Infosys Shares Plunge 4.5% After Earnings

By Rediff Money Desk, New Delhi Oct 18, 2024 10:53

Infosys shares tumbled 4.50% on Friday after the company's Q2 earnings failed to impress investors. The stock was the biggest laggard on the BSE Sensex and NSE Nifty, dragging markets lower.

New Delhi, Oct 18 (PTI) Shares of Infosys Ltd slumped 4.50 per cent on Friday morning after the company's second quarter earnings failed to cheer investors.

The stock tanked 4.50 per cent to Rs 1,880.80 on the BSE.

At the NSE, it dived 4.44 per cent to Rs 1,880.65.

The stock was the biggest laggard among the BSE Sensex and NSE Nifty firms.

The company's market valuation eroded by Rs 31,327.94 crore to Rs 7,86,437.37 crore during the morning trade.

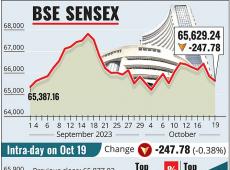

Decline in the bellwether stock dragged the markets lower. The BSE benchmark tanked 570.45 points to 80,436.16 in early trade. The NSE Nifty slumped 178.3 points to 24,571.55.

Infosys Ltd, India's second-largest IT services exporter, on Thursday reported a near 5 per cent rise in its second quarter net profit and raised revenue guidance for the year on broad-based recovery in demand particularly from its key financial industry clients.

Consolidated net profit of Rs 6,506 crore in July-September -- the second quarter of current 2024-25 fiscal year -- was 4.7 per cent higher than the year-ago earnings and 2.2 per cent more than the net profit in the preceding quarter, according to a company statement.

Technology services bellwether for the second consecutive quarter raised its revenue guidance for the full fiscal. It now expects constant currency revenue growth between 3.75 per cent and 4.5 per cent for the financial year April 2024 to March 2025, higher than its earlier guidance of 3 per cent to 4 per cent.

Infosys CEO and MD Salil Parekh termed it a "huge upward movement" in growth guidance. The upward revision comes on the back of a ramp-up of mega deals.

The company had raised its guidance in the June quarter from the 1-3 per cent range it started the year with.

The stock tanked 4.50 per cent to Rs 1,880.80 on the BSE.

At the NSE, it dived 4.44 per cent to Rs 1,880.65.

The stock was the biggest laggard among the BSE Sensex and NSE Nifty firms.

The company's market valuation eroded by Rs 31,327.94 crore to Rs 7,86,437.37 crore during the morning trade.

Decline in the bellwether stock dragged the markets lower. The BSE benchmark tanked 570.45 points to 80,436.16 in early trade. The NSE Nifty slumped 178.3 points to 24,571.55.

Infosys Ltd, India's second-largest IT services exporter, on Thursday reported a near 5 per cent rise in its second quarter net profit and raised revenue guidance for the year on broad-based recovery in demand particularly from its key financial industry clients.

Consolidated net profit of Rs 6,506 crore in July-September -- the second quarter of current 2024-25 fiscal year -- was 4.7 per cent higher than the year-ago earnings and 2.2 per cent more than the net profit in the preceding quarter, according to a company statement.

Technology services bellwether for the second consecutive quarter raised its revenue guidance for the full fiscal. It now expects constant currency revenue growth between 3.75 per cent and 4.5 per cent for the financial year April 2024 to March 2025, higher than its earlier guidance of 3 per cent to 4 per cent.

Infosys CEO and MD Salil Parekh termed it a "huge upward movement" in growth guidance. The upward revision comes on the back of a ramp-up of mega deals.

The company had raised its guidance in the June quarter from the 1-3 per cent range it started the year with.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Standard Capital

- 1.15 (+ 9.52)

- 33072440

- Vodafone Idea L

- 9.03 ( -0.33)

- 29036751

- Srestha Finvest

- 0.81 (+ 2.53)

- 23204772

- Filatex Fashions

- 1.08 (+ 1.89)

- 23107868

- Spicejet Ltd.

- 61.25 (+ 0.16)

- 16360532

MORE NEWS

TAFE Wins Interim Injunction in Massey Ferguson...

TAFE secures interim injunction from Madras High Court in its trademark ownership suit...

Granules India Gets USFDA Nod for Generic...

Granules India has received USFDA approval to market a generic medication for major...

Areca & Coconut Prices in Mangaluru - Oct 18

Get the latest areca and coconut prices in Mangaluru for October 18th. Find out the...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.