IMF Upgrades China, India Outlook, Global Growth Tepid

By Rediff Money Desk, Washington Jul 16, 2024 19:20

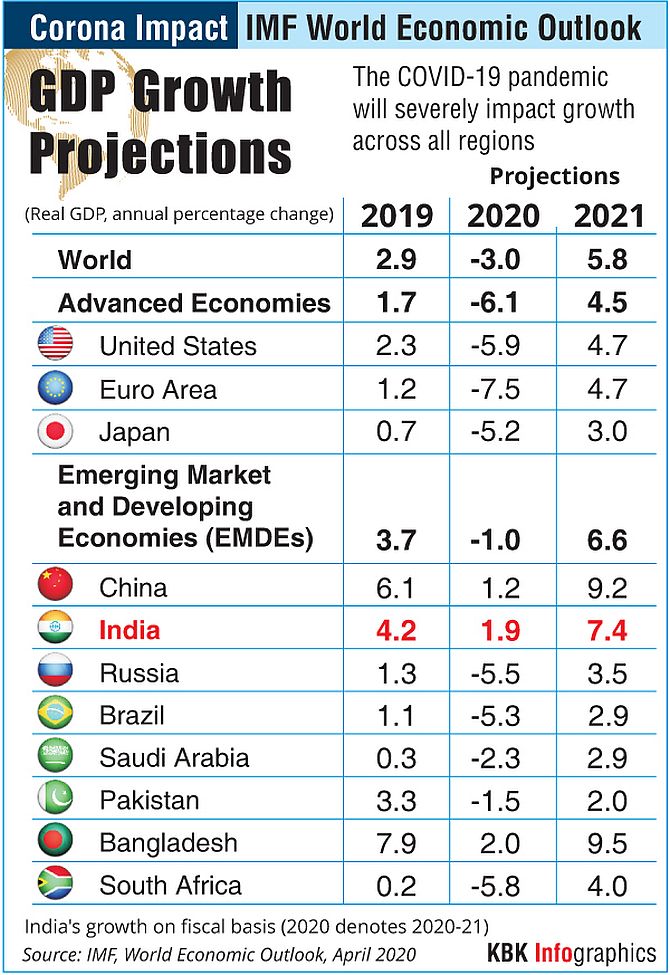

The IMF is upgrading its economic outlook for China and India, but expects tepid global growth due to persistent inflation. Read more about the IMF's latest World Economic Outlook.

Illustration: Dominic Xavier/Rediff.com

Washington, Jul 16 (AP) The International Monetary Fund is upgrading its economic outlook this year for China, India and Europe while modestly lowering expectations for the United States and Japan. But it says worldwide progress against accelerating prices has been slowed by stickier-than-expected inflation for services, from airline travel to restaurant meals.

Overall, the IMF said Tuesday that it still expects the world economy to grow a lackluster 3.2 per cent this year, unchanged from its previous forecast in April and down a tick from 3.3 per cent growth in 2023. From 2000 through 2019, before the pandemic upended economic activity, global growth had averaged 3.8 per cent a year.

The IMF, a 190-nation lending organisation, works to promote economic growth and financial stability and reduce global poverty. In a blog post that accompanied the latest update to its World Economic Outlook, the IMF's chief economist, Pierre-Olivier Gourinchas, wrote that China and India would account for nearly half of global growth this year.

Partly because of a surge in Chinese exports at the start of 2024, the IMF upgraded its growth forecast for China this year to 5 per cent from the 4.6 per cent it had projected in April, though down from 5.2 per cent in 2023. The IMF forecast was posted before Beijing reported Monday that the Chinese economy, the world's second-largest after the United States, had grown at a slower-than-expected 4.7 per cent annual rate from April through June, down from 5.3 per cent in the first three months of the year.

China's economy, which once regularly grew at a double-digit annual pace, is facing significant challenges, notably the collapse of its housing market and an aging population that is leaving the country with labour shortages. By 2029, Gourinchas wrote, China's growth will slow to 3.3 per cent.

India's economy is now forecast to expand 7 per cent, up from the 6.8 per cent the IMF had projected in April, in part because of stronger consumer spending in rural areas.

The IMF said that the shoots of recovery materialised in Europe, which had been battered by high energy prices and other economic damage from Russia's 2022 invasion of Ukraine. Citing a rise in Europe's services businesses, IMF raised its 2024 growth forecast for the 20 countries that share the euro currency by a tenth of a percentage point from its April forecast, to 0.9 per cent. In 2023, the eurozone grew 0.5 per cent.

