Punjab Extends OTS Deadline for Tax Dues: FM Cheema

Punjab Finance Minister Harpal Cheema announced an extension of the One Time Settlement (OTS) scheme deadline to August 16 for taxpayers to settle outstanding dues. The scheme aims to reduce compliance burden and promote tax compliance.

Chandigarh, Jul 2 (PTI) Punjab Finance Minister Harpal Singh Cheema on Tuesday said the state government has extended the last date for filing applications under the Punjab One Time Settlement (Amendment) Scheme for recovery of dues to August 16.

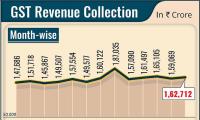

Cheema said the extension of the scheme's deadline is aimed to reduce the compliance burden of legacy cases and enable trade and industry to enhance their compliance under the GST regime.

The Punjab One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, implemented from November 15, 2023, offers a one-time opportunity for taxpayers to settle their outstanding dues.

The scheme was initially valid till June 30, 2024, he said.

Taxpayers whose assessments were framed till March 31, 2024, and all rectification or revision/assessment after remand orders passed till March 31, 2024, under the relevant Acts with a total demand (tax, penalty, and interest as per the original assessment order) up to Rs 1 crore as of March 31, 2024, are eligible to apply for settlement under this scheme, an official statement said.

Key benefits of the scheme include complete waiver of tax, interest, and penalty in case of arrears up to Rs 1 lakh as of March 31, 2024, and waiver of 100 per cent interest, 100 per cent penalty, and 50 per cent of the tax amount in cases with demands ranging from Rs 1 lakh to Rs 1 crore, the statement said.

Dealers can submit original statutory forms under CST Act, 1956, at the time of applying under OTS-2023, and waiver will be calculated accordingly, it said.

Cheema said the Punjab government's commitment was to support taxpayers and promote a tax-compliant culture.

He said the extended deadline provides more time for applicants to avail of this scheme.

Cheema said the extension of the scheme's deadline is aimed to reduce the compliance burden of legacy cases and enable trade and industry to enhance their compliance under the GST regime.

The Punjab One Time Settlement Scheme for Recovery of Outstanding Dues, 2023, implemented from November 15, 2023, offers a one-time opportunity for taxpayers to settle their outstanding dues.

The scheme was initially valid till June 30, 2024, he said.

Taxpayers whose assessments were framed till March 31, 2024, and all rectification or revision/assessment after remand orders passed till March 31, 2024, under the relevant Acts with a total demand (tax, penalty, and interest as per the original assessment order) up to Rs 1 crore as of March 31, 2024, are eligible to apply for settlement under this scheme, an official statement said.

Key benefits of the scheme include complete waiver of tax, interest, and penalty in case of arrears up to Rs 1 lakh as of March 31, 2024, and waiver of 100 per cent interest, 100 per cent penalty, and 50 per cent of the tax amount in cases with demands ranging from Rs 1 lakh to Rs 1 crore, the statement said.

Dealers can submit original statutory forms under CST Act, 1956, at the time of applying under OTS-2023, and waiver will be calculated accordingly, it said.

Cheema said the Punjab government's commitment was to support taxpayers and promote a tax-compliant culture.

He said the extended deadline provides more time for applicants to avail of this scheme.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.18 ( -2.58)

- 62825560

- Standard Capital

- 0.47 ( -4.08)

- 12893677

- Srestha Finvest

- 0.54 (+ 5.88)

- 12292380

- GTL Infrastructure

- 1.49 (+ 1.36)

- 10933503

- YES Bank Ltd.

- 17.18 (+ 1.90)

- 10046358

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.