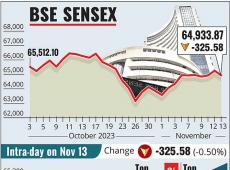

Markets Extend Losses for 5th Session: Metal & Bank Stocks Drag

By Rediff Money Desk, Mumbai Jul 25, 2024 16:03

Indian stock markets continued their downward trend for the fifth consecutive session, dragged by metal and banking stocks. FII outflows and global market weakness contributed to the decline.

Photograph: Francis Mascarenhas/Reuters

Mumbai, Jul 25 (PTI) Equity market benchmark indices Sensex and Nifty stayed on the back foot for the fifth straight session on Thursday as investors offloaded metal, banking and finance stocks amid a lacklustre trend in global markets.

Heavy foreign fund outflows after a hike in securities transaction tax and short-term capital gains tax also impacted markets' sentiment negatively.

After a sharp fall in intra-day trade, the 30-share BSE Sensex managed to recover some of the lost ground to settle 109.08 points or 0.14 per cent lower at 80,039.80, as a sharp rally in Tata Motors and Larsen & Toubro restricted markets fall. During the day, it tanked 671 points or 0.83 per cent to 79,477.83.

The NSE Nifty dipped 7.40 points or 0.03 per cent to 24,406.10. Intra-day, it tumbled 202.7 points or 0.83 per cent to 24,210.80.

From the Sensex pack, Axis Bank declined over 5 per cent after the company's June quarter earnings failed to cheer investors.

Nestle, Titan, ICICI Bank, Tata Steel, IndusInd Bank, ITC, JSW Steel and State Bank of India were the other laggards.

Among the gainers, Tata Motors jumped nearly 6 per cent.

Larsen & Toubro, Sun Pharma, Kotak Mahindra Bank, Bajaj Finance and Power Grid also ended in the positive territory.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled lower.

European markets were trading in the negative territory. The US markets ended significantly lower on Wednesday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 5,130.90 crore on Wednesday, according to exchange data.

Global oil benchmark Brent crude declined 1.73 per cent to USD 80.31 a barrel.

The BSE benchmark declined 280.16 points or 0.35 per cent to settle at 80,148.88 on Wednesday. The NSE Nifty dropped 65.55 points or 0.27 per cent to 24,413.50.

Heavy foreign fund outflows after a hike in securities transaction tax and short-term capital gains tax also impacted markets' sentiment negatively.

After a sharp fall in intra-day trade, the 30-share BSE Sensex managed to recover some of the lost ground to settle 109.08 points or 0.14 per cent lower at 80,039.80, as a sharp rally in Tata Motors and Larsen & Toubro restricted markets fall. During the day, it tanked 671 points or 0.83 per cent to 79,477.83.

The NSE Nifty dipped 7.40 points or 0.03 per cent to 24,406.10. Intra-day, it tumbled 202.7 points or 0.83 per cent to 24,210.80.

From the Sensex pack, Axis Bank declined over 5 per cent after the company's June quarter earnings failed to cheer investors.

Nestle, Titan, ICICI Bank, Tata Steel, IndusInd Bank, ITC, JSW Steel and State Bank of India were the other laggards.

Among the gainers, Tata Motors jumped nearly 6 per cent.

Larsen & Toubro, Sun Pharma, Kotak Mahindra Bank, Bajaj Finance and Power Grid also ended in the positive territory.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled lower.

European markets were trading in the negative territory. The US markets ended significantly lower on Wednesday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 5,130.90 crore on Wednesday, according to exchange data.

Global oil benchmark Brent crude declined 1.73 per cent to USD 80.31 a barrel.

The BSE benchmark declined 280.16 points or 0.35 per cent to settle at 80,148.88 on Wednesday. The NSE Nifty dropped 65.55 points or 0.27 per cent to 24,413.50.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 9.96 (+ 9.21)

- 181391955

- Thinkink Picturez

- 1.28 ( -4.48)

- 29795790

- Standard Capital

- 0.94 (+ 2.17)

- 15878801

- YES Bank Ltd.

- 18.92 (+ 3.61)

- 14375643

- G G Engineering

- 1.51 ( 0.00)

- 14059736

MORE NEWS

Urja Mobility Launches B2C Battery Leasing for...

Urja Mobility launches its B2C battery leasing program for e-rickshaw drivers in 10...

IOB Q3 Profit Jumps 21% on Lower Bad Loans

Indian Overseas Bank (IOB) reported a 21% increase in net profit to Rs 874 crore for Q3...

Brightchamps Acquires Edjust: Expanding K12...

Brightchamps, a leading edtech platform, acquires Indian K12 marketplace Edjust,...

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.