Sebi Makes Certification Mandatory for AIF Managers' Investment Teams

Sebi has made it mandatory for at least one key personnel in an AIF manager's investment team to obtain NISM certification, aiming to enhance competency and professionalism in the AIF space.

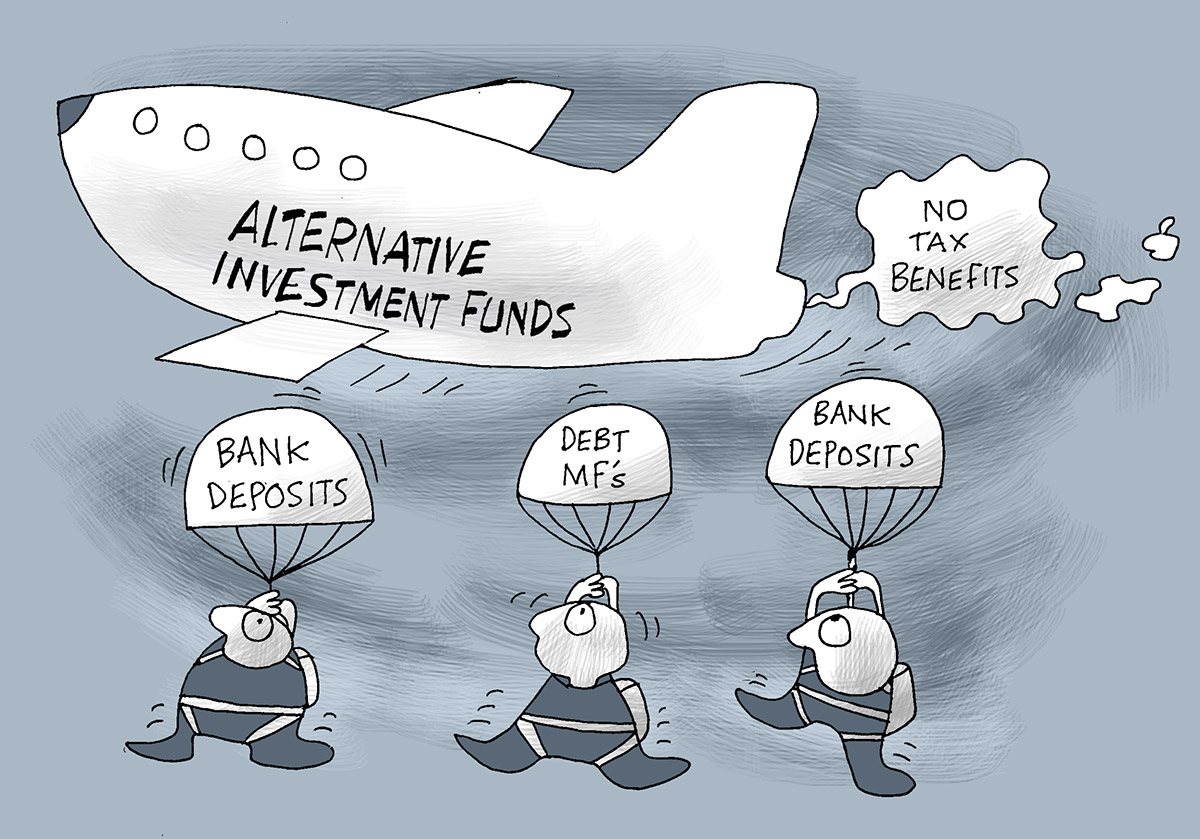

Illustration: Uttam Ghosh/Rediff.com

New Delhi, May 13 (PTI) Capital markets regulator Sebi has amended rules making it mandatory for at least one key personnel within an investment team of an Alternative Investment Fund (AIF) manager to obtain requisite certification.

The new requirement is aimed at boosting competency and professionalism in the AIF space.

In a notification dated May 10, Sebi said, "At least one key personnel, amongst the associated persons functioning in the key investment team of the Manager of an Alternative Investment Fund, shall obtain certification from the National Institute of Securities Market (NISM) by passing the NISM Series-XIX-C."

To give this effect, the Securities and Exchange Board of India (Sebi) has amended AIF rules.

The new rules have been made applicable from the same date. Through this requirement of certification for key personnel, the capital markets regulator is looking to ensure a higher proficiency in managing AIFs.

Last month, Sebi announced that certain changes in the private placement memorandum of AIFs can be submitted directly to the regulator rather than through a merchant banker in a bid to facilitate ease of doing business.

Also, the move is aimed at rationalising the cost of compliance for alternative investment funds.

The new requirement is aimed at boosting competency and professionalism in the AIF space.

In a notification dated May 10, Sebi said, "At least one key personnel, amongst the associated persons functioning in the key investment team of the Manager of an Alternative Investment Fund, shall obtain certification from the National Institute of Securities Market (NISM) by passing the NISM Series-XIX-C."

To give this effect, the Securities and Exchange Board of India (Sebi) has amended AIF rules.

The new rules have been made applicable from the same date. Through this requirement of certification for key personnel, the capital markets regulator is looking to ensure a higher proficiency in managing AIFs.

Last month, Sebi announced that certain changes in the private placement memorandum of AIFs can be submitted directly to the regulator rather than through a merchant banker in a bid to facilitate ease of doing business.

Also, the move is aimed at rationalising the cost of compliance for alternative investment funds.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 10.80 (+ 1.12)

- 64479733

- Pradhin

- 0.27 (+ 17.39)

- 41923542

- Sattva-Sukun-Lifecar

- 0.56 (+ 5.66)

- 34488002

- Alstone-Textiles

- 0.30 ( 0.00)

- 34091490

- Sunshine-Capital

- 0.25 ( -3.85)

- 30901660