New Tax Slabs in FY26 Budget: Revised Rates and Income Brackets

Learn about the new tax regime in India's FY26 budget with revised tax slabs and rates for different income brackets. Get details on nil tax slab and standard deduction for salaried individuals.

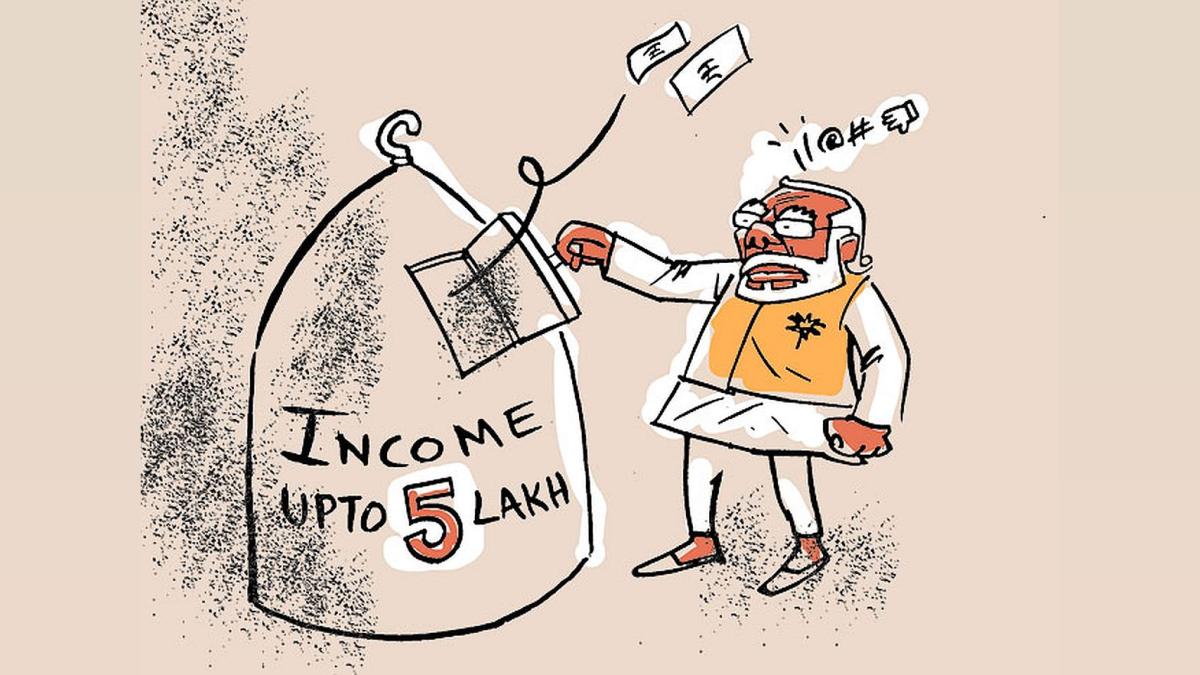

Illustration: Dominic Xavier/Rediff.com

New Delhi, Feb 1 (PTI) Following are the revised slabs and rates under new tax regime announced in the FY26 Budget:

Income up to Rs 4 lakh (per annum) ----- Nil

Between Rs 4 and 8 lakh ---------------- 5 per cent (tax)

Between Rs 8 and 12 lakh --------------- 10 per cent

Between Rs 12 and 16 lakh -------------- 15 per cent

Between Rs16 and 20 lakh --------------- 20 per cent

Between Rs 20 and 24 lakh -------------- 25 per cent

Above Rs 24 lakh ------------------------- 30 per cent

* Nil tax slab will apply for annual income up to Rs 12 lakh (Rs 12.75 lakh for salaried tax payers with standard deduction of Rs 75,000) under new tax regime.

Income up to Rs 4 lakh (per annum) ----- Nil

Between Rs 4 and 8 lakh ---------------- 5 per cent (tax)

Between Rs 8 and 12 lakh --------------- 10 per cent

Between Rs 12 and 16 lakh -------------- 15 per cent

Between Rs16 and 20 lakh --------------- 20 per cent

Between Rs 20 and 24 lakh -------------- 25 per cent

Above Rs 24 lakh ------------------------- 30 per cent

* Nil tax slab will apply for annual income up to Rs 12 lakh (Rs 12.75 lakh for salaried tax payers with standard deduction of Rs 75,000) under new tax regime.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.33 (+ 2.09)

- 49418710

- Standard Capital

- 0.49 (+ 2.08)

- 24177276

- Integrated Industrie

- 19.52 (+ 2.57)

- 12400338

- AvanceTechnologies

- 0.64 (+ 3.23)

- 11280143

- Srestha Finvest

- 0.54 ( 0.00)

- 10950967

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.