Sensex Rebounds 358 pts on HDFC Bank, Reliance Gains

By Rediff Money Desk, MUMBAI Dec 21, 2023 16:39

Indian benchmark indices Sensex and Nifty rebounded on Thursday, driven by gains in HDFC Bank and Reliance Industries. Most sectors participated in the rally, with energy, metal, and banking sectors leading the charge.

Mumbai, Dec 21 (PTI) Benchmark equity indices Sensex and Nifty recovered by more than half cent on Thursday following buying in index majors HDFC Bank and Reliance Industries.

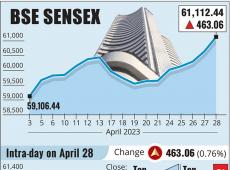

The 30-share BSE Sensex jumped 358.79 points or 0.51 per cent to settle at 70,865.10 with 21 of its stocks ending in the green and nine in the red.

The barometer opened lower and fell further by 585.92 points or 0.83 per cent to a low of 69,920.39. But, markets found the winning momentum in the afternoon session and climbed 452.4 points or 0.64 per cent to 70,958.71.

The broader Nifty rallied 104.90 points or 0.50 per cent to 21,255.05 as 38 of its constituents advanced and 12 declined. During the day, it hit a high of 21,288.35 and a low of 20,976.80.

Both key indices had hit record high levels in intra-day trade on Wednesday before closing sharply down by over 1 per cent. Sensex tanked 930 points while Nifty lost around 303 points.

Most sectors participated in the rebound on Thursday with energy, metal and banking sectors emerging as top performers, analysts said.

Buying in HDFC Bank and Reliance Industries helped indices to recover from day's lows, they said. RIL and HDFC contributed more than 300 points to Sensex gains.

Among the Sensex firms, Power Grid rose the most by 2.27 per cent, HDFC Bank by 1.82 per cent, Kotak Bank by 1.66 per cent, and Reliance Industries by 1.38 per cent. NTPC, State Bank of India, Tata Steel and Bharti Airtel were also among the gainers.

Bajaj Finance, Axis Bank, HCL Tech and Mahindra & Mahindra were among the major laggards.

"After a subdued start, the market reversed from the day's low amid buy-on-dips strategy. However, the overall trend is subdued, FIIs stayed muted ahead of festive break and global market traded on a negative note ahead of announcement of the US GDP data today," said Vinod Nair, Head of Research at Geojit Financial Services.

"Some consolidation is warranted in the near term due to peak valuation. A gradual rise in oil prices along with concern over high domestic food inflation may have a hindrance to the stretched rally of the last 2 months."

In the broader market, the BSE smallcap gauge jumped 1.69 per cent and midcap index climbed 1.61 per cent.

Among the indices, utilities rallied 2.46 per cent, power jumped 2.43 per cent, oil & gas (1.72 per cent), telecommunication (1.64 per cent) and energy (1.62 per cent).

Auto emerged as the only laggard.

In Asian markets, Seoul and Tokyo settled lower while Shanghai and Hong Kong ended in the green.

European markets were trading in the negative territory. The US markets ended lower on Wednesday.

Global oil benchmark Brent crude climbed 0.33 per cent to USD 79.96 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,322.08 crore on Wednesday, according to exchange data.

The 30-share BSE Sensex jumped 358.79 points or 0.51 per cent to settle at 70,865.10 with 21 of its stocks ending in the green and nine in the red.

The barometer opened lower and fell further by 585.92 points or 0.83 per cent to a low of 69,920.39. But, markets found the winning momentum in the afternoon session and climbed 452.4 points or 0.64 per cent to 70,958.71.

The broader Nifty rallied 104.90 points or 0.50 per cent to 21,255.05 as 38 of its constituents advanced and 12 declined. During the day, it hit a high of 21,288.35 and a low of 20,976.80.

Both key indices had hit record high levels in intra-day trade on Wednesday before closing sharply down by over 1 per cent. Sensex tanked 930 points while Nifty lost around 303 points.

Most sectors participated in the rebound on Thursday with energy, metal and banking sectors emerging as top performers, analysts said.

Buying in HDFC Bank and Reliance Industries helped indices to recover from day's lows, they said. RIL and HDFC contributed more than 300 points to Sensex gains.

Among the Sensex firms, Power Grid rose the most by 2.27 per cent, HDFC Bank by 1.82 per cent, Kotak Bank by 1.66 per cent, and Reliance Industries by 1.38 per cent. NTPC, State Bank of India, Tata Steel and Bharti Airtel were also among the gainers.

Bajaj Finance, Axis Bank, HCL Tech and Mahindra & Mahindra were among the major laggards.

"After a subdued start, the market reversed from the day's low amid buy-on-dips strategy. However, the overall trend is subdued, FIIs stayed muted ahead of festive break and global market traded on a negative note ahead of announcement of the US GDP data today," said Vinod Nair, Head of Research at Geojit Financial Services.

"Some consolidation is warranted in the near term due to peak valuation. A gradual rise in oil prices along with concern over high domestic food inflation may have a hindrance to the stretched rally of the last 2 months."

In the broader market, the BSE smallcap gauge jumped 1.69 per cent and midcap index climbed 1.61 per cent.

Among the indices, utilities rallied 2.46 per cent, power jumped 2.43 per cent, oil & gas (1.72 per cent), telecommunication (1.64 per cent) and energy (1.62 per cent).

Auto emerged as the only laggard.

In Asian markets, Seoul and Tokyo settled lower while Shanghai and Hong Kong ended in the green.

European markets were trading in the negative territory. The US markets ended lower on Wednesday.

Global oil benchmark Brent crude climbed 0.33 per cent to USD 79.96 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,322.08 crore on Wednesday, according to exchange data.

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- IFL Enterprises

- 1.36 (+ 4.62)

- 96270207

- Franklin Industries

- 3.90 (+ 4.56)

- 27488423

- Vodafone Idea L

- 16.17 ( -3.69)

- 21236550

- Indian Renewable

- 259.85 ( -4.55)

- 14220958

- AvanceTechnologies

- 0.91 ( 0.00)

- 11517194

MORE NEWS

Wipro Transfers Stake in Financial Outsourcing...

Wipro Holdings (UK) has transferred its entire stake in Wipro Financial Outsourcing...

Indian Markets Turn Negative After Record Highs

Indian stock markets experienced volatility on Thursday, turning negative after...

ASK Property Fund Invests Rs 190 Cr in...

ASK Property Fund has invested Rs 190 crore in a real estate project being developed by...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.