Juniper Hotels IPO Oversubscribed: 2x Subscription on Final Day

By Rediff Money Desk, NEWDELHI Feb 23, 2024 19:33

Juniper Hotels IPO received 2.08 times subscription on the final day, with strong demand from QIBs and RIIs. The IPO raised Rs 1,800 crore to repay debt and for general corporate purposes.

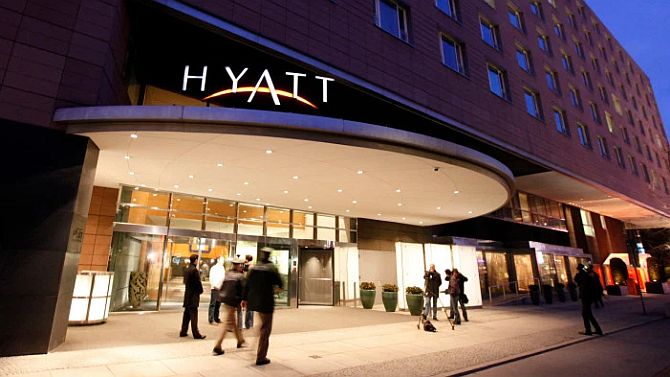

New Delhi, Feb 23 (PTI) The initial share sale of Juniper Hotels, which runs hotels under the Hyatt brand, was subscribed 2.08 times on the final day of offer on Friday.

The Initial Public Offering (IPO) received bids for 6,01,14,160 shares against 2,89,47,367 shares on offer, as per NSE data.

The category for Retail Individual Investors (RIIs) got subscribed 1.28 times, quota for non-institutional investors received 85 per cent subscription, and the portion for Qualified Institutional Buyers (QIBs) got subscribed 2.96 times.

On Tuesday, Juniper Hotels said it has garnered Rs 810 crore from anchor investors.

The IPO is entirely a fresh issue of equity shares worth Rs 1,800 crore and the price band is Rs 342-360 apiece.

Funds to the tune of Rs 1,500 crore will be utilised for repayment of debt availed by the company and subsidiaries -- Chartered Hotels Pvt Ltd and Chartered Hampi Hotels Pvt Ltd.

Besides, a portion of the proceeds will be used for general corporate purposes.

The hospitality firm had a portfolio of seven hotels and serviced apartments and operated 1,836 keys across the luxury, upper upscale, and upscale categories of hotels in India as of September 2023.

Currently, Saraf Hotels owns a 44.68 per cent stake in Juniper Hotels, Two Seas Holdings holds a 50 per cent stake and the remaining 5.32 per cent shareholding is with Juniper Investments.

The equity shares of the company will be listed on the BSE and NSE.

JM Financial, CLSA India and ICICI Securities Ltd are the book-running lead managers to the issue.

The Initial Public Offering (IPO) received bids for 6,01,14,160 shares against 2,89,47,367 shares on offer, as per NSE data.

The category for Retail Individual Investors (RIIs) got subscribed 1.28 times, quota for non-institutional investors received 85 per cent subscription, and the portion for Qualified Institutional Buyers (QIBs) got subscribed 2.96 times.

On Tuesday, Juniper Hotels said it has garnered Rs 810 crore from anchor investors.

The IPO is entirely a fresh issue of equity shares worth Rs 1,800 crore and the price band is Rs 342-360 apiece.

Funds to the tune of Rs 1,500 crore will be utilised for repayment of debt availed by the company and subsidiaries -- Chartered Hotels Pvt Ltd and Chartered Hampi Hotels Pvt Ltd.

Besides, a portion of the proceeds will be used for general corporate purposes.

The hospitality firm had a portfolio of seven hotels and serviced apartments and operated 1,836 keys across the luxury, upper upscale, and upscale categories of hotels in India as of September 2023.

Currently, Saraf Hotels owns a 44.68 per cent stake in Juniper Hotels, Two Seas Holdings holds a 50 per cent stake and the remaining 5.32 per cent shareholding is with Juniper Investments.

The equity shares of the company will be listed on the BSE and NSE.

JM Financial, CLSA India and ICICI Securities Ltd are the book-running lead managers to the issue.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.