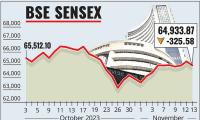

Sensex, Nifty Edge Up Ahead of US Inflation Data

Indian stock markets closed higher on Wednesday as investors awaited key US inflation data. Sensex rose by 16.09 points, while Nifty advanced 31.75 points. Read more.

Photograph: Utpal Sarkar / ANI Photo.

Mumbai, Dec 11 (PTI) Benchmark equity indices Sensex and Nifty closed higher in restricted trade on Wednesday as investors awaited key US inflation data for further cues.

The 30-share BSE Sensex rose by 16.09 points or 0.02 per cent to close at 81,526.14 even as 17 of its constituents declined and 13 advanced.

Snapping its three-day losing run, the broader NSE Nifty advanced 31.75 points or 0.13 per cent to settle at 24,641.80.

From the 30-share Sensex pack, Bajaj Finance, Nestle India, Bajaj Finserv, Asian Paints, UltraTech Cement, Infosys, Maruti, Bharti Airtel and Hindustan Unilever were among the gainers.

JSW Steel, Adani Ports, NTPC, State Bank of India, Reliance Industries, Tech Mahindra, Axis Bank, Titan and HDFC Bank were the laggards.

"The Indian market exhibited subtle movements, reflecting mixed sentiments prevailing in global markets ahead of the US CPI inflation data release, which could influence the Fed policy," Vinod Nair, Head of Research, Geojit Financial Services, said.

The BSE smallcap gauge climbed 0.35 per cent and the midcap index gained 0.25 per cent.

Among sectoral indices, Consumer Durables rose 0.59 per cent, Industrials by 0.40 per cent, Auto by 0.37 per cent, IT and Teck by 0.35 per cent each and FMCG by 0.34 per cent.

Utilities, Bankex, Power and Services were the laggards.

Meanwhile, shares of PNC Infratech surged 12 per cent to close at Rs 347.90 apiece, after the company announced the early completion of a key highway project in Uttar Pradesh, boosting investor sentiment.

During the day, the scrip of the company climbed 15 per cent to hit intraday high of Rs 357.15 apiece on the BSE.

On the other hand, stock of food delivery and quick-commerce major Swiggy fell 4 per cent to close at Rs 522.70 apiece, as investors booked profits after the one-month lock-in period for anchor investors expired.

As many as 2,146 stocks advanced, 1,840 declined and 110 remained unchanged on the BSE. The market capitalisation of BSE-listed firms climbed by Rs 91,110.2 crore to Rs 4,60,46,637.96 (USD 5.43 trillion).

"The market exhibited a lackluster performance on Wednesday as it traded within a narrow range of just 107 points, marking the smallest trading range over the past seven sessions.

"The index remained close to its previous trading range, with relatively low trading volume suggesting a compression in volatility," Ameya Ranadive Chartered Market Technician, CFTe, Sr Technical Analyst, StoxBox, said.

In Asian markets, Tokyo, Shanghai and Seoul closed higher, while Hong Kong settled in the negative territory.

European markets were trading on a mixed note. The US markets closed in the red on Tuesday.

Global oil benchmark Brent crude rose 0.98 per cent to USD 72.90 a barrel.

Foreign Institutional Investors (FIIs) bought equities worth Rs 1,285.96 crore on Tuesday, according to exchange data.

On Tuesday, the 30-share BSE Sensex edged up 1.59 points to close at 81,510.05. Falling for the third day, the NSE Nifty dropped by 8.95 points to settle at 24,610.05.

The 30-share BSE Sensex rose by 16.09 points or 0.02 per cent to close at 81,526.14 even as 17 of its constituents declined and 13 advanced.

Snapping its three-day losing run, the broader NSE Nifty advanced 31.75 points or 0.13 per cent to settle at 24,641.80.

From the 30-share Sensex pack, Bajaj Finance, Nestle India, Bajaj Finserv, Asian Paints, UltraTech Cement, Infosys, Maruti, Bharti Airtel and Hindustan Unilever were among the gainers.

JSW Steel, Adani Ports, NTPC, State Bank of India, Reliance Industries, Tech Mahindra, Axis Bank, Titan and HDFC Bank were the laggards.

"The Indian market exhibited subtle movements, reflecting mixed sentiments prevailing in global markets ahead of the US CPI inflation data release, which could influence the Fed policy," Vinod Nair, Head of Research, Geojit Financial Services, said.

The BSE smallcap gauge climbed 0.35 per cent and the midcap index gained 0.25 per cent.

Among sectoral indices, Consumer Durables rose 0.59 per cent, Industrials by 0.40 per cent, Auto by 0.37 per cent, IT and Teck by 0.35 per cent each and FMCG by 0.34 per cent.

Utilities, Bankex, Power and Services were the laggards.

Meanwhile, shares of PNC Infratech surged 12 per cent to close at Rs 347.90 apiece, after the company announced the early completion of a key highway project in Uttar Pradesh, boosting investor sentiment.

During the day, the scrip of the company climbed 15 per cent to hit intraday high of Rs 357.15 apiece on the BSE.

On the other hand, stock of food delivery and quick-commerce major Swiggy fell 4 per cent to close at Rs 522.70 apiece, as investors booked profits after the one-month lock-in period for anchor investors expired.

As many as 2,146 stocks advanced, 1,840 declined and 110 remained unchanged on the BSE. The market capitalisation of BSE-listed firms climbed by Rs 91,110.2 crore to Rs 4,60,46,637.96 (USD 5.43 trillion).

"The market exhibited a lackluster performance on Wednesday as it traded within a narrow range of just 107 points, marking the smallest trading range over the past seven sessions.

"The index remained close to its previous trading range, with relatively low trading volume suggesting a compression in volatility," Ameya Ranadive Chartered Market Technician, CFTe, Sr Technical Analyst, StoxBox, said.

In Asian markets, Tokyo, Shanghai and Seoul closed higher, while Hong Kong settled in the negative territory.

European markets were trading on a mixed note. The US markets closed in the red on Tuesday.

Global oil benchmark Brent crude rose 0.98 per cent to USD 72.90 a barrel.

Foreign Institutional Investors (FIIs) bought equities worth Rs 1,285.96 crore on Tuesday, according to exchange data.

On Tuesday, the 30-share BSE Sensex edged up 1.59 points to close at 81,510.05. Falling for the third day, the NSE Nifty dropped by 8.95 points to settle at 24,610.05.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 8.08 (+ 18.65)

- 331437391

- GTL Infrastructure

- 1.50 (+ 7.14)

- 19224768

- G G Engineering

- 0.89 (+ 9.88)

- 18649194

- AvanceTechnologies

- 0.56 ( -5.08)

- 14098564

- YES Bank Ltd.

- 17.32 (+ 2.55)

- 12831757

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.