NDTV Loan Case Closed: Complainant Satisfied with CBI Probe

The complainant in the NDTV loan case has accepted the CBI's closure report, expressing satisfaction with the investigation which found no irregularities in the transactions between ICICI Bank and NDTV promoters. The case was filed in 2013 based on allegations of irregularities by ICICI Bank in...

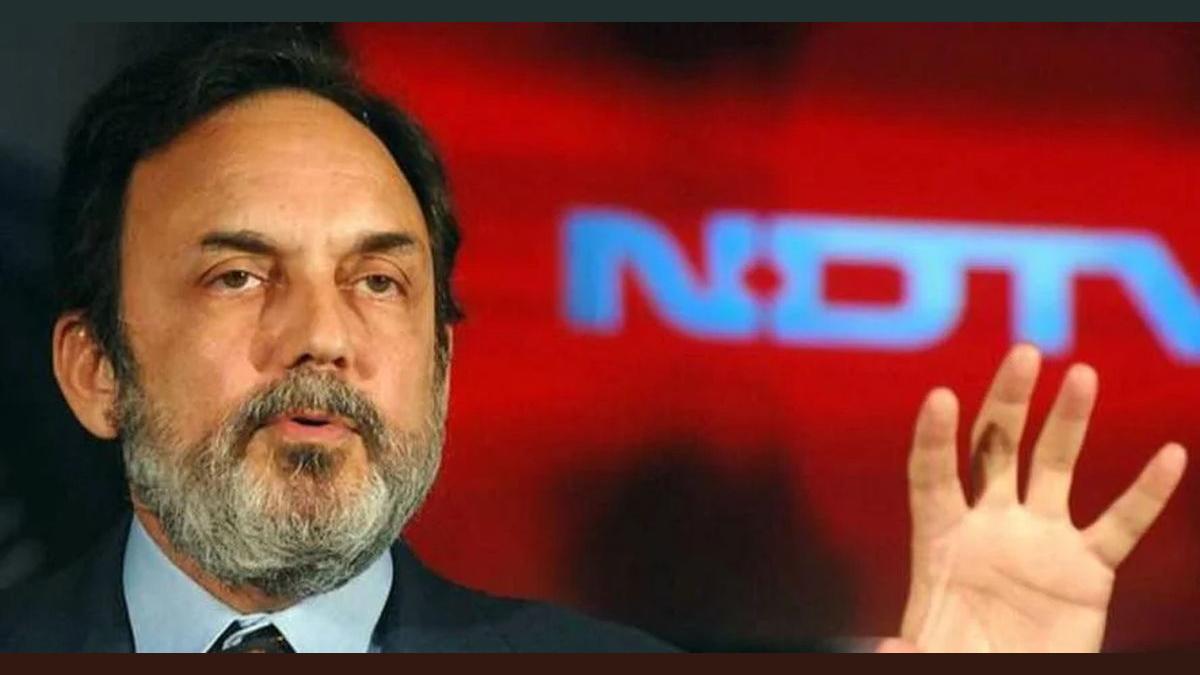

Photograph: PTI Photo from the Rediff Archives

New Delhi, Jan 15 (PTI) The complainant in the NDTV case, who had alleged irregularities by the ICICI Bank in accepting loan repayment from the media house, has accepted the CBI closure report and expressed satisfaction over the agency's probe, which did not find any collusion, criminal conspiracy or abuse of position in the matter.

The Central Bureau of Investigation (CBI) filed the closure report before a special court last year, after its six-year-long probe did not find any irregularities in the transactions between the ICICI Bank and NDTV promoters Prannoy Roy and Radhika Roy.

The case was lodged on a complaint from Sanjay Dutt of Quantum Securities Limited, who had alleged that the ICICI Bank had sanctioned a loan of Rs 375 crore in 2008 against the entire 61 per cent shareholding of the NDTV promoters as collateral.

"The statement of the complainant (Sanjay Dutt) has been recorded to the effect that he does not want to file any protest petition against the closure report filed by the CBI as he is satisfied with the investigation," the court noted in a recent order.

The court will now decide whether to accept the closure report or order further investigation in the matter, officials said.

There was no collusion, criminal conspiracy or abuse of position by officials of the ICICI Bank in accepting repayment of a loan at a reduced rate of interest from Prannoy Roy and Radhika Roy, the CBI had concluded in its closure report.

In 2022, the Adani Group acquired a controlling stake in NDTV, purchasing shares from the Roys at a premium of nearly 17 per cent over the price paid to the minority shareholders.

The CBI, which filed its closure report in October last year, also said that the reduction of the rate of interest for NDTV was not a "one-off incident". The repayment of the loan at the reduced interest rate was "higher than the average cost of funds", the federal agency said.

The CBI also found a forensic audit of the case conducted by Pramod Kumar and Associates, which described the repayment as a "normal business transaction and closure of loan", with no violation of the Banking Regulation Act.

The Central Bureau of Investigation (CBI) filed the closure report before a special court last year, after its six-year-long probe did not find any irregularities in the transactions between the ICICI Bank and NDTV promoters Prannoy Roy and Radhika Roy.

The case was lodged on a complaint from Sanjay Dutt of Quantum Securities Limited, who had alleged that the ICICI Bank had sanctioned a loan of Rs 375 crore in 2008 against the entire 61 per cent shareholding of the NDTV promoters as collateral.

"The statement of the complainant (Sanjay Dutt) has been recorded to the effect that he does not want to file any protest petition against the closure report filed by the CBI as he is satisfied with the investigation," the court noted in a recent order.

The court will now decide whether to accept the closure report or order further investigation in the matter, officials said.

There was no collusion, criminal conspiracy or abuse of position by officials of the ICICI Bank in accepting repayment of a loan at a reduced rate of interest from Prannoy Roy and Radhika Roy, the CBI had concluded in its closure report.

In 2022, the Adani Group acquired a controlling stake in NDTV, purchasing shares from the Roys at a premium of nearly 17 per cent over the price paid to the minority shareholders.

The CBI, which filed its closure report in October last year, also said that the reduction of the rate of interest for NDTV was not a "one-off incident". The repayment of the loan at the reduced interest rate was "higher than the average cost of funds", the federal agency said.

The CBI also found a forensic audit of the case conducted by Pramod Kumar and Associates, which described the repayment as a "normal business transaction and closure of loan", with no violation of the Banking Regulation Act.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 8.05 ( -0.25)

- 35567075

- Pradhin

- 0.48 (+ 2.13)

- 10534547

- Sharanam Infra

- 0.67 (+ 4.69)

- 8570083

- Alok Industries Ltd.

- 18.90 (+ 14.75)

- 8501051

- Suzlon Energy Ltd.

- 59.87 ( -0.73)

- 8072664

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.