SEBI to Survey Retail Market Participation & Risk Awareness

SEBI plans a pan-India survey to boost retail participation in the capital market, promote risk awareness, and address ecosystem gaps. The regulator aims to nurture domestic investment growth while remaining attractive to global investors.

Photograph: Kind courtesy Pixabay/Pexels.com

New Delhi, Dec 11 (PTI) Market regulator SEBI will conduct a pan India survey on how to bring more people into the capital market, create risk awareness and bridge the gaps in the ecosystem, a Sebi official said on Wednesday.

Sebi whole time member Ananth Narayan G said that volatility in the Indian markets is low and USD 14 billion FPI outflow in October-November was matched by an equivalent amount of inflow by the domestic investors, like mutual funds.

He, however, cautioned that there is no room for complacency.

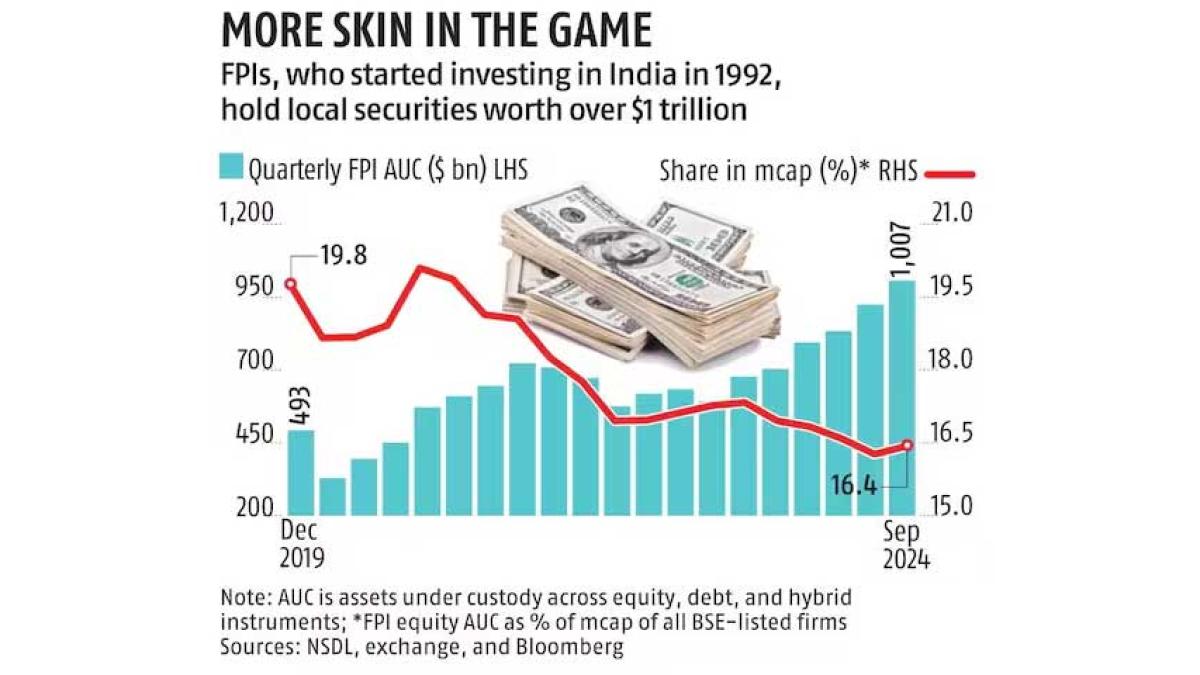

"While we celebrate the growth of domestic investors, it does not mean we do not need foreign investments. We need foreign investment. We have to ensure that we remain an attractive destination to draw in investment across the globe so that we can fund future growth," Narayan said at the CII Global Economic Policy Forum 2024.

He also said that this inflow from retail and fresh investors should not be taken for granted.

"We have to nurture the golden goose. We are worried about young people, many of them have not seen investment cycle or capital market downside (investing in market), Narayan said while wondering that if there is adequate risk awareness. The regulator, he said, is working with AMFI, exchanges and clearing corporations to increase investor awareness.

Narayan also said that Sebi will be launching a pan-India survey on how to bring more people into the capital market ecosystem. How to make them risk aware. And also, the gaps in the system and how to bridge the gap.

Sebi whole time member Ananth Narayan G said that volatility in the Indian markets is low and USD 14 billion FPI outflow in October-November was matched by an equivalent amount of inflow by the domestic investors, like mutual funds.

He, however, cautioned that there is no room for complacency.

"While we celebrate the growth of domestic investors, it does not mean we do not need foreign investments. We need foreign investment. We have to ensure that we remain an attractive destination to draw in investment across the globe so that we can fund future growth," Narayan said at the CII Global Economic Policy Forum 2024.

He also said that this inflow from retail and fresh investors should not be taken for granted.

"We have to nurture the golden goose. We are worried about young people, many of them have not seen investment cycle or capital market downside (investing in market), Narayan said while wondering that if there is adequate risk awareness. The regulator, he said, is working with AMFI, exchanges and clearing corporations to increase investor awareness.

Narayan also said that Sebi will be launching a pan-India survey on how to bring more people into the capital market ecosystem. How to make them risk aware. And also, the gaps in the system and how to bridge the gap.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 8.10 (+ 18.94)

- 352105814

- GTL Infrastructure

- 1.50 (+ 7.14)

- 20982285

- G G Engineering

- 0.90 (+ 11.11)

- 20091512

- AvanceTechnologies

- 0.54 ( -8.47)

- 18780688

- YES Bank Ltd.

- 17.33 (+ 2.61)

- 14468025

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.