Eurozone Inflation Rises, ECB Faces Tough Interest Rate Decision

By Rediff Money Desk, Frankfurt Jul 31, 2024 15:33

Eurozone inflation ticked up to 2.6% in July, complicating the European Central Bank's decision on whether to cut interest rates and boost growth. The ECB's next meeting is scheduled for September 12.

Frankfurt (Germany), Jul 31 (AP) Inflation in the 20 countries that use the Euro ticked up to 2.6 per cent in July, stubbornly above the European Central Bank's target and complicating the ECB's next decision on whether to cut interest rates and boost growth as the economy struggles to stage a convincing recovery after more than a year of stagnation.

Inflation rose from 2.5 per cent in June, according to official figures Wednesday from the EU statistics agency Eurostat. Services inflation, a figure closely watched by the ECB, remained elevated at 4.0 per cent, down from 4.1 per cent.

The uptick will intensify discussions around the ECB's next move at its September 12 meeting. The central bank for the eurozone countries made a first tentative interest rate cut in June, lowering its benchmark rate by a quarter percentage point to 3.75 per cent. The bank's governing council then hit pause at the July meeting, with ECB President Christine Lagarde saying the bank would take its next decisions meeting by meeting based on incoming data.

The ECB along with other central banks including the US Federal Reserve rapidly raised interest rates to combat a spike in inflation sparked by Russia's invasion of Ukraine and higher energy prices as well as by the sudden rebound of the economy after the pandemic, which strained supplies of parts and raw materials. Europe in particular was hit by higher energy prices after Russia cut off most supplies of natural gas.

Energy prices have fallen and inflation is now down from its peak of 10.6 per cent in October 2022. But it has remained stuck between 2 per cent and 3 per cent, short of the ECB's target of 2 per cent which is considered best for the economy. Rate hikes combat inflation by raising the cost of credit for buying things, cooling demand for goods and taking the pressure off prices.

But higher rates can hurt growth, and recent economic data have been downbeat as Europe struggles to show a convincing recovery after more than a year of near-zero growth figures.

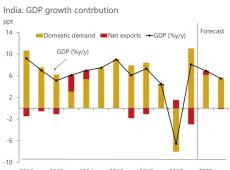

Gross domestic product rose 0.3 per cent in each of the first two quarters of this year, an improvement on zero or below. But recent indicators of economic activity going forward, such as SandP Global's purchasing managers' index, suggest that the economy is still barely growing.

Inflation rose from 2.5 per cent in June, according to official figures Wednesday from the EU statistics agency Eurostat. Services inflation, a figure closely watched by the ECB, remained elevated at 4.0 per cent, down from 4.1 per cent.

The uptick will intensify discussions around the ECB's next move at its September 12 meeting. The central bank for the eurozone countries made a first tentative interest rate cut in June, lowering its benchmark rate by a quarter percentage point to 3.75 per cent. The bank's governing council then hit pause at the July meeting, with ECB President Christine Lagarde saying the bank would take its next decisions meeting by meeting based on incoming data.

The ECB along with other central banks including the US Federal Reserve rapidly raised interest rates to combat a spike in inflation sparked by Russia's invasion of Ukraine and higher energy prices as well as by the sudden rebound of the economy after the pandemic, which strained supplies of parts and raw materials. Europe in particular was hit by higher energy prices after Russia cut off most supplies of natural gas.

Energy prices have fallen and inflation is now down from its peak of 10.6 per cent in October 2022. But it has remained stuck between 2 per cent and 3 per cent, short of the ECB's target of 2 per cent which is considered best for the economy. Rate hikes combat inflation by raising the cost of credit for buying things, cooling demand for goods and taking the pressure off prices.

But higher rates can hurt growth, and recent economic data have been downbeat as Europe struggles to show a convincing recovery after more than a year of near-zero growth figures.

Gross domestic product rose 0.3 per cent in each of the first two quarters of this year, an improvement on zero or below. But recent indicators of economic activity going forward, such as SandP Global's purchasing managers' index, suggest that the economy is still barely growing.

Source: ASSOCIATED PRESS

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.90 ( -1.69)

- 39214315

- Vodafone Idea L

- 16.27 (+ 0.31)

- 39205258

- YES Bank Ltd.

- 26.50 (+ 3.15)

- 34956677

- Suzlon Energy Ltd.

- 69.35 (+ 1.61)

- 22603407

- Comfort Intech

- 17.60 ( -8.76)

- 21669591

MORE NEWS

Lab Chemical Duty Slashed to 10% in India

India's Finance Ministry reduced customs duty on lab chemicals to 10% from 150%,...

India Cuts Windfall Tax on Crude Oil to Rs...

India has reduced the windfall tax on domestically produced crude oil to Rs 4,600 per...

RBI Draft Rules on AePS Operators to Prevent...

The Reserve Bank of India has released draft rules on Aadhar-enabled Payment System...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.