Reliance Capital Delisting: Final Milestone for IIHL Acquisition

IndusInd International Holdings (IIHL) confirms Reliance Capital delisting as the final step towards acquiring the debt-ridden financial firm. The transaction is expected to be completed by February 10.

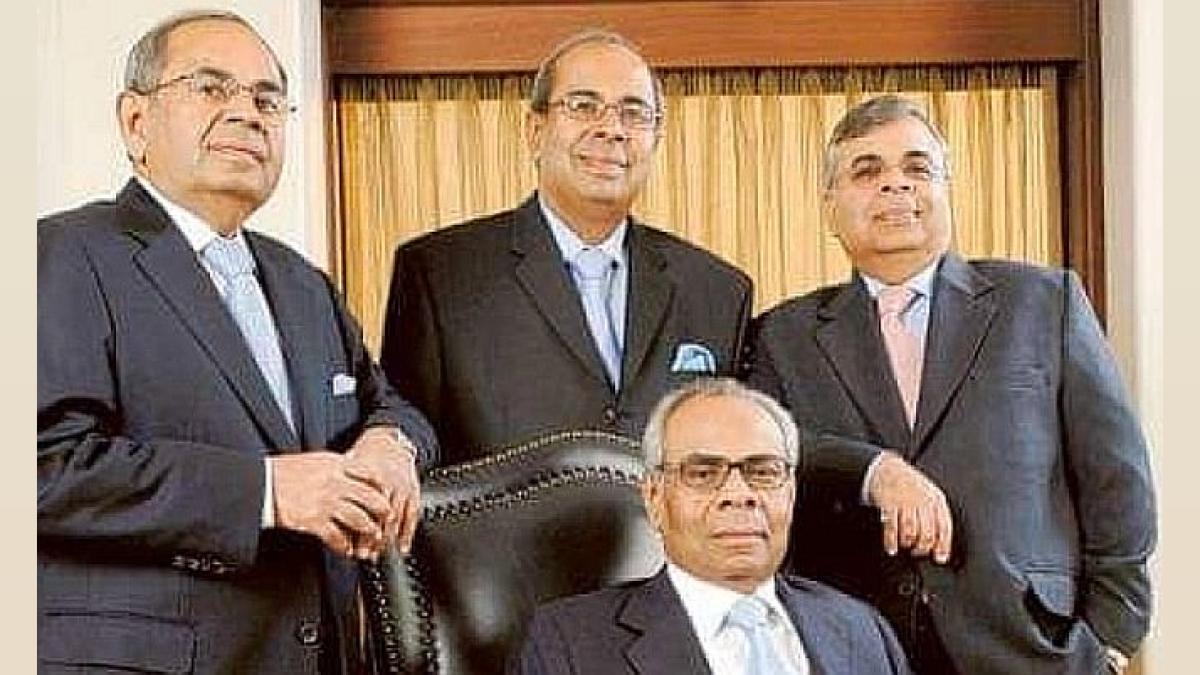

Photograph: Kind courtesy, Hinduja Foundation

New Delhi, Jan 22 (PTI) IndusInd International Holdings Ltd (IIHL) Chairman Ashok P Hinduja said the delisting of Reliance Capital is one of the last milestones towards the closure of the acquisition of the debt-ridden financial firm.

"This is one of the last milestones towards the closure of this acquisition process", he said, while referring Reliance Capital approaching bourses for delisting of its shares as part of resolution process.

Reliance Capital on Tuesday in a regulatory filing said it has approached the bourses for delisting of its shares as part of the resolution process.

"The delisting is likely to be completed by the stock exchanges by the end of this month. Thereafter, the transaction is likely to be completed by February 10," said a person aware of the development.

Reliance Capital had said it has in accordance with the approval of the monitoring committee, made applications to the BSE and the NSE for delisting of equity shares of the company, RCAP said in a regulatory filing.

Besides, it has also approached the BSE for delisting of non-convertible debentures.

Mauritius-based IIHL emerged as the successful suitor with a bid of Rs 9,650 crore for the resolution of RCAP. Later, the company paid Rs 200 crore to bolster RCAP solvency, which was over and above the bid amount.

The National Company Law Tribunal (NCLT), Mumbai, on February 27, 2024, approved IIHL's resolution plan and subsequently extended the deadline for completion of the transaction to February 15, 2025.

RCAP, registered as core investment company with the RBI, has several entities under it, including Reliance Nippon Life Insurance, Reliance General Insurance, Reliance Money, Reliance Securities, Reliance Asset Reconstruction, and Reliance Commercial Finance.

In November 2021, the Reserve Bank superseded the board of Reliance Capital on governance issues and payment defaults by the Anil Dhirubhai Ambani Group company.

The central bank had appointed Nageswara Rao Y as the administrator, who invited bids in February 2022 to take over the company.

"This is one of the last milestones towards the closure of this acquisition process", he said, while referring Reliance Capital approaching bourses for delisting of its shares as part of resolution process.

Reliance Capital on Tuesday in a regulatory filing said it has approached the bourses for delisting of its shares as part of the resolution process.

"The delisting is likely to be completed by the stock exchanges by the end of this month. Thereafter, the transaction is likely to be completed by February 10," said a person aware of the development.

Reliance Capital had said it has in accordance with the approval of the monitoring committee, made applications to the BSE and the NSE for delisting of equity shares of the company, RCAP said in a regulatory filing.

Besides, it has also approached the BSE for delisting of non-convertible debentures.

Mauritius-based IIHL emerged as the successful suitor with a bid of Rs 9,650 crore for the resolution of RCAP. Later, the company paid Rs 200 crore to bolster RCAP solvency, which was over and above the bid amount.

The National Company Law Tribunal (NCLT), Mumbai, on February 27, 2024, approved IIHL's resolution plan and subsequently extended the deadline for completion of the transaction to February 15, 2025.

RCAP, registered as core investment company with the RBI, has several entities under it, including Reliance Nippon Life Insurance, Reliance General Insurance, Reliance Money, Reliance Securities, Reliance Asset Reconstruction, and Reliance Commercial Finance.

In November 2021, the Reserve Bank superseded the board of Reliance Capital on governance issues and payment defaults by the Anil Dhirubhai Ambani Group company.

The central bank had appointed Nageswara Rao Y as the administrator, who invited bids in February 2022 to take over the company.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 6.81 ( -1.73)

- 117225274

- Srestha Finvest

- 0.48 ( -4.00)

- 23917778

- G G Engineering

- 0.81 ( -2.41)

- 23181029

- Shangar Decor

- 1.11 (+ 4.72)

- 20087292

- Guj. Toolroom Lt

- 1.40 ( -4.76)

- 17858668

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.