NTPC Green Energy to Invest Rs 1 Lakh Cr in Solar, Wind by FY27

By Rediff Money Desk, Mumbai Nov 13, 2024 17:20

NTPC Green Energy aims to invest Rs 1 lakh crore in solar and wind assets by FY27, with an IPO planned to raise Rs 10,000 crore. The company is also exploring green hydrogen and pump storage power.

Illustration: Uttam Ghosh/Rediff.com

Mumbai, Nov 13 (PTI) IPO-bound NTPC Green Energy is aiming to invest up to Rs 1 lakh crore in solar and wind assets by FY27, a top official said on Wednesday.

Assuming about 20 per cent of the investment to come from equity, it will need Rs 20,000 crore of its own funds for the expansion, its chairman and managing director Gurdeep Singh told reporters here, adding that Rs 10,000 crore of funds will be coming through the upcoming initial public offering.

The company will be able to raise the remaining resources through internal accruals, he added.

For the debt part, the company enjoys a very good credit rating from multiple agencies courtesy the strong parentage in India's biggest power producer NTPC, Singh said, stressing that this enables it to land debt at softer rates when compared to rivals.

NTPC Green Energy, which has an installed capacity of 3,220 MW right now, is aiming to take up the same number to 6,000 MW by March 2025, 11,000 MW by March 2026 and 19,000 by March 2027, Singh said, adding that 11,000 MW of projects are already under implementation at multiple levels.

It will operate at a level where 90 per cent of the capacity will be solar, which requires an investment of Rs 5 crore per MW, and the rest will be wind which needs Rs 8 crore per MW, he said.

"The capital expenditure requirement by FY27 will be approximately Rs 1 lakh crore," he said speaking at the IPO roadshow here.

In the IPO, which will be open from November 19-22, the company is planning a fresh issue of shares worth up to Rs 10,000 crore at a price band of Rs 102-108 apiece.

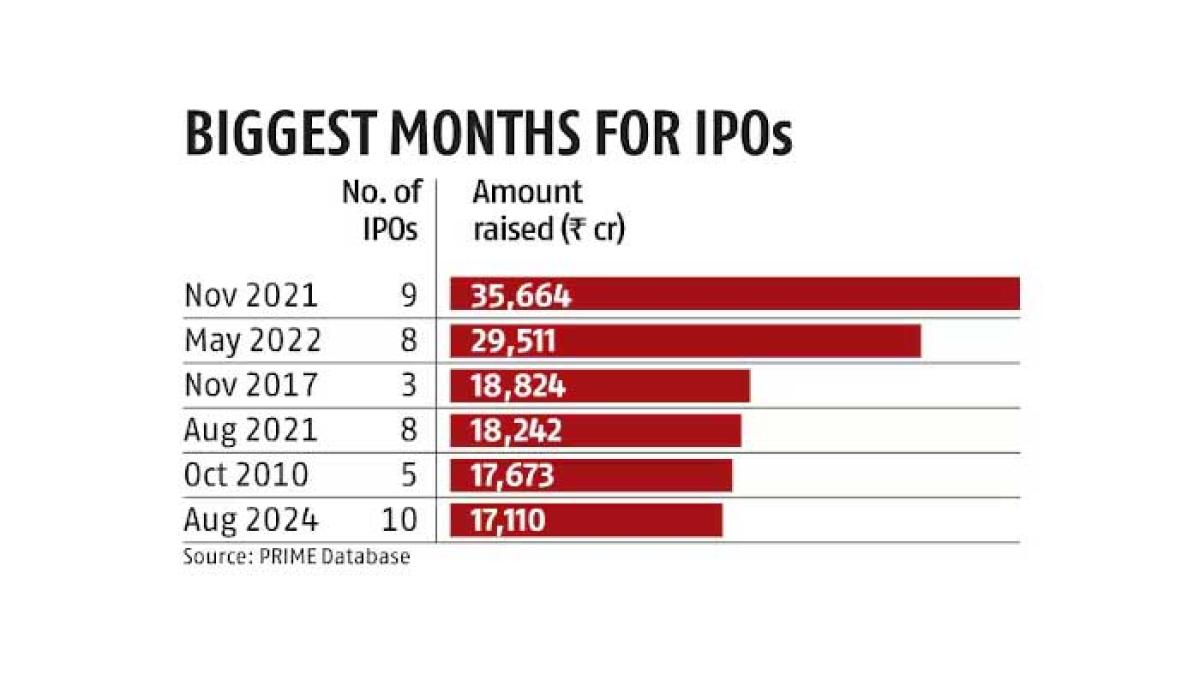

Investors will have to apply for a minimum of 138 shares and in multiples of 138 thereafter in the IPO, which is one of the biggest offerings by any companies in recent times and comes right after food delivery company Swiggy's Rs 7,000-crore share sale.

