Q2 Earnings, Global Trends Drive Market Sentiment

By Rediff Money Desk, New Delhi Oct 20, 2024 11:15

Indian markets are expected to be volatile this week, driven by Q2 corporate earnings, global trends, and foreign investor activity. Key factors include geopolitical tensions, FII outflows, and domestic economic conditions.

Photograph: Danish Siddiqui/Reuters

New Delhi, Oct 20 (PTI) Quarterly earnings from corporates, global trends, and trading activity of foreign investors will guide market sentiment this week, analysts said, adding that benchmark indices may face volatile trends.

"The upcoming release of Q2 results will be closely watched, providing insights into corporate performance. Meanwhile, the escalating tensions between Israel and Iran introduce a significant geopolitical risk, potentially leading to increased oil prices and market volatility. Foreign Institutional Investors (FIIs) have been a key driver of the Indian market's performance, and their stance will depend on factors such as global economic conditions, and domestic political developments," said Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd.

HDFC Bank on Saturday reported a 6 per cent increase in September quarter net profit to Rs 17,825.91 crore on a consolidated basis.

On a standalone basis, the largest private sector lender's post-tax net grew to Rs 16,820.97 crore during the reporting period, as against Rs 15,976.11 crore in the year-ago period.

"In the absence of any major triggers, market participants will focus on upcoming earnings for direction. First, they will react to the results of banking heavyweights such as HDFC Bank and Kotak Bank. Later, companies like ITC, Hindustan Unilever, BPCL, HPCL, and Ultratech Cement will also announce their earnings," said Ajit Mishra, SVP, Research, Religare Broking Ltd.

Bajaj Housing Finance, Adani Green Energy, Bajaj Finance, One97 Communications, Zomato, Bajaj Finserv and Bank of Baroda would also announce their earnings this week.

Kotak Mahindra Bank on Saturday posted a 13 per cent growth in September quarter profit to Rs 5,044 crore, helped by performance of its subsidiaries.

On a standalone basis, the private sector lender's net profit for the quarter grew 5 per cent to Rs 3,344 crore, limited by a jump in provisions.

"Geopolitical uncertainty, coupled with sluggishness in the Chinese economy and persistent FII outflows from the domestic markets, have led to caution," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

Massive foreign fund exodus from the domestic markets dragged the benchmark indices lower last week.

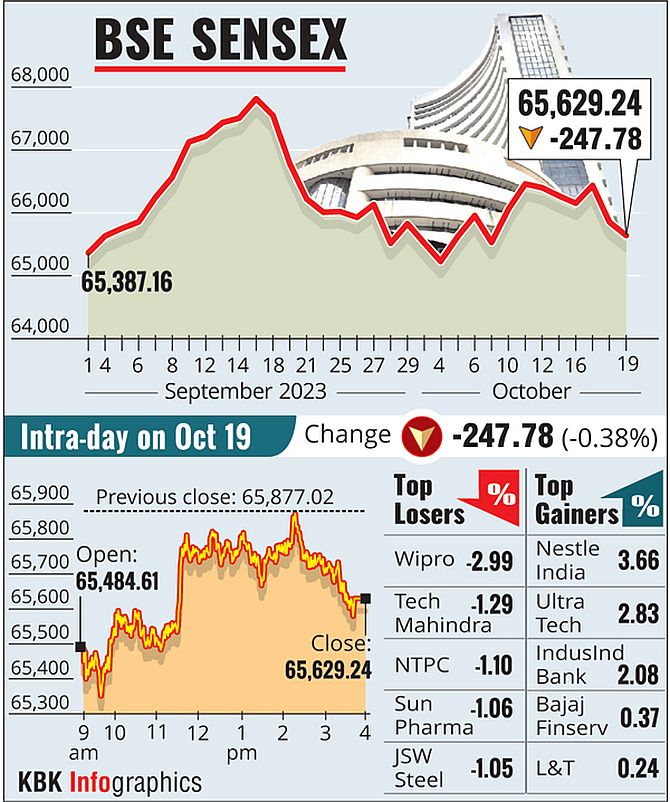

Last week, the BSE benchmark declined 156.61 points, or 0.19 per cent, and the Nifty went lower by 110.2 points, or 0.44 per cent.

"The trend of FII selling and DII (Domestic Institutional Investors) buying is likely to sustain in the near-term. The rationale behind FPIs (Foreign Portfolio Investors) selling is the elevated valuations in India and the cheap valuations of Chinese stocks, which the FPIs have been buying aggressively since mid-September," V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said.

"The upcoming release of Q2 results will be closely watched, providing insights into corporate performance. Meanwhile, the escalating tensions between Israel and Iran introduce a significant geopolitical risk, potentially leading to increased oil prices and market volatility. Foreign Institutional Investors (FIIs) have been a key driver of the Indian market's performance, and their stance will depend on factors such as global economic conditions, and domestic political developments," said Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd.

HDFC Bank on Saturday reported a 6 per cent increase in September quarter net profit to Rs 17,825.91 crore on a consolidated basis.

On a standalone basis, the largest private sector lender's post-tax net grew to Rs 16,820.97 crore during the reporting period, as against Rs 15,976.11 crore in the year-ago period.

"In the absence of any major triggers, market participants will focus on upcoming earnings for direction. First, they will react to the results of banking heavyweights such as HDFC Bank and Kotak Bank. Later, companies like ITC, Hindustan Unilever, BPCL, HPCL, and Ultratech Cement will also announce their earnings," said Ajit Mishra, SVP, Research, Religare Broking Ltd.

Bajaj Housing Finance, Adani Green Energy, Bajaj Finance, One97 Communications, Zomato, Bajaj Finserv and Bank of Baroda would also announce their earnings this week.

Kotak Mahindra Bank on Saturday posted a 13 per cent growth in September quarter profit to Rs 5,044 crore, helped by performance of its subsidiaries.

On a standalone basis, the private sector lender's net profit for the quarter grew 5 per cent to Rs 3,344 crore, limited by a jump in provisions.

"Geopolitical uncertainty, coupled with sluggishness in the Chinese economy and persistent FII outflows from the domestic markets, have led to caution," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

Massive foreign fund exodus from the domestic markets dragged the benchmark indices lower last week.

Last week, the BSE benchmark declined 156.61 points, or 0.19 per cent, and the Nifty went lower by 110.2 points, or 0.44 per cent.

"The trend of FII selling and DII (Domestic Institutional Investors) buying is likely to sustain in the near-term. The rationale behind FPIs (Foreign Portfolio Investors) selling is the elevated valuations in India and the cheap valuations of Chinese stocks, which the FPIs have been buying aggressively since mid-September," V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Srestha Finvest

- 0.77 ( -2.53)

- 52772969

- Vodafone Idea L

- 9.02 ( -0.44)

- 34797427

- Standard Capital

- 1.15 (+ 9.52)

- 33669934

- Filatex Fashions

- 1.08 (+ 1.89)

- 27453664

- Spicejet Ltd.

- 60.48 ( -1.10)

- 21769448

MORE NEWS

eShram-One Stop Solution Launch for Unorganized...

Union Labour Minister Mansukh Mandaviya launches 'eShram-One Stop Solution' on Monday,...

AI Key to Competitive Advantage: Report...

A new report reveals a significant percentage of organizations view AI as crucial for...

Prestige Estates Invests Rs 7,000 Cr in...

Prestige Estates will invest Rs 7,000 crore to develop a 62.5-acre township in...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.