Govt Targets Higher Dividends from RBI, Banks in Budget

By Rediff Money Desk, NEWDELHI Jan 29, 2024 17:42

India's government aims to receive Rs 70,000 crore in dividends from the RBI, banks, and financial institutions in the upcoming budget, exceeding the previous year's target.

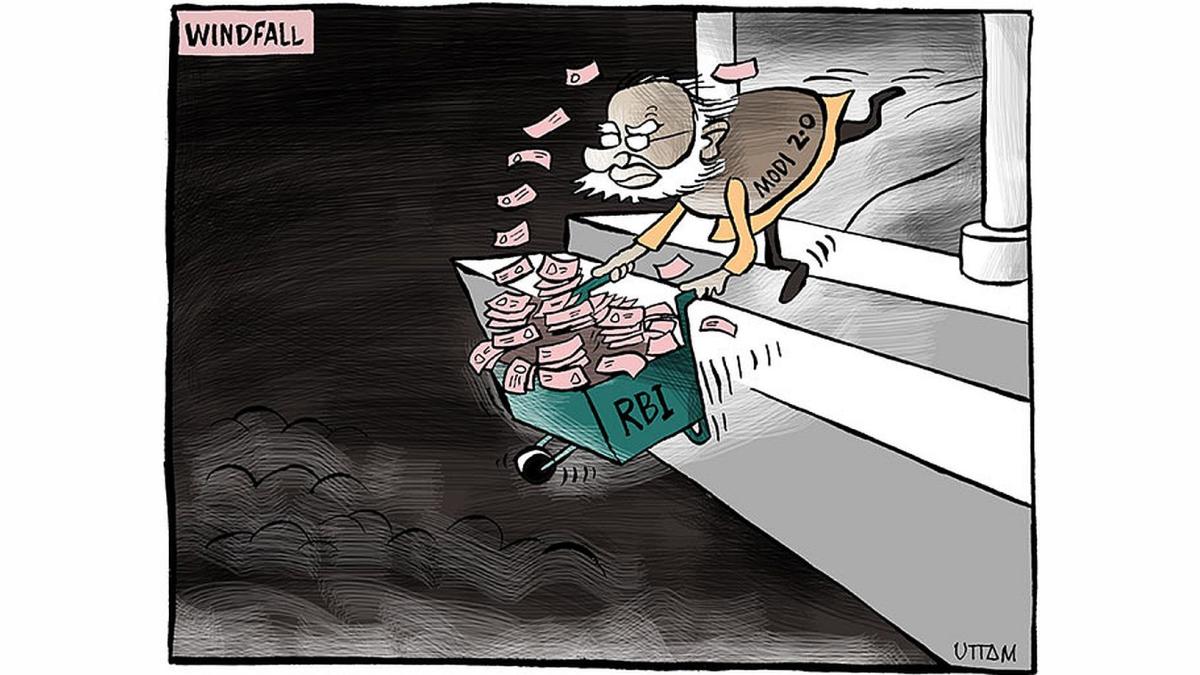

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Jan 29 (PTI) Having reaped rich dividends from the Reserve Bank in the current financial year, the government will be looking forward to receiving about Rs 70,000 crore from the central bank and the financial institutions (FIs) in the next financial year.

In the interim Budget to be unveiled in the Lok Sabha on February 1 by Finance Minister Nirmala Sitharaman, sources said, the government would peg receipts from dividends from financial institutions at much higher level than Rs 48,000 crore estimated for the current fiscal.

The current financial year estimate has already exceeded the Budget target as RBI paid a dividend of Rs 87,416 crore.

With public sector banks and financial institutions posting good quarterly numbers during the current financial year, the dividend payout by them in the coming year would be higher compared to this year.

So, it would be feasible to expect about Rs 70,000 crore as dividend payout from RBI and financial institutions in FY'25, sources said.

The government had pegged a 17 per cent higher dividend at Rs 48,000 crore from the Reserve Bank of India (RBI), public sector banks and financial institutions in 2023-24.

However, this target was very much surpassed with the transfer of Rs 87,416 crore as surplus to the central government for 2022-23 by the Reserve Bank.

During 2023-24, the Reserve Bank transferred a surplus of Rs 87,416.22 crore to the central government which is higher than both the amount transferred last year (Rs 30,307.45 crore) and the budgeted amount under Dividend/Surplus transfer of Reserve Bank of India, Nationalised Banks and Financial Institutions in the Union Budget 2023-24 (Rs 48,000 crore).

In the previous financial year, the government mobilised Rs 40,953 crore from RBI and public sector financial institutions.

The higher dividend from banks and financial institutions, apart from higher tax mobilisation, would help achieve a fiscal deficit glide path.

As per the fiscal consolidation roadmap, the government aims to reduce the fiscal deficit to below 4.5 per cent by 2025-26 from an estimated 5.9 per cent of GDP in 2023-24.

The government, as per the roadmap, is required to bring down the fiscal deficit to 5.4 per cent in the next financial year beginning April 1, 2024.

In the interim Budget to be unveiled in the Lok Sabha on February 1 by Finance Minister Nirmala Sitharaman, sources said, the government would peg receipts from dividends from financial institutions at much higher level than Rs 48,000 crore estimated for the current fiscal.

The current financial year estimate has already exceeded the Budget target as RBI paid a dividend of Rs 87,416 crore.

With public sector banks and financial institutions posting good quarterly numbers during the current financial year, the dividend payout by them in the coming year would be higher compared to this year.

So, it would be feasible to expect about Rs 70,000 crore as dividend payout from RBI and financial institutions in FY'25, sources said.

The government had pegged a 17 per cent higher dividend at Rs 48,000 crore from the Reserve Bank of India (RBI), public sector banks and financial institutions in 2023-24.

However, this target was very much surpassed with the transfer of Rs 87,416 crore as surplus to the central government for 2022-23 by the Reserve Bank.

During 2023-24, the Reserve Bank transferred a surplus of Rs 87,416.22 crore to the central government which is higher than both the amount transferred last year (Rs 30,307.45 crore) and the budgeted amount under Dividend/Surplus transfer of Reserve Bank of India, Nationalised Banks and Financial Institutions in the Union Budget 2023-24 (Rs 48,000 crore).

In the previous financial year, the government mobilised Rs 40,953 crore from RBI and public sector financial institutions.

The higher dividend from banks and financial institutions, apart from higher tax mobilisation, would help achieve a fiscal deficit glide path.

As per the fiscal consolidation roadmap, the government aims to reduce the fiscal deficit to below 4.5 per cent by 2025-26 from an estimated 5.9 per cent of GDP in 2023-24.

The government, as per the roadmap, is required to bring down the fiscal deficit to 5.4 per cent in the next financial year beginning April 1, 2024.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- ARC Finance

- 1.51 (+ 2.72)

- 99106131

- Vodafone Idea L

- 8.27 (+ 1.72)

- 37910491

- Guj. Toolroom Lt

- 18.98 (+ 4.98)

- 33052379

- Srestha Finvest

- 0.81 ( -2.41)

- 24087791

- Filatex Fashions

- 0.69 ( -4.17)

- 20455844

MORE NEWS

CCI Clears Coal India in E-Auction Scheme Case

India's competition watchdog CCI dismissed a complaint against Coal India's e-auction...

HDFC Bank Loan Growth Rises 3% in Q3

HDFC Bank reports a 3% increase in loan growth in the December quarter, reaching Rs...

IDBI Bank Reports 18% Loan Growth in Q3

IDBI Bank saw an 18% increase in loan growth during the December quarter, reaching Rs...

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.