Innova Captab IPO: Secures Rs 171 Cr from Anchor Investors

Innova Captab, an integrated pharmaceutical company, has raised Rs 171 crore from anchor investors ahead of its IPO. The IPO, priced between Rs 426-448 per share, will open on December 21 and conclude on December 26.

New Delhi, Dec 20 (PTI) Integrated pharmaceutical company Innova Captab on Wednesday said it has collected Rs 171 crore from anchor investors a day before its Initial Public Offering (IPO).

The company has allotted 38.17 lakh equity shares to 17 funds at Rs 448 apiece, which is the upper end of the price band, according to a circular uploaded on the BSE website.

Investors that participated in the anchor book include ICICI Prudential Mutual Fund (MF), Kotak Mahindra MF, Whiteoak MF, Bandhan MF, Canara Robeco MF, 360 One MF, Edelweiss MF, SBI Life Insurance Company, and Aditya Birla Sun Life Insurance.

Of the total allocation of 38.17 lakh equity shares to anchor investors, 17.13 lakh equity shares were allocated to six domestic mutual funds through a total of eight schemes amounting to Rs 76.74 crore -- 45 per cent of the total anchor book size, it showed.

The maiden public issue comprises a fresh issue of equity shares worth up to Rs 320 crore and an Offer-For-Sale (OFS) of up to 55.80 lakh equity shares by promoters and selling shareholders.

Those selling shares in the OFS are Manoj Kumar Lohariwala, Vinay Kumar Lohariwala, and Gian Parkash Aggarwal.

The issue, with a price band of Rs 426-448 per share, will open on December 21 and conclude on December 26.

At the upper end of the price band, the IPO is expected to fetch Rs 570 crore.

Proceeds from fresh issuance worth Rs 144.40 crore will be utilised for payment of the debt, Rs 23.60 crore for investment in the subsidiary, UML, Rs 72 crore for funding working capital requirements, besides, a portion will be used for general corporate purposes.

Innova Captab is an integrated pharmaceutical company with a presence across the pharmaceuticals value chain, including research and development, manufacturing, drug distribution, and marketing, and exports.

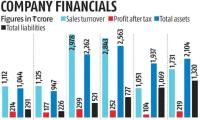

The company's consolidated revenue from operations grew 15.72 per cent to Rs 926.38 crore for FY23 from Rs 800.53 crore in the preceding fiscal while profit after tax rose 6.26 per cent to Rs 67.95 crore for FY23 from Rs 63.95 crore in FY22.

ICICI Securities and JM Financial are book-running lead managers to the IPO. The equity shares are proposed to be listed on the BSE and the NSE.

The company has allotted 38.17 lakh equity shares to 17 funds at Rs 448 apiece, which is the upper end of the price band, according to a circular uploaded on the BSE website.

Investors that participated in the anchor book include ICICI Prudential Mutual Fund (MF), Kotak Mahindra MF, Whiteoak MF, Bandhan MF, Canara Robeco MF, 360 One MF, Edelweiss MF, SBI Life Insurance Company, and Aditya Birla Sun Life Insurance.

Of the total allocation of 38.17 lakh equity shares to anchor investors, 17.13 lakh equity shares were allocated to six domestic mutual funds through a total of eight schemes amounting to Rs 76.74 crore -- 45 per cent of the total anchor book size, it showed.

The maiden public issue comprises a fresh issue of equity shares worth up to Rs 320 crore and an Offer-For-Sale (OFS) of up to 55.80 lakh equity shares by promoters and selling shareholders.

Those selling shares in the OFS are Manoj Kumar Lohariwala, Vinay Kumar Lohariwala, and Gian Parkash Aggarwal.

The issue, with a price band of Rs 426-448 per share, will open on December 21 and conclude on December 26.

At the upper end of the price band, the IPO is expected to fetch Rs 570 crore.

Proceeds from fresh issuance worth Rs 144.40 crore will be utilised for payment of the debt, Rs 23.60 crore for investment in the subsidiary, UML, Rs 72 crore for funding working capital requirements, besides, a portion will be used for general corporate purposes.

Innova Captab is an integrated pharmaceutical company with a presence across the pharmaceuticals value chain, including research and development, manufacturing, drug distribution, and marketing, and exports.

The company's consolidated revenue from operations grew 15.72 per cent to Rs 926.38 crore for FY23 from Rs 800.53 crore in the preceding fiscal while profit after tax rose 6.26 per cent to Rs 67.95 crore for FY23 from Rs 63.95 crore in FY22.

ICICI Securities and JM Financial are book-running lead managers to the IPO. The equity shares are proposed to be listed on the BSE and the NSE.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.04 ( -1.68)

- 102363129

- Srestha Finvest

- 0.51 ( -3.77)

- 22605309

- GMR Airports

- 76.30 (+ 0.83)

- 19768792

- Bajaj HindusthanSuga

- 19.57 ( -2.59)

- 15088109

- G G Engineering

- 0.90 ( -3.23)

- 13176176

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.