Private Capex in India Poised for Takeoff: Mahindra CEO

By Rediff Money Desk, NEWDELHI Feb 26, 2024 18:43

Mahindra Group CEO Anish Shah says private capex in India is poised to take off, driven by strong growth and government spending, despite rural market challenges. He highlights increased investment in manufacturing and a K-shaped recovery.

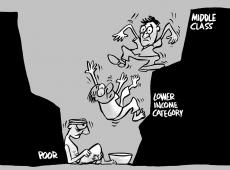

Illustration: Dominic Xavier/Rediff.com

New Delhi, Feb 26 (PTI) Private capex in India is poised to take off with the country's "amazingly strong" growth so far, led by government spending, set to attract investments, Mahindra Group CEO and Managing Director Anish Shah said on Monday.

The current lower demand from rural markets is not a cause for worry as it is a part of India's growth story, although the country has witnessed a K-shaped recovery after the pandemic, said Shah while speaking at the News9 Global Summit.

In the last few years, it has essentially been the government that's really driving the economic growth till this point of time, said Shah, who is also the President of industry body Ficci.

On the reasons for lack of private investment, he said, "There are multiple factors. We have gone through a time when there are huge amounts of uncertainties around the world. Suddenly, when you feel things are back and stable again, something else happens. So, that has resulted in companies pulling back to some extent."

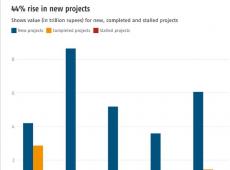

However, he said, "If you look at certain pockets, we are still seeing significant growth and I think we are at the point where private capex will start taking off. That will apply to agriculture, as well as many other sectors because they are starting to see capacity utilisation hit certain levels, where capex has to come in."

Shah further said, "The India growth story is just amazingly strong right now and that is going to essentially pull private capex in and grow much faster."

Citing the example of the Mahindra group, he said, "We have started. At Mahindra, we have doubled capacity in our auto business and we are going to put in even more capacity as we go forward. Our tractor capacity is up 60 per cent and we are looking at tripling the capacity for our resorts in India."

He further said, "This is just the start and... we are going to see a lot more growth across multiple sectors in India."

Shah said to achieve the Viksit Bharat goal to reach USD 30 trillion economy by 2047, the manufacturing sector has to go from 18 per cent to 25 per cent of GDP.

"For that to happen, manufacturing has to go up 16 times in the next 23 years. Therefore, industry will have to play a significant role, and industry sees growth across multiple sectors, that's where investment is going to come in," he said.

However, he pointed out that India's challenge will be "inclusive growth" and bridge the divide between the richer and poorer segments of society.

Shah disagreed on the notion of rural-urban divide in growth pattern, and said it was more of a case of income difference and not a market divide.

"We are seeing more of a K-shaped recovery. Consumers in the higher end of income segment are buying and that's what you have seen in real estate and a number of other things... but consumers at the lower end of the income segment are not buying as much even in urban India," Shah said.

In rural areas, he said, "We have seen very strong demand across SUVs. Tractors have been relatively flat this year but that comes after a couple of years ago where we had 27 per cent growth in the industry. So, we are not worried at this point about rural demand being lower."

Shah acknowledged the strong government spending in rural India post-pandemic and "that enabled rural India to essentially lead the country through the pandemic".

"After that, rightly so, the spending has come down to normal levels. Therefore, we are seeing some challenges in a sense of the market being flat or slightly down. I really don't think that's a problem. That's a part of the growth story we will have," Shah added.

The current lower demand from rural markets is not a cause for worry as it is a part of India's growth story, although the country has witnessed a K-shaped recovery after the pandemic, said Shah while speaking at the News9 Global Summit.

In the last few years, it has essentially been the government that's really driving the economic growth till this point of time, said Shah, who is also the President of industry body Ficci.

On the reasons for lack of private investment, he said, "There are multiple factors. We have gone through a time when there are huge amounts of uncertainties around the world. Suddenly, when you feel things are back and stable again, something else happens. So, that has resulted in companies pulling back to some extent."

However, he said, "If you look at certain pockets, we are still seeing significant growth and I think we are at the point where private capex will start taking off. That will apply to agriculture, as well as many other sectors because they are starting to see capacity utilisation hit certain levels, where capex has to come in."

Shah further said, "The India growth story is just amazingly strong right now and that is going to essentially pull private capex in and grow much faster."

Citing the example of the Mahindra group, he said, "We have started. At Mahindra, we have doubled capacity in our auto business and we are going to put in even more capacity as we go forward. Our tractor capacity is up 60 per cent and we are looking at tripling the capacity for our resorts in India."

He further said, "This is just the start and... we are going to see a lot more growth across multiple sectors in India."

Shah said to achieve the Viksit Bharat goal to reach USD 30 trillion economy by 2047, the manufacturing sector has to go from 18 per cent to 25 per cent of GDP.

"For that to happen, manufacturing has to go up 16 times in the next 23 years. Therefore, industry will have to play a significant role, and industry sees growth across multiple sectors, that's where investment is going to come in," he said.

However, he pointed out that India's challenge will be "inclusive growth" and bridge the divide between the richer and poorer segments of society.

Shah disagreed on the notion of rural-urban divide in growth pattern, and said it was more of a case of income difference and not a market divide.

"We are seeing more of a K-shaped recovery. Consumers in the higher end of income segment are buying and that's what you have seen in real estate and a number of other things... but consumers at the lower end of the income segment are not buying as much even in urban India," Shah said.

In rural areas, he said, "We have seen very strong demand across SUVs. Tractors have been relatively flat this year but that comes after a couple of years ago where we had 27 per cent growth in the industry. So, we are not worried at this point about rural demand being lower."

Shah acknowledged the strong government spending in rural India post-pandemic and "that enabled rural India to essentially lead the country through the pandemic".

"After that, rightly so, the spending has come down to normal levels. Therefore, we are seeing some challenges in a sense of the market being flat or slightly down. I really don't think that's a problem. That's a part of the growth story we will have," Shah added.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.