HUDCO raises USD 200 mn from overseas lenders

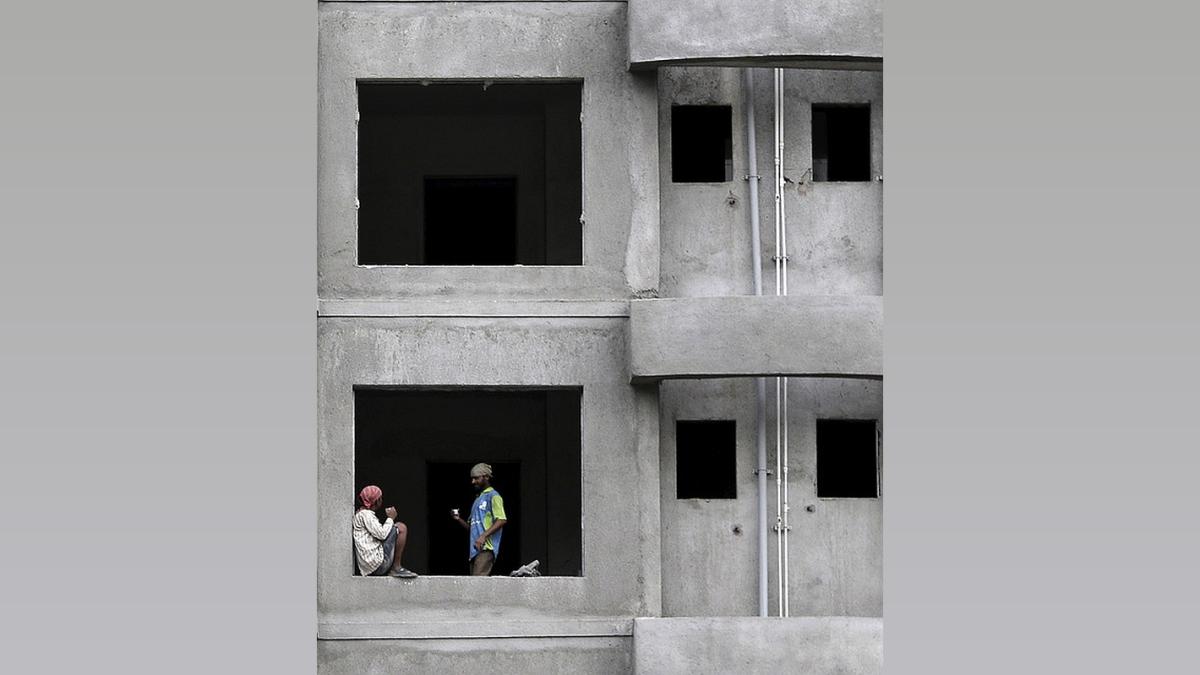

Housing and Urban Development Corporation (HUDCO) has secured USD 200 million in a social loan, marking its debut in the syndicated loan market. The five-year loan was arranged by Sumitomo Mitsui Banking Corporation (SMBC) and will fund social housing expansion in India.

Mumbai, Jun 18 (PTI) Housing and Urban Development Corporation (HUDCO) has raised USD 200 million (JPY 30 billion) in its maiden foray into the syndicated loan market, its arranger said on Tuesday.

The state-run body has raised the five-year money as part of its inaugural "social loan", Japan's Sumitomo Mitsui Banking Corporation (SMBC) said.

The deal, led by SMBC's Singapore branch, saw an oversubscription with a total of nine lenders, and was upsized from its original launch size of JPY 15 billion to JPY 30 billion after exercising the greenshoe option, an official statement said.

The inaugural social loan will enable further expansion of HUDCO's social housing platform to improve the quality of life for the Indian community and enhance infrastructure facilities in urban areas, the statement said.

SMBC acted as the sole mandated lead arranger, book runner and social loan coordinator.

"We look forward to expanding our reach to the underserved communities and strengthening the local community's access to resources," Hiroyuki Mesaki, country head of SMBC India, said.

SMBC India's chief business officer Rakesh Garg said the financing sets new benchmarks and paves the way for more Indian companies to tap into the Japanese Yen loan markets.

HUDCO's chairman and managing director Sanjay Kulshreshta said the body anticipates a surge in demand for its services given the government's focus on infrastructure-led growth.

"The substantial increase in infrastructure outlay signals significant growth prospects," he said, adding that the deal helps diversify the resource base and optimise costs. PTI AA

--

The state-run body has raised the five-year money as part of its inaugural "social loan", Japan's Sumitomo Mitsui Banking Corporation (SMBC) said.

The deal, led by SMBC's Singapore branch, saw an oversubscription with a total of nine lenders, and was upsized from its original launch size of JPY 15 billion to JPY 30 billion after exercising the greenshoe option, an official statement said.

The inaugural social loan will enable further expansion of HUDCO's social housing platform to improve the quality of life for the Indian community and enhance infrastructure facilities in urban areas, the statement said.

SMBC acted as the sole mandated lead arranger, book runner and social loan coordinator.

"We look forward to expanding our reach to the underserved communities and strengthening the local community's access to resources," Hiroyuki Mesaki, country head of SMBC India, said.

SMBC India's chief business officer Rakesh Garg said the financing sets new benchmarks and paves the way for more Indian companies to tap into the Japanese Yen loan markets.

HUDCO's chairman and managing director Sanjay Kulshreshta said the body anticipates a surge in demand for its services given the government's focus on infrastructure-led growth.

"The substantial increase in infrastructure outlay signals significant growth prospects," he said, adding that the deal helps diversify the resource base and optimise costs. PTI AA

--

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.18 (+ 1.13)

- 52653381

- GTL Infrastructure

- 1.49 (+ 0.68)

- 33373393

- GMR Airports

- 85.66 ( 0.00)

- 20868077

- Pradhin

- 0.49 ( 0.00)

- 16829759

- Standard Capital

- 0.49 (+ 2.08)

- 16405397

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.