RBI Tweaks Regulatory Sandbox Norms: Digital Data Protection Focus

The Reserve Bank of India has updated its Regulatory Sandbox framework, extending the testing period to nine months and emphasizing compliance with the Digital Personal Data Protection Act.

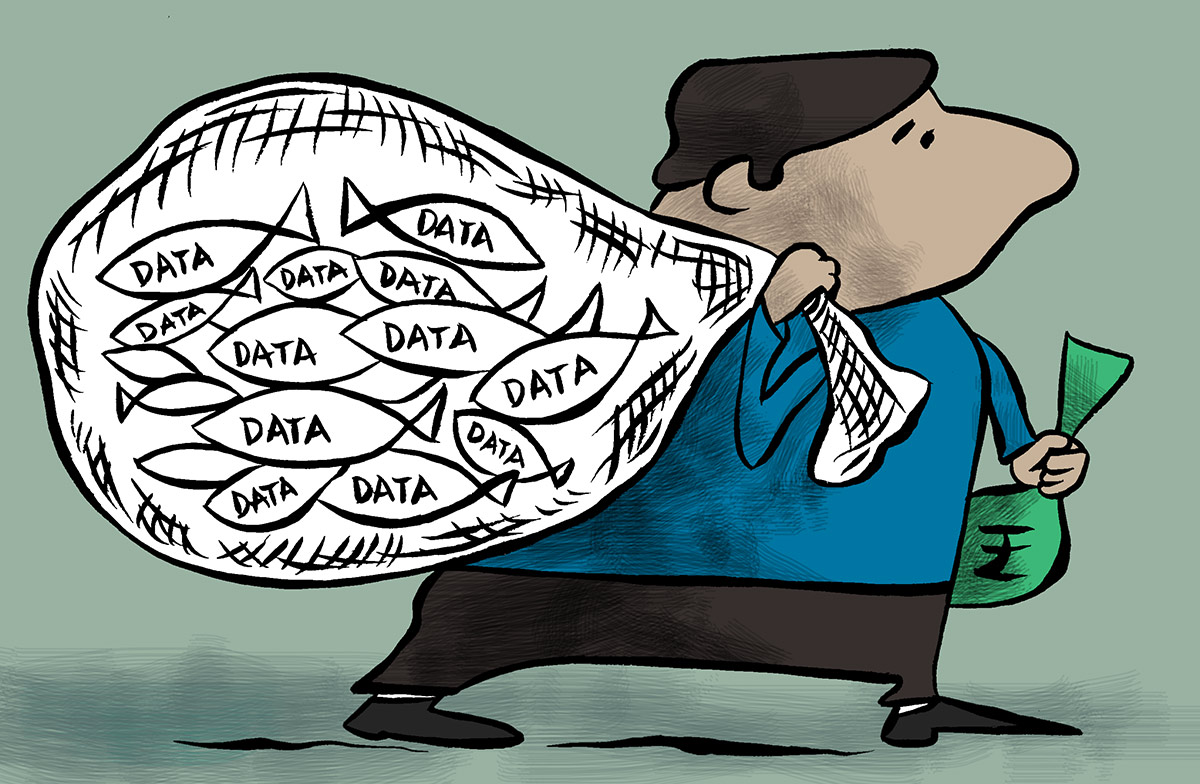

Photograph: Uttam Ghosh/Rediff.com

Mumbai, Feb 28 (PTI) The Reserve Bank on Wednesday tweaked guidelines for Regulatory Sandbox (RS) scheme under which participating entities will have to comply with digital personal data protection norms.

Regulatory Sandbox usually refers to live testing of new products or services in a controlled/test regulatory environment for which regulators may (or may not) permit certain relaxations for the limited purpose of the testing.

The RBI had issued the Enabling Framework for Regulatory Sandbox' in August 2019, after wide ranging consultations with stakeholders.

The objective of the RS is to foster responsible innovation in financial services, promote efficiency and bring benefit to consumers.

On Wednesday, the RBI placed on its website the updated Enabling Framework for Regulatory Sandbox'.

The framework, it said has been revised based on the experience gained over the last four-and-half years in running four cohorts and feedback received from fintechs, banking partners and other stakeholders.

"Among others, the timelines of the various stages of the Regulatory Sandbox process have been revised from seven months to nine months," it said.

Also, the updated framework requires sandbox entities to ensure compliance with provisions of the Digital Personal Data Protection Act, 2023.

The target applicants for entry to the RS are fintech companies, including startups, banks, financial institutions, any other company, Limited Liability Partnership (LLP) and partnership firms, partnering with or providing support to financial services businesses.

Regulatory Sandbox usually refers to live testing of new products or services in a controlled/test regulatory environment for which regulators may (or may not) permit certain relaxations for the limited purpose of the testing.

The RBI had issued the Enabling Framework for Regulatory Sandbox' in August 2019, after wide ranging consultations with stakeholders.

The objective of the RS is to foster responsible innovation in financial services, promote efficiency and bring benefit to consumers.

On Wednesday, the RBI placed on its website the updated Enabling Framework for Regulatory Sandbox'.

The framework, it said has been revised based on the experience gained over the last four-and-half years in running four cohorts and feedback received from fintechs, banking partners and other stakeholders.

"Among others, the timelines of the various stages of the Regulatory Sandbox process have been revised from seven months to nine months," it said.

Also, the updated framework requires sandbox entities to ensure compliance with provisions of the Digital Personal Data Protection Act, 2023.

The target applicants for entry to the RS are fintech companies, including startups, banks, financial institutions, any other company, Limited Liability Partnership (LLP) and partnership firms, partnering with or providing support to financial services businesses.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Alstone-Textiles

- 0.31 (+ 3.33)

- 92150305

- Vodafone-Idea-L

- 10.53 (+ 2.33)

- 45245052

- Mehai-Technology

- 1.83 (+ 3.98)

- 31323704

- Murae-Organisor

- 0.27 ( 0.00)

- 25468656

- Spicejet-Ltd

- 34.61 (+ 6.49)

- 24957116