Sri Lanka Welcomes Chinese Investment in Key Sectors

By Rediff Money Desk, Colombo May 03, 2024 19:12

Sri Lankan Prime Minister Dinesh Gunawardena welcomes direct private investments from China in agriculture, renewable energy, IT, education, and water supply sectors.

Colombo, May 3 (PTI) Sri Lankan Prime Minister Dinesh Gunawardena has welcomed direct private investments from China and greater Chinese participation in sectors like agriculture, renewable energy, IT and education.

The issue of direct private investment came during a meeting of Prime Minister Gunawardena and Chinese Ambassador to Sri Lanka Qi Zhenhong on Thursday when they discussed ways for the early implementation of the agreements and Memorandums of Understanding (MoUs) reached between the two countries during the former's official visit to Beijing in March.

A statement from the Prime Minister's Media Office said Gunawardena and Qi met at the Temple Trees, the official residence of the Sri Lankan prime minister.

During the talks with Ambassador Qi Zhenhong, the Prime Minister stated that in addition to the implementation of the MoUs, Sri Lanka would also welcome direct private investments from China as well as investments in agriculture, renewable energy, IT, education and water supply sectors to provide long term solutions to economic issues, the statement said.

Ambassador Qi said he was pleased to see the resilience of Sri Lanka to overcome difficulties and assured China's continuous support to Sri Lanka's current efforts at debt restructuring and meeting economic challenges, it added.

Earlier on March 30, a joint statement by the two countries as Gunawardena wrapped up his official weeklong visit to China, said that China will play a positive role in easing the financial difficulties of cash-strapped Sri Lanka and its bid to achieve debt sustainability while Colombo will accelerate the formulation of a Belt and Road Initiative (BRI) cooperation plan to advance Beijing's projects in the island nation.

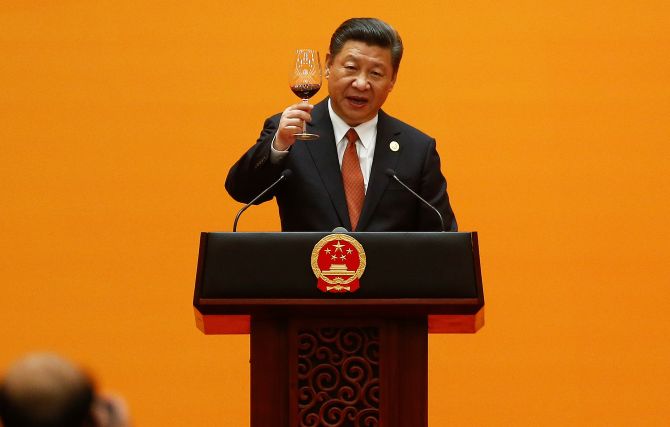

On March 27, China and Sri Lanka had signed nine agreements as Gunawardena met Chinese President Xi Jinping and Premier Li Qiang in Beijing amid Colombo's efforts to restructure its to revive its bankrupt economy.

China is Sri Lanka's largest bilateral lender owning 52 per cent of the USD 40 billion external debt