Parent NTPC has invested Rs 7,5f00 crore in NTPC Green Energy since inception, Singh said. The company is seeking a valuation of Rs 1 lakh crore for the company.

Singh said given the entire focus on sustainability, there are a slew of opportunities for the company and added that the company is faring better than rivals including Renew and Adani Green Energy.

He also said that NTPC Green Energy does not want to restrict itself to power generation alone, and added that it has drawn up plans on green hydrogen, pump storage power and energy storage as well.

A 1,200-acre land parcel near Vishakhapatnam picked up by parent NTPC many years ago to set up an imported coal-based power plant will host the green hydrogen complex, Singh said.

On the PSP front, it is in talks with several states, including Tamil Nadu, Andhra Pradesh, Chhattisgarh and Odisha, which have the potential, Singh said, adding that it will also be fine picking up stressed projects even though its preference is for a new project.

Assuming about 20 per cent of the investment to come from equity, it will need Rs 20,000 crore of its own funds for the expansion, its chairman and managing director Gurdeep Singh told reporters here, adding that Rs 10,000 crore of funds will be coming through the upcoming initial public offering.

The company will be able to raise the remaining resources through internal accruals, he added.

For the debt part, the company enjoys a very good credit rating from multiple agencies courtesy the strong parentage in India's biggest power producer NTPC, Singh said, stressing that this enables it to land debt at softer rates when compared to rivals.

NTPC Green Energy, which has an installed capacity of 3,220 MW right now, is aiming to take up the same number to 6,000 MW by March 2025, 11,000 MW by March 2026 and 19,000 by March 2027, Singh said, adding that 11,000 MW of projects are already under implementation at multiple levels.

It will operate at a level where 90 per cent of the capacity will be solar, which requires an investment of Rs 5 crore per MW, and the rest will be wind which needs Rs 8 crore per MW, he said.

"The capital expenditure requirement by FY27 will be approximately Rs 1 lakh crore," he said speaking at the IPO roadshow here.

In the IPO, which will be open from November 19-22, the company is planning a fresh issue of shares worth up to Rs 10,000 crore at a price band of Rs 102-108 apiece.

Investors will have to apply for a minimum of 138 shares and in multiples of 138 thereafter in the IPO, which is one of the biggest offerings by any companies in recent times and comes right after food delivery company Swiggy's Rs 7,000-crore share sale.

Parent NTPC has invested Rs 7,5f00 crore in NTPC Green Energy since inception, Singh said. The company is seeking a valuation of Rs 1 lakh crore for the company.

Singh said given the entire focus on sustainability, there are a slew of opportunities for the company and added that the company is faring better than rivals including Renew and Adani Green Energy.

He also said that NTPC Green Energy does not want to restrict itself to power generation alone, and added that it has drawn up plans on green hydrogen, pump storage power and energy storage as well.

A 1,200-acre land parcel near Vishakhapatnam picked up by parent NTPC many years ago to set up an imported coal-based power plant will host the green hydrogen complex, Singh said.

On the PSP front, it is in talks with several states, including Tamil Nadu, Andhra Pradesh, Chhattisgarh and Odisha, which have the potential, Singh said, adding that it will also be fine picking up stressed projects even though its preference is for a new project.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.92 (+ 1.93)

- 73044382

- ARC Finance

- 1.40 (+ 4.48)

- 39044891

- G G Engineering

- 1.77 (+ 18.00)

- 37302457

- Easy Trip Planners

- 16.00 ( -6.16)

- 23734088

- Srestha Finvest

- 0.82 ( -4.65)

- 20314586

MORE NEWS

Sensex Ends 2024 With 8% Gains, Declines 109...

The Sensex closed lower on Tuesday, but ended 2024 with over 8% gains. Foreign fund...

Areca & Coconut Prices in Mangaluru - Dec 31

Get the latest areca and coconut prices in Mangaluru for December 31. Find details on...

Reliance Acquires USD 13 Billion in 5 Years

Reliance Industries Ltd has spent USD 13 billion on acquisitions in the past five years...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.