Q3 GDP Growth Forecast: SBI Research Predicts 6.7-6.9%

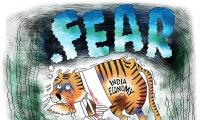

SBI Research forecasts India's Q3 GDP growth at 6.7-6.9% due to weak farm sector performance, compared to 7.6% in Q2. The forecast is lower than RBI's 7% projection.

Photograph: Anushree Fadnavis/Reuters

Mumbai, Feb 28 (PTI) The Indian economy is likely to grow at 6.7-6.9 per cent in December quarter FY24 as compared to 7.6 per cent growth in the second quarter on poor performance in the farm sector, a report by SBI Research said on Wednesday.

The report comes a day ahead of the release of official GDP data for the third quarter of 2023-24 financial year.

India retained the tag of the world's fastest-growing major economy, with its GDP expanding by a faster-than-expected rate of 7.6 per cent in September quarter on booster shots from government spending and manufacturing.

The 6.7-6.9 per cent growth forecast by SBI Research is lower than the Reserve Bank's 7 per cent growth projection for the quarter. SBI Research has projected Q4 GDP at 6.8 per cent.

SBI Research said the biggest reason for the lower growth forecast is the very poor show by the farm sector as, barring fisheries, the whole sector is badly affected.

As per the first advance estimates, the production of major kharif crops in 2023-24 is pegged at 148.5 million tonne, which is 4.6 per cent lower than that in the year-ago period.

While the sowing season for rabi crops indicates a slight increase in overall acreage compared to the previous year, there are concerns over the sown area under cereals, which saw a decline of 6.5 per cent from the previous year, the report said.

While agriculture may see some moderation if the rabi output does not offset the kharif shortfall, value added in agriculture will decline, it added.

On the other hand, corporate results as recorded from around 4,000 listed entities for Q3FY24, show robust growth of over 30 per cent in PAT, while topline grew by around 7 per cent compared to Q3FY23.

Further, listed entities reported improvement in margins as reflected in results of around 3,000 companies ex-BFSI (banking, financial services and insurance), with margins of 14.95 per cent in Q3 compared to around 12 per cent in the same period previous year.

Corporate Gross Value Added (GVA), as measured by operating profit plus employee expenses grew around 26 per cent in Q3 on-year.

The report comes a day ahead of the release of official GDP data for the third quarter of 2023-24 financial year.

India retained the tag of the world's fastest-growing major economy, with its GDP expanding by a faster-than-expected rate of 7.6 per cent in September quarter on booster shots from government spending and manufacturing.

The 6.7-6.9 per cent growth forecast by SBI Research is lower than the Reserve Bank's 7 per cent growth projection for the quarter. SBI Research has projected Q4 GDP at 6.8 per cent.

SBI Research said the biggest reason for the lower growth forecast is the very poor show by the farm sector as, barring fisheries, the whole sector is badly affected.

As per the first advance estimates, the production of major kharif crops in 2023-24 is pegged at 148.5 million tonne, which is 4.6 per cent lower than that in the year-ago period.

While the sowing season for rabi crops indicates a slight increase in overall acreage compared to the previous year, there are concerns over the sown area under cereals, which saw a decline of 6.5 per cent from the previous year, the report said.

While agriculture may see some moderation if the rabi output does not offset the kharif shortfall, value added in agriculture will decline, it added.

On the other hand, corporate results as recorded from around 4,000 listed entities for Q3FY24, show robust growth of over 30 per cent in PAT, while topline grew by around 7 per cent compared to Q3FY23.

Further, listed entities reported improvement in margins as reflected in results of around 3,000 companies ex-BFSI (banking, financial services and insurance), with margins of 14.95 per cent in Q3 compared to around 12 per cent in the same period previous year.

Corporate Gross Value Added (GVA), as measured by operating profit plus employee expenses grew around 26 per cent in Q3 on-year.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795