Emkay Launches New AIF, Targets Rs 500 Crore

Emkay Investment Managers launches Emkay Capital Builder Fund, an AIF targeting Rs 500 crore. The fund aims for long-term capital appreciation through a multi-cap equity portfolio.

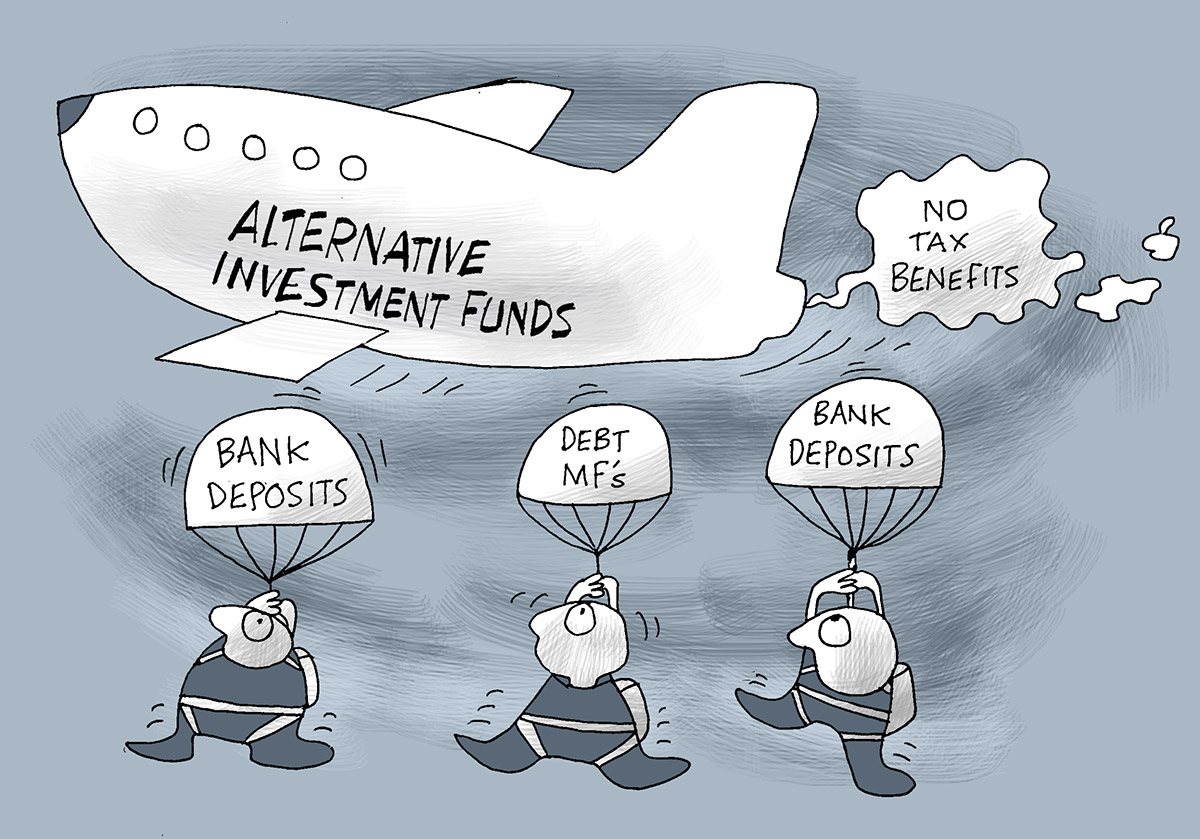

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Jun 27 (PTI) Portfolio management firm Emkay Investment Managers Ltd (EIML) on Thursday announced the launch of an alternative investment fund -- Emkay Capital Builder Fund-- through which it is aiming to mobilise Rs 500 crore in the next 6 to 8 months.

The open-ended category III Alternative Investment Fund (AIF) -- Emkay Capital Builder Fund-- is hoping to generate long-term capital appreciation for investors from a portfolio of equity and equity-related securities. This will be a multi-cap portfolio of around 20-25 stocks.

"Emkay Capital Builder AIF caters to the growing preference for Alternative Investment Funds as an investment avenue amongst UHNIs in India. Our bottom-up stock-picking strategy will help in formulating a winning AIF portfolio backed by the robust E-Qual model to mitigate risks related to management quality," Sachin Shah, Executive Director and Fund Manager, Emkay Investment Managers Ltd, said.

In a webinar on opportunities in AIFs, the portfolio management firm said," EIML is aiming to raise Rs 500 crore from the latest AIF in the coming 6 to 8 months".

Earlier, Emkay Investment Managers, the asset management arm of Emkay Global Financial Services, raised over Rs 450 crore with the four previous series of its close-ended AIFs and returned more than Rs 740 crore to the investors before the stipulated time.

EIML has a portfolio management strategy under the name of Emkay Capital Builder PMS which is similar to the AIF offering. The average market capital of the existing PMS strategy is Rs 2.7 lakh crore and about 60 per cent of the PMS' portfolio is currently formulated of stocks from the financial services, pharmaceuticals, and IT sectors. Currently, 70 per cent of the strategy's composition is large-caps.

Over the past 11 years, since its inception in April 2013, Emkay Capital Builder PMS has consistently achieved a compounded annual growth rate (CAGR) of 16.75 per cent.

The open-ended category III Alternative Investment Fund (AIF) -- Emkay Capital Builder Fund-- is hoping to generate long-term capital appreciation for investors from a portfolio of equity and equity-related securities. This will be a multi-cap portfolio of around 20-25 stocks.

"Emkay Capital Builder AIF caters to the growing preference for Alternative Investment Funds as an investment avenue amongst UHNIs in India. Our bottom-up stock-picking strategy will help in formulating a winning AIF portfolio backed by the robust E-Qual model to mitigate risks related to management quality," Sachin Shah, Executive Director and Fund Manager, Emkay Investment Managers Ltd, said.

In a webinar on opportunities in AIFs, the portfolio management firm said," EIML is aiming to raise Rs 500 crore from the latest AIF in the coming 6 to 8 months".

Earlier, Emkay Investment Managers, the asset management arm of Emkay Global Financial Services, raised over Rs 450 crore with the four previous series of its close-ended AIFs and returned more than Rs 740 crore to the investors before the stipulated time.

EIML has a portfolio management strategy under the name of Emkay Capital Builder PMS which is similar to the AIF offering. The average market capital of the existing PMS strategy is Rs 2.7 lakh crore and about 60 per cent of the PMS' portfolio is currently formulated of stocks from the financial services, pharmaceuticals, and IT sectors. Currently, 70 per cent of the strategy's composition is large-caps.

Over the past 11 years, since its inception in April 2013, Emkay Capital Builder PMS has consistently achieved a compounded annual growth rate (CAGR) of 16.75 per cent.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795