Sensex, Nifty Hit Record Highs: Bank, Energy Shares Drive Gains

By Rediff Money Desk, MUMBAI Mar 04, 2024 16:57

Sensex and Nifty soared to new all-time highs driven by strong banking and energy shares. Moody's upgraded India's GDP forecast for 2024. Read more.

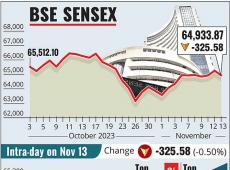

Mumbai, Mar 4 (PTI) Benchmark equity indices Sensex and Nifty settled at new record high levels on Monday in a highly volatile trade following buying in energy and banking shares as Moody's upgraded 2024 India GDP growth forecast on "better than expected" economic data.

Extending its rally to the fourth session in a row, the 30-share BSE Sensex rose by 66.14 points or 0.09 per cent to settle at an all-time high of 73,872.29. During the day, it jumped 183.98 points or 0.24 per cent to record intra-day high of 73,990.13.

The broader Nifty rose by 27.20 points or 0.12 per cent to close at a lifetime high of 22,405.60 points. During the day, it hit a record intra-day level of 22,440.90.

In the four-day record-breaking spree, Sensex rallied 1,567 points or 2.15 per cent while Nifty shot up 454 points or around 2 per cent.

Analysts said though benchmark indices closed at record levels, the market traded in a range. Gains were driven by buying in banks, energy and pharma shares while IT, FMCG and auto shares retreated, analysts said.

"The market traded in a range-bound manner due to weak global cues, while investors turned stock-specific due to the prevailing caution on broader indices. Further, the tepid consumption data influenced investors to refrain from FMCG and discretionary stocks," said Vinod Nair, Head of Research, Geojit Financial Services.

The global sentiment is likely to be cautious ahead of FED chair testimony and ECB policy later this week, Nair added.

Among Sensex shares, NTPC rose the most by 3.5 per cent. Power Grid gained 2.63 per cent, Reliance Industries by 1.03 per cent and Axis Bank by 0.90 per cent.

Bajaj Finserv, Tech Mahindra, ICICI Bank, Bharti Airtel and IndusInd Bank were also among the major gainers.

On the other hand, JSW Steel fell the most by 2.49 per cent. Mahindra & Mahindra, Tata Steel, UltraTech Cement, Infosys and Titan were among the laggards.

Global rating agency Moody's raised India's growth forecast for 2024 calendar year to 6.8 per cent, from 6.1 per cent earlier, on the back of 'stronger-than-expected' economic data of 2023 and fading global economic headwinds.

In the broader market, the BSE midcap gauge climbed 0.16 per cent while the smallcap index dipped 0.78 per cent.

Among the indices, oil & gas zoomed 1.88 per cent, energy jumped 1.71 per cent, power by 1.67 per cent, utilities by 1.45 per cent, telecommunication by 0.50 per cent and bankex by 0.39 per cent.

Commodities, consumer discretionary, FMCG, IT and teck were among the laggards.

The total market capitalisation of BSE-listed companies stood at Rs 3.93 lakh crore (USD 4.80 trillion).

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled in the green.

European markets were trading on a mixed note. The US markets ended with gains on Friday.

In a special trading session on Saturday, Sensex climbed 60.80 points or 0.08 per cent to reach its all-time closing high of 73,806.15. The Nifty went up by 39.65 points or 0.18 per cent to settle at a new closing high of 22,378.40.

Leading stock exchanges BSE and NSE conducted a special trading session in the equity and equity derivative segments on Saturday to check their preparedness to handle major disruption or failure at the primary site.

Global oil benchmark Brent crude climbed 0.30 per cent to USD 83.80 a barrel.

Foreign institutional investors (FIIs) offloaded equities worth Rs 81.87 crore on Saturday, according to exchange data.

Extending its rally to the fourth session in a row, the 30-share BSE Sensex rose by 66.14 points or 0.09 per cent to settle at an all-time high of 73,872.29. During the day, it jumped 183.98 points or 0.24 per cent to record intra-day high of 73,990.13.

The broader Nifty rose by 27.20 points or 0.12 per cent to close at a lifetime high of 22,405.60 points. During the day, it hit a record intra-day level of 22,440.90.

In the four-day record-breaking spree, Sensex rallied 1,567 points or 2.15 per cent while Nifty shot up 454 points or around 2 per cent.

Analysts said though benchmark indices closed at record levels, the market traded in a range. Gains were driven by buying in banks, energy and pharma shares while IT, FMCG and auto shares retreated, analysts said.

"The market traded in a range-bound manner due to weak global cues, while investors turned stock-specific due to the prevailing caution on broader indices. Further, the tepid consumption data influenced investors to refrain from FMCG and discretionary stocks," said Vinod Nair, Head of Research, Geojit Financial Services.

The global sentiment is likely to be cautious ahead of FED chair testimony and ECB policy later this week, Nair added.

Among Sensex shares, NTPC rose the most by 3.5 per cent. Power Grid gained 2.63 per cent, Reliance Industries by 1.03 per cent and Axis Bank by 0.90 per cent.

Bajaj Finserv, Tech Mahindra, ICICI Bank, Bharti Airtel and IndusInd Bank were also among the major gainers.

On the other hand, JSW Steel fell the most by 2.49 per cent. Mahindra & Mahindra, Tata Steel, UltraTech Cement, Infosys and Titan were among the laggards.

Global rating agency Moody's raised India's growth forecast for 2024 calendar year to 6.8 per cent, from 6.1 per cent earlier, on the back of 'stronger-than-expected' economic data of 2023 and fading global economic headwinds.

In the broader market, the BSE midcap gauge climbed 0.16 per cent while the smallcap index dipped 0.78 per cent.

Among the indices, oil & gas zoomed 1.88 per cent, energy jumped 1.71 per cent, power by 1.67 per cent, utilities by 1.45 per cent, telecommunication by 0.50 per cent and bankex by 0.39 per cent.

Commodities, consumer discretionary, FMCG, IT and teck were among the laggards.

The total market capitalisation of BSE-listed companies stood at Rs 3.93 lakh crore (USD 4.80 trillion).

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled in the green.

European markets were trading on a mixed note. The US markets ended with gains on Friday.

In a special trading session on Saturday, Sensex climbed 60.80 points or 0.08 per cent to reach its all-time closing high of 73,806.15. The Nifty went up by 39.65 points or 0.18 per cent to settle at a new closing high of 22,378.40.

Leading stock exchanges BSE and NSE conducted a special trading session in the equity and equity derivative segments on Saturday to check their preparedness to handle major disruption or failure at the primary site.

Global oil benchmark Brent crude climbed 0.30 per cent to USD 83.80 a barrel.

Foreign institutional investors (FIIs) offloaded equities worth Rs 81.87 crore on Saturday, according to exchange data.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 9.95 (+ 9.10)

- 188409319

- Thinkink Picturez

- 1.28 ( -4.48)

- 30095526

- Standard Capital

- 0.94 (+ 2.17)

- 16517444

- AvanceTechnologies

- 0.78 ( -2.50)

- 15411897

- Srestha Finvest

- 0.71 (+ 2.90)

- 15297031

MORE NEWS

India Needs Rs 15 Lakh Cr Infra Outlay for...

Union Minister Mansukh Mandaviya calls for Rs 15 lakh crore annual infrastructure...

Central Bank of India Q3 Profit Jumps 33% to Rs...

Central Bank of India's Q3 profit surged by 33% to Rs 959 crore, driven by increased...

India Launches First Edible Oil Consumption Survey

India's agriculture ministry has launched a nationwide survey to assess edible oil...

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.