Punjab GST Revenue Rises 16.52% in April-December

Punjab's GST revenue surged 16.52% to Rs 15,524 crore in April-December 2023, driven by strong economic activity and government reforms. Excise revenue also saw a significant increase.

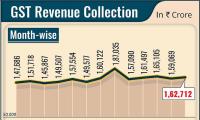

Chandigarh, Jan 3 (PTI) Punjab saw a 16.52 per cent year-on-year growth in revenue from Goods and Services Tax (GST) and a 10.4 per cent increase in revenue from excise levy during the April-December period of the current fiscal year.

Punjab's Finance Minister Harpal Singh Cheema on Wednesday said the net GST collection up to December in FY24 was Rs 15,523.74 crore against the mop-up of Rs 13,322.59 crore during the April-December period of the previous financial year.

Thus, the net increase in GST collection amounts to Rs 2,201.15 crore, he added.

The minister said that the revenue from excise levy up to December in FY23 was Rs 6,050.7 crore, whereas for the current fiscal year, it rose to Rs 6,679.84 crore.

Giving details about state's tax revenue, Cheema, in an official statement, said that Punjab achieved a growth rate of 14.15 per cent in total revenue from VAT, CST, GST, PSDT and excise up to December during the current fiscal year as compared to the same period of FY23.

He said that revenue from VAT, CST, and PSDT (Punjab State Development Tax) reflects a growth rate of 12 per cent, 26.8 per cent, and 5.24 per cent, respectively.

He said that the state's own tax revenue during the last nine months was Rs 27,931.16 crore against Rs 24,468.14 crore collected during the same period a year ago.

Cheema attributed the growth in tax revenue to major reforms adopted by the state government, and said many more reforms are being adopted in FY24 to maintain the growth chart.

Punjab's Finance Minister Harpal Singh Cheema on Wednesday said the net GST collection up to December in FY24 was Rs 15,523.74 crore against the mop-up of Rs 13,322.59 crore during the April-December period of the previous financial year.

Thus, the net increase in GST collection amounts to Rs 2,201.15 crore, he added.

The minister said that the revenue from excise levy up to December in FY23 was Rs 6,050.7 crore, whereas for the current fiscal year, it rose to Rs 6,679.84 crore.

Giving details about state's tax revenue, Cheema, in an official statement, said that Punjab achieved a growth rate of 14.15 per cent in total revenue from VAT, CST, GST, PSDT and excise up to December during the current fiscal year as compared to the same period of FY23.

He said that revenue from VAT, CST, and PSDT (Punjab State Development Tax) reflects a growth rate of 12 per cent, 26.8 per cent, and 5.24 per cent, respectively.

He said that the state's own tax revenue during the last nine months was Rs 27,931.16 crore against Rs 24,468.14 crore collected during the same period a year ago.

Cheema attributed the growth in tax revenue to major reforms adopted by the state government, and said many more reforms are being adopted in FY24 to maintain the growth chart.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 8.23 (+ 1.60)

- 120450353

- Standard Capital

- 0.55 (+ 3.77)

- 26234194

- AvanceTechnologies

- 0.64 (+ 18.52)

- 15503509

- G G Engineering

- 0.97 (+ 7.78)

- 14312441

- Sharp Investments

- 1.14 (+ 20.00)

- 10870953

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.