Indonesia's Trade Dilemma: Balancing Domestic Industry with Chinese Imports

By Rediff Money Desk, Jakarta Aug 21, 2024 11:17

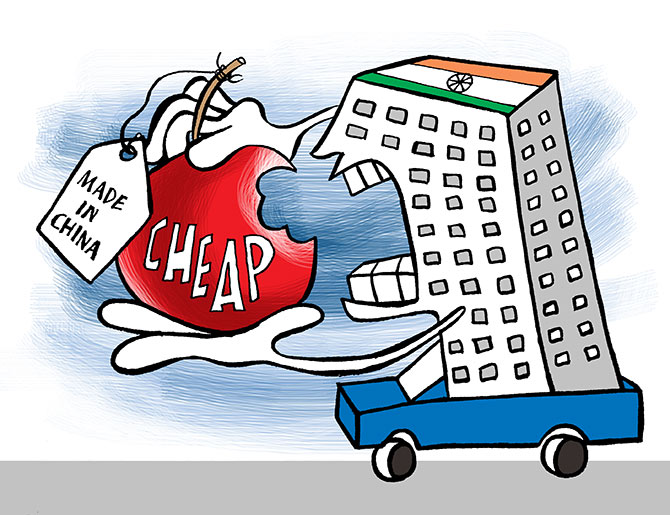

Indonesia faces a trade challenge as cheap Chinese imports impact local manufacturers. The government is exploring options to protect domestic industries while maintaining relations with its largest trading partner.

Jakarta, Aug 21 (AP) A flood of Chinese products into Indonesia has hit local manufacturers hard, prompting the government to look for ways to placate domestic producers while avoiding angering the country's biggest trading partner.

Garment makers both home-based piece work producers and factories have appealed for help as they lose market share to low-cost apparel and textiles from China. A surge of products bought online has added to the problem.

A protest by workers in Jakarta prompted Indonesian Minister of Trade Zulkifli Hasan to announce in July that the government will impose import tariffs of up to 200% on some products from China, particularly textiles, clothing, footwear, electronics, ceramics and cosmetics, to try to protect local businesses and prevent layoffs.

The United States can impose a 200% tariff on imported ceramics or clothes, so we can do it as well," Zulkifli said, to ensure micro, small, and medium-sized enterprises and industries survive and thrive.

But China is Indonesia's largest trading partner, with two-way trade exceeding $127 billion in 2023. Imposing higher tariffs could prompt Chinese manufacturers to invest in more in factories in Indonesia, but could also backfire, leading Beijing to retaliate. As a result, the government announced in July that it was setting up a task force to monitor and handle problems related to certain imports.

It's an urgent matter, Hasan said, given the flood of imported products that has caused closures of textile factories and mass layoffs. From January to July 2024, at least 12 textile factories shut down operations, causing more than 12,000 workers to lose their jobs, according to the Nusantara Trade Union Confederation.

In Bandung district in Indonesia's West Java province an area famous for textiles such as batiks, handwoven fabrics and silks imports of Chinese products have left thousands of workers idle and without regular incomes, said Neng Wati, a manager at manufacturing company Asnur Konveksi.

Now they take turns. The number of workers stays the same, but the work is divided up and not all get some. Some of them have been off for two weeks, some of them haven't gotten work for a month, Wati said.

That's a hard blow coming after the slow days of the COVID-19 pandemic, when many workers were shifted to e-commerce to make ends meet, said Nandi Herdiaman, head of a local organization of small- and medium-sized entrepreneurs. Only 60% of the 8,000 members of the association kept working after the pandemic.

Now, the biggest challenge is cheap imports from China. In the past two months, output from home-based industries has fallen by 70%, the industry organization says.

The uptick in imports of Chinese products is partly seen as the result of trade friction between the U.S. and China, which has led to increased American tariffs on Chinese goods. But it also reflects rising trade within Asia as the region implements various free trade pacts, as well as weakening demand in Western markets for Chinese exports.

Industry groups in Thailand have also expressed increasing concern about an influx of cheap products from China, which they say have greatly hurt sales by domestic producers who are unable to compete.

In what it called an urgent measure, the Thai government imposed a 7% value-added tax on all imported products, a change from the previous rule that only collected taxes on imported products that cost more than 1,500 baht ($44). The policy is only in effect from July until December this year to give the government time to study the issue before a longer-term solution can be applied.

In December, Indonesia issued a regulation to tighten monitoring of more than 3,000 imported goods, including food ingredients, electronics and chemicals. But the regulation was reversed after domestic industry said it hindered the flow of imported materials needed for local production, and the government began considering steep tariff hikes instead.

While smaller manufacturers have suffered the greatest setbacks, big factories are also hurting.