But a weak first quarter in the United States led the IMF to downgrade its forecast for US growth this year to 2.6 per cent from the 2.7 per cent it had predicted in April.

Likewise, the IMF lowered its outlook for 2024 growth in Japan to 0.7 per cent from the 0.9 per cent it had envisioned in April and from 1.9 per cent in 2023. Japan's first-quarter growth was disrupted by the shutdown of a major automobile plant, the IMF said.

After surging to 8.7 per cent in 2022 as the global economy rapidly recovered from the pandemic recession, worldwide inflation is expected to continue easing from 6.7 per cent in 2023 to 5.9 per cent this year and 4.4 per cent in 2025.

But progress is slowing, the IMF said, because services inflation has proved persistently difficult to tame. The fund warned that some central banks may keep interest rates higher for longer than anticipated, until they're convinced that inflation is firmly under control. Higher-than-expected borrowing costs could weaken global growth as a result.

The good news is that as headline shocks receded, inflation came down without a recession,' Gourinchas wrote. The bad news, he said, is that it still isn't back to pre-pandemic levels. (AP)

Overall, the IMF said Tuesday that it still expects the world economy to grow a lackluster 3.2 per cent this year, unchanged from its previous forecast in April and down a tick from 3.3 per cent growth in 2023. From 2000 through 2019, before the pandemic upended economic activity, global growth had averaged 3.8 per cent a year.

The IMF, a 190-nation lending organisation, works to promote economic growth and financial stability and reduce global poverty. In a blog post that accompanied the latest update to its World Economic Outlook, the IMF's chief economist, Pierre-Olivier Gourinchas, wrote that China and India would account for nearly half of global growth this year.

Partly because of a surge in Chinese exports at the start of 2024, the IMF upgraded its growth forecast for China this year to 5 per cent from the 4.6 per cent it had projected in April, though down from 5.2 per cent in 2023. The IMF forecast was posted before Beijing reported Monday that the Chinese economy, the world's second-largest after the United States, had grown at a slower-than-expected 4.7 per cent annual rate from April through June, down from 5.3 per cent in the first three months of the year.

China's economy, which once regularly grew at a double-digit annual pace, is facing significant challenges, notably the collapse of its housing market and an aging population that is leaving the country with labour shortages. By 2029, Gourinchas wrote, China's growth will slow to 3.3 per cent.

India's economy is now forecast to expand 7 per cent, up from the 6.8 per cent the IMF had projected in April, in part because of stronger consumer spending in rural areas.

The IMF said that the shoots of recovery materialised in Europe, which had been battered by high energy prices and other economic damage from Russia's 2022 invasion of Ukraine. Citing a rise in Europe's services businesses, IMF raised its 2024 growth forecast for the 20 countries that share the euro currency by a tenth of a percentage point from its April forecast, to 0.9 per cent. In 2023, the eurozone grew 0.5 per cent.

But a weak first quarter in the United States led the IMF to downgrade its forecast for US growth this year to 2.6 per cent from the 2.7 per cent it had predicted in April.

Likewise, the IMF lowered its outlook for 2024 growth in Japan to 0.7 per cent from the 0.9 per cent it had envisioned in April and from 1.9 per cent in 2023. Japan's first-quarter growth was disrupted by the shutdown of a major automobile plant, the IMF said.

After surging to 8.7 per cent in 2022 as the global economy rapidly recovered from the pandemic recession, worldwide inflation is expected to continue easing from 6.7 per cent in 2023 to 5.9 per cent this year and 4.4 per cent in 2025.

But progress is slowing, the IMF said, because services inflation has proved persistently difficult to tame. The fund warned that some central banks may keep interest rates higher for longer than anticipated, until they're convinced that inflation is firmly under control. Higher-than-expected borrowing costs could weaken global growth as a result.

The good news is that as headline shocks receded, inflation came down without a recession,' Gourinchas wrote. The bad news, he said, is that it still isn't back to pre-pandemic levels. (AP)

Source: ASSOCIATED PRESS

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

India To Set Up Centre For Trade Negotiation...

India's Commerce Ministry plans to establish a centre for negotiation skills to...

SBI 444-Day Term Deposit: Up to 7.25% Annual...

State Bank of India launches a 444-day term deposit offering up to 7.25% annual...

Vi Improves Network Coverage in Uttarakhand & UP

Vi expands L900 & L2100 technologies in UP and Uttarakhand, offering improved indoor...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.