Sitharaman Meets Fintech CEOs: Regulatory Compliance Focus

By Rediff Money Desk, NEWDELHI Feb 26, 2024 18:23

Finance Minister Nirmala Sitharaman held a meeting with top fintech executives to discuss regulatory issues and compliance. The meeting comes after RBI's action against Paytm Payments Bank.

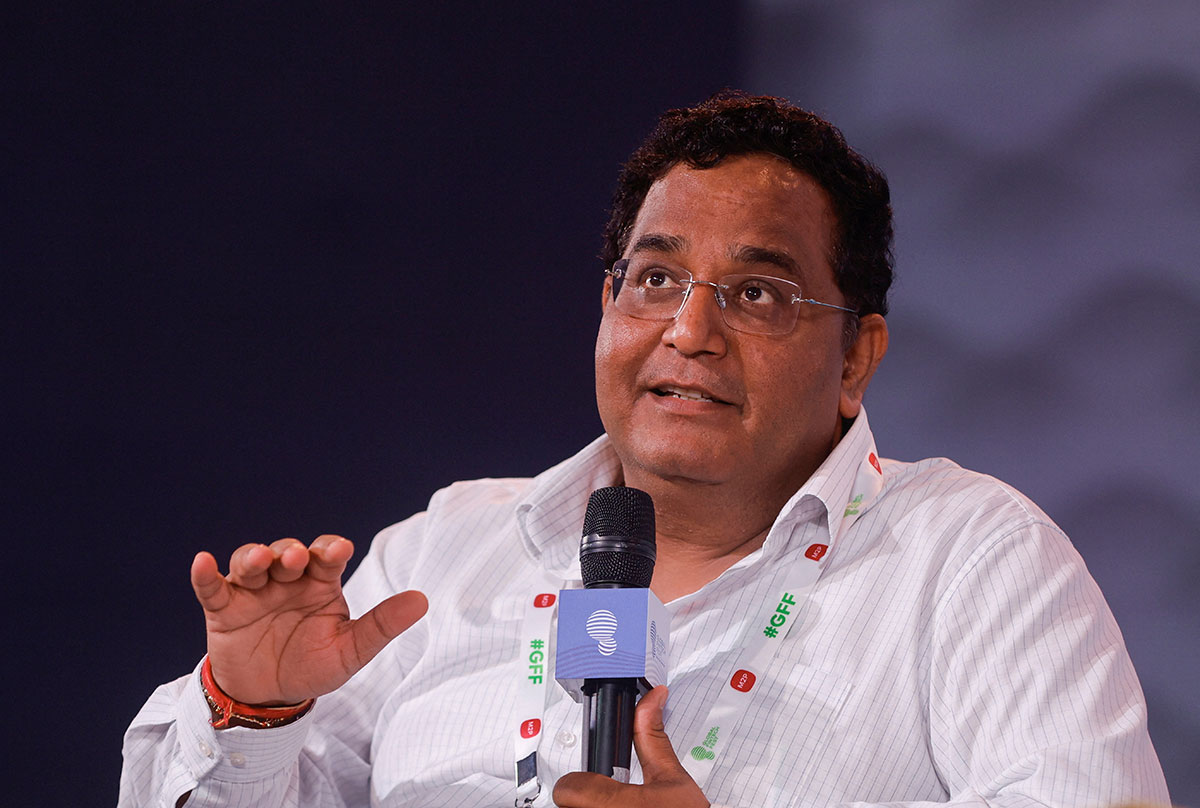

Photograph: Francis Mascarenhas/Reuters

New Delhi, Feb 26 (PTI) Finance Minister Nirmala Sitharaman on Monday chaired a meeting with top executives of around 50 fintech firms to discuss regulatory issues being faced by them and impressed upon them to strictly comply with the norms, according to an official.

The meeting was attended by top executives of private sector fintech firms, including RazorPay, PhonePe, Google Pay and Amazon Pay. NPCI officials too were present.

From the government side, the meeting was attended by Financial Services Secretary Vivek Joshi and MeitY (Ministry of Electronics and Information Technology) Secretary S Krishnan. RBI Deputy Governor T Rabi Sankar was also present.

The meeting comes at a time when the Reserve Bank of India's action against Paytm Payments Bank has put the spotlight on regulatory compliance in the fintech industry.

Representatives of Paytm was not invited for the meeting on Monday.

On January 31, RBI barred Paytm Payments Bank Ltd (PPBL) from accepting any fresh deposits or top ups from customers after February 29 for not complying with regulations. The deadline was later extended till March 15.

Last week, RBI advised the National Payments Corporation of India (NPCI) to examine the possibility of migrating the users from PPBL to four to five other banks. PPBL has 30 crore wallets and 3 crore bank customers.

The meeting was attended by top executives of private sector fintech firms, including RazorPay, PhonePe, Google Pay and Amazon Pay. NPCI officials too were present.

From the government side, the meeting was attended by Financial Services Secretary Vivek Joshi and MeitY (Ministry of Electronics and Information Technology) Secretary S Krishnan. RBI Deputy Governor T Rabi Sankar was also present.

The meeting comes at a time when the Reserve Bank of India's action against Paytm Payments Bank has put the spotlight on regulatory compliance in the fintech industry.

Representatives of Paytm was not invited for the meeting on Monday.

On January 31, RBI barred Paytm Payments Bank Ltd (PPBL) from accepting any fresh deposits or top ups from customers after February 29 for not complying with regulations. The deadline was later extended till March 15.

Last week, RBI advised the National Payments Corporation of India (NPCI) to examine the possibility of migrating the users from PPBL to four to five other banks. PPBL has 30 crore wallets and 3 crore bank customers.

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.