IIM Bangalore with 13 years of experience in Investment Banking and Corporate Finance.

The company had reported a net loss of Rs 254 crore for the year-ago period, it said in a regulatory filing.

Total income rose to Rs 2,042.98 crore from Rs 1,883.38 crore in the year-ago period.

Total expenses fell to Rs 2,148.18 crore from Rs 2,157.79 crore earlier.

The company in a statement said its express parcel shipment volumes grew 12 per cent year-on-year to 181 million in Q2 FY24 from 161 million in Q2 FY23.

MD & CEO Sahil Barua said," We are pleased with H1 operating and financial performance, and volume levels at our mega-facilities have also been consistently high."

The company further announced that effective January 15, 2024, Suraj Saharan, co-founder of Delhivery, would take over as Chief People Officer. Varun Bakshi would be Head of Business Development, Part Truckload Freight business effective January 9 next year.

Vivek Pabari, SVP of Corporate Finance, will take up additional responsibilities of Investor Relations & Treasury.

These leadership appointments are aimed at creating experienced long-term leaders for key functions and business roles, Barua said.

Saharan is an alumnus of IIT Mumbai and prior to founding Delhivery, worked as a management consultant at Bain and Company.

Bakshi is an alumnus of IIT Delhi and IIM Bangalore with almost 10 years of sales experience at Deutsche Bank apart from stints with Invest India and as a fintech entrepreneur.

Pabari is an alumnus of IIM Bangalore with 13 years of experience in Investment Banking and Corporate Finance.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Gold and Silver Rates Today: July 16, 2023

Get the latest gold and silver rates for July 16, 2023. Check the prices of standard...

GVK Power Faces Insolvency: Loan Default Leads...

GVK Power and Infrastructure Ltd faces insolvency proceedings after failing to repay...

Waaree Renewable Wins 30 MW Solar Project in...

Waaree Renewable Technologies Ltd has secured a 30 MW ground-mounted solar project from...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.