Jany Suhertan, managing director of PT Eksonindo Multi Product Industry, which makes clothing and accessories like backpacks and handbags in West Java, wants the government to raise import duties on finished goods from China but not on raw materials needed to make products in Indonesia.

Nearly half of the materials his company uses are from China.

I don't agree with imposing (higher tariffs) on raw products, since the government should protect the supply chain. If it is not secure, it will impact production, Suhertan said.

Garment makers both home-based piece work producers and factories have appealed for help as they lose market share to low-cost apparel and textiles from China. A surge of products bought online has added to the problem.

A protest by workers in Jakarta prompted Indonesian Minister of Trade Zulkifli Hasan to announce in July that the government will impose import tariffs of up to 200% on some products from China, particularly textiles, clothing, footwear, electronics, ceramics and cosmetics, to try to protect local businesses and prevent layoffs.

The United States can impose a 200% tariff on imported ceramics or clothes, so we can do it as well," Zulkifli said, to ensure micro, small, and medium-sized enterprises and industries survive and thrive.

But China is Indonesia's largest trading partner, with two-way trade exceeding $127 billion in 2023. Imposing higher tariffs could prompt Chinese manufacturers to invest in more in factories in Indonesia, but could also backfire, leading Beijing to retaliate. As a result, the government announced in July that it was setting up a task force to monitor and handle problems related to certain imports.

It's an urgent matter, Hasan said, given the flood of imported products that has caused closures of textile factories and mass layoffs. From January to July 2024, at least 12 textile factories shut down operations, causing more than 12,000 workers to lose their jobs, according to the Nusantara Trade Union Confederation.

In Bandung district in Indonesia's West Java province an area famous for textiles such as batiks, handwoven fabrics and silks imports of Chinese products have left thousands of workers idle and without regular incomes, said Neng Wati, a manager at manufacturing company Asnur Konveksi.

Now they take turns. The number of workers stays the same, but the work is divided up and not all get some. Some of them have been off for two weeks, some of them haven't gotten work for a month, Wati said.

That's a hard blow coming after the slow days of the COVID-19 pandemic, when many workers were shifted to e-commerce to make ends meet, said Nandi Herdiaman, head of a local organization of small- and medium-sized entrepreneurs. Only 60% of the 8,000 members of the association kept working after the pandemic.

Now, the biggest challenge is cheap imports from China. In the past two months, output from home-based industries has fallen by 70%, the industry organization says.

The uptick in imports of Chinese products is partly seen as the result of trade friction between the U.S. and China, which has led to increased American tariffs on Chinese goods. But it also reflects rising trade within Asia as the region implements various free trade pacts, as well as weakening demand in Western markets for Chinese exports.

Industry groups in Thailand have also expressed increasing concern about an influx of cheap products from China, which they say have greatly hurt sales by domestic producers who are unable to compete.

In what it called an urgent measure, the Thai government imposed a 7% value-added tax on all imported products, a change from the previous rule that only collected taxes on imported products that cost more than 1,500 baht ($44). The policy is only in effect from July until December this year to give the government time to study the issue before a longer-term solution can be applied.

In December, Indonesia issued a regulation to tighten monitoring of more than 3,000 imported goods, including food ingredients, electronics and chemicals. But the regulation was reversed after domestic industry said it hindered the flow of imported materials needed for local production, and the government began considering steep tariff hikes instead.

While smaller manufacturers have suffered the greatest setbacks, big factories are also hurting.

Jany Suhertan, managing director of PT Eksonindo Multi Product Industry, which makes clothing and accessories like backpacks and handbags in West Java, wants the government to raise import duties on finished goods from China but not on raw materials needed to make products in Indonesia.

Nearly half of the materials his company uses are from China.

I don't agree with imposing (higher tariffs) on raw products, since the government should protect the supply chain. If it is not secure, it will impact production, Suhertan said.

Source: ASSOCIATED PRESS

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Alstone Textiles

- 0.82 (+ 3.80)

- 20990978

- Filatex Fashions

- 1.30 ( -3.70)

- 19412822

- AvanceTechnologies

- 0.92 (+ 3.37)

- 16446587

- Vodafone Idea L

- 15.95 (+ 0.06)

- 16242352

- GTL Infrastructure

- 2.79 ( -0.71)

- 16058836

MORE NEWS

NMDC Steel Achieves 1 MT HRC Production in a Year

NMDC Steel Limited (NSL) has achieved a significant milestone by producing 1 million...

ICICI Securities Delisting Approved by NCLT

The National Company Law Tribunal (NCLT) has approved the delisting of ICICI...

Decathlon to Invest €100 Million in India for...

French sports retailer Decathlon will invest €100 million in India over the next 5...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.