Gold Price Rises Rs 100 on Jewellers' Buying - PTI

By Rediff Money Desk, New Delhi Jul 22, 2024 16:19

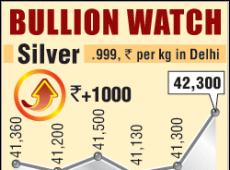

Gold prices in India rose by Rs 100 to Rs 75,650 per 10 grams on Monday, driven by increased buying from jewellers and a firm trend in global markets. Silver prices, however, plunged by Rs 600.

New Delhi, Jul 22 (PTI) Gold prices rose by Rs 100 to Rs 75,650 per 10 grams in the national capital on Monday due to increased buying by jewellers and a firm trend in the overseas markets.

However, silver prices plunged by Rs 600 to Rs 91,000 per kg. In the previous session, it had settled at Rs 91,600 per kg, as per the All India Sarafa Association.

On Saturday, the precious metal rates had closed at Rs 75,550 per 10 grams.

Meanwhile, gold of 99.5 per cent purity also rose by Rs 100 to Rs 75,300 per 10 grams. It had ended at Rs 75,200 per 10 grams in the previous session.

Traders attributed the rise in gold prices to fresh demand by local jewellers and a firm trend in the international markets.

The white metal has declined Rs 3,400 per kg in the past four sessions since July 18 when it had fallen by Rs 400 to end at Rs 94,000 per kg.

Globally, Comex gold is trading higher at USD 2,451.70 per ounce, up by USD 4.90 per ounce from the previous close.

"After a sharp pullback from all-time highs last week, Comex gold edged higher on Monday as US election uncertainty weighed on US dollar and treasury yields," Kaynat Chainwala, AVP of Commodity Research at Kotak Securities, said.

President Joe Biden's decision to end his re-election campaign and endorse Vice President Kamala Harris prompted speculation on whether it would benefit or hinder chances of former President Donald Trump returning to the White House.

As a result, the bulls of the US dollar remained cautious and the commodity prices gained some traction.

Traders are now eagerly anticipating the release of several key economic indicators ahead of the Federal Open Market Committee (FOMC) policy decision next week, Chainwala added.

However, silver was marginally down at USD 29.25 per ounce in New York.

According to commodity market experts, traders also worried about slowing Chinese economic growth, geopolitical risks from the Russia-Ukraine war and the ongoing conflicts in the Middle East will benefit the safe-haven asset.

Further, traders are awaiting the upcoming release of the US Personal Consumption Expenditures (PCE) price index data on Friday for more cues about the US Federal Reserve's monetary policy path, which will provide directions for the bullion prices in the near future, they said.

However, silver prices plunged by Rs 600 to Rs 91,000 per kg. In the previous session, it had settled at Rs 91,600 per kg, as per the All India Sarafa Association.

On Saturday, the precious metal rates had closed at Rs 75,550 per 10 grams.

Meanwhile, gold of 99.5 per cent purity also rose by Rs 100 to Rs 75,300 per 10 grams. It had ended at Rs 75,200 per 10 grams in the previous session.

Traders attributed the rise in gold prices to fresh demand by local jewellers and a firm trend in the international markets.

The white metal has declined Rs 3,400 per kg in the past four sessions since July 18 when it had fallen by Rs 400 to end at Rs 94,000 per kg.

Globally, Comex gold is trading higher at USD 2,451.70 per ounce, up by USD 4.90 per ounce from the previous close.

"After a sharp pullback from all-time highs last week, Comex gold edged higher on Monday as US election uncertainty weighed on US dollar and treasury yields," Kaynat Chainwala, AVP of Commodity Research at Kotak Securities, said.

President Joe Biden's decision to end his re-election campaign and endorse Vice President Kamala Harris prompted speculation on whether it would benefit or hinder chances of former President Donald Trump returning to the White House.

As a result, the bulls of the US dollar remained cautious and the commodity prices gained some traction.

Traders are now eagerly anticipating the release of several key economic indicators ahead of the Federal Open Market Committee (FOMC) policy decision next week, Chainwala added.

However, silver was marginally down at USD 29.25 per ounce in New York.

According to commodity market experts, traders also worried about slowing Chinese economic growth, geopolitical risks from the Russia-Ukraine war and the ongoing conflicts in the Middle East will benefit the safe-haven asset.

Further, traders are awaiting the upcoming release of the US Personal Consumption Expenditures (PCE) price index data on Friday for more cues about the US Federal Reserve's monetary policy path, which will provide directions for the bullion prices in the near future, they said.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- FSN E-Commerce Ventu

- 226.90 (+ 7.84)

- 44986839

- Rajnish Wellness

- 4.35 (+ 9.85)

- 42383762

- Reliance Power L

- 34.45 ( -4.99)

- 37949700

- GTL Infrastructure

- 2.81 ( -2.09)

- 34669129

- ARC Finance

- 1.33 (+ 4.72)

- 30775342

MORE NEWS

India-Seychelles Trade Ties Strengthen:...

India and Seychelles are exploring stronger business ties with opportunities for Indian...

Funskool Brings CATAN Board Game to India | MRF...

Funskool India, backed by MRF Group, has secured rights from Asmodee to distribute the...

Jeyyam Global Foods IPO: Rs 80-82 cr Raise, Sep...

Jeyyam Global Foods, a leading supplier of Bengal gram and fried gram, is launching an...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.