Mobile Phone Duty Cut to Boost Production, Exports: ICEA

By Rediff Money Desk, NEWDELHI Jan 10, 2024 20:44

India Cellular and Electronics Association (ICEA) says import duty cut on mobile phone components can increase domestic production to USD 82 billion by 2027 and boost exports.

Photograph: Sanjay Sharma/ANI Photo

New Delhi, Jan 10 (PTI) Import duty cut on mobile phone components can increase domestic production of handsets by 28 per cent to USD 82 billion and boost export, crucial to support indigenous manufacturing, industry body ICEA said on Wednesday.

India Cellular and Electronics Association (ICEA) Chairman Pankaj Mohindroo said that the next phase of mobile manufacturing growth has to come from exports as the production for the local market is close to saturation.

He said India will need to enhance competitiveness in mobile manufacturing at the global level by matching the tariffs or reducing the cost of production with respect to countries like China and Vietnam, where import duty on most of the mobile components is nil or in a lower tax bracket.

ICEA, whose members include Apple, Foxconn, Dixon, Vivo, Oppo, Xiaomi, and Lava etc, has projected that lowering duties on mobile inputs, as recommended by the industry, will enhance local production of mobile phones to USD 82 billion by 2026-27 compared and USD 64 billion with business as usual.

The export can grow to USD 39 billion on tariff reforms and USD 50 billion with 100 per cent reforms, as recommended by the industry, by 2026-27 compared to USD 27 billion projected if business continues as usual.

"To achieve this target of high export, India needs more than just ambition. It requires a tangible shift of global value chains, bringing major production lines to India and integrating our businesses into the international supply web," Mohindroo said.

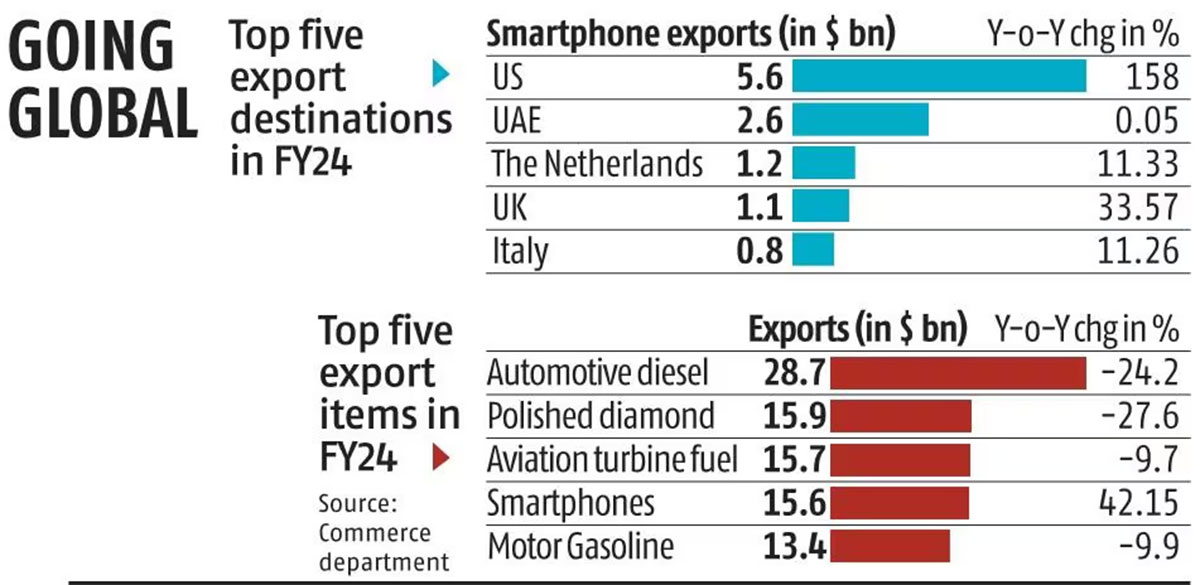

India's smartphone exports jumped 100 per cent in FY 2022-23 to USD 11.1 billion over the previous fiscal.

The industry expects mobile phone exports worth USD 15 billion in FY2024.

ICEA projects exports will form 30 per cent of the total production of USD 49-50 billion in the current fiscal.

According to a study conducted by ICEA, India's simple average most-favoured nation (MFN) tariff for inputs is 8.5 per cent, higher than China's 3.7 per cent.

"In practice, China's tariffs are closer to zero because most mobile production takes place in 'Bonded zones' where all inputs are at zero tariffs. Nearly 80 per cent of Vietnam's imported inputs are from countries with whom it has FTAs. Hereto, FTA (free trade agreement) weighted average tariff comparison between India and Vietnam shows that India's simple average is at 6.8 per cent vis-a-vis Vietnam's at 0.7 per cent," the ICEA study said.

ICEA said that the highest tariffs for both China and Vietnam are 10 per cent maximum and by contrast, India has many more tariff lines, in addition to higher tariffs.

According to the study, almost all (97 per cent) of Vietnam's weighted average tariffs are between zero to 5 per cent, while 60 per cent of China's tariff lines are in that range.

"A line-by-line comparison of India's non-zero tariffs shows that India has higher MFN tariffs for 85 per cent of these lines compared to China, and 100 per cent of the lines compared to Vietnam. Higher tariffs of India result in an overall loss of competitiveness of about 6 to 7 per cent compared to Vietnam and China," the study said.

ICEA said high tariffs increase costs, and make India less competitive, which makes it difficult for companies to join GVCs (global value chains) and simultaneously discourages GVCs from shifting large-scale production to India.

Mohindroo said that value addition in mobile phones will increase after local production gets very high scale.

He said that earlier recommendations of the industry for tariff intervention were made with a focus on reducing import dependence, which has been almost achieved and the change in industry stand is to focus on the next phase of growth, which will come from exports from India.

India Cellular and Electronics Association (ICEA) Chairman Pankaj Mohindroo said that the next phase of mobile manufacturing growth has to come from exports as the production for the local market is close to saturation.

He said India will need to enhance competitiveness in mobile manufacturing at the global level by matching the tariffs or reducing the cost of production with respect to countries like China and Vietnam, where import duty on most of the mobile components is nil or in a lower tax bracket.

ICEA, whose members include Apple, Foxconn, Dixon, Vivo, Oppo, Xiaomi, and Lava etc, has projected that lowering duties on mobile inputs, as recommended by the industry, will enhance local production of mobile phones to USD 82 billion by 2026-27 compared and USD 64 billion with business as usual.

The export can grow to USD 39 billion on tariff reforms and USD 50 billion with 100 per cent reforms, as recommended by the industry, by 2026-27 compared to USD 27 billion projected if business continues as usual.

"To achieve this target of high export, India needs more than just ambition. It requires a tangible shift of global value chains, bringing major production lines to India and integrating our businesses into the international supply web," Mohindroo said.

India's smartphone exports jumped 100 per cent in FY 2022-23 to USD 11.1 billion over the previous fiscal.

The industry expects mobile phone exports worth USD 15 billion in FY2024.

ICEA projects exports will form 30 per cent of the total production of USD 49-50 billion in the current fiscal.

According to a study conducted by ICEA, India's simple average most-favoured nation (MFN) tariff for inputs is 8.5 per cent, higher than China's 3.7 per cent.

"In practice, China's tariffs are closer to zero because most mobile production takes place in 'Bonded zones' where all inputs are at zero tariffs. Nearly 80 per cent of Vietnam's imported inputs are from countries with whom it has FTAs. Hereto, FTA (free trade agreement) weighted average tariff comparison between India and Vietnam shows that India's simple average is at 6.8 per cent vis-a-vis Vietnam's at 0.7 per cent," the ICEA study said.

ICEA said that the highest tariffs for both China and Vietnam are 10 per cent maximum and by contrast, India has many more tariff lines, in addition to higher tariffs.

According to the study, almost all (97 per cent) of Vietnam's weighted average tariffs are between zero to 5 per cent, while 60 per cent of China's tariff lines are in that range.

"A line-by-line comparison of India's non-zero tariffs shows that India has higher MFN tariffs for 85 per cent of these lines compared to China, and 100 per cent of the lines compared to Vietnam. Higher tariffs of India result in an overall loss of competitiveness of about 6 to 7 per cent compared to Vietnam and China," the study said.

ICEA said high tariffs increase costs, and make India less competitive, which makes it difficult for companies to join GVCs (global value chains) and simultaneously discourages GVCs from shifting large-scale production to India.

Mohindroo said that value addition in mobile phones will increase after local production gets very high scale.

He said that earlier recommendations of the industry for tariff intervention were made with a focus on reducing import dependence, which has been almost achieved and the change in industry stand is to focus on the next phase of growth, which will come from exports from India.

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 17.90 ( -3.35)

- 166585989

- Alstone Textiles

- 0.75 (+ 8.70)

- 47681821

- GTL Infrastructure

- 3.27 (+ 4.81)

- 44040612

- Visagar Financial

- 0.91 (+ 12.35)

- 29755394

- YES Bank Ltd.

- 23.70 (+ 0.77)

- 22163699

MORE NEWS

Indian Economy Growth: Exports, Manufacturing &...

Mumbai, June 30 (PTI) Healthy increase in the country's exports, improvement in the...

India Launches Anti-Dumping Probe on Glass...

New Delhi, June 30 (PTI) India has initiated an anti-dumping probe into the import of...

IBBI Launches Electronic Forms for Liquidation...

New Delhi, Jun 30 (PTI) To ease the compliance burden for insolvency professionals, and...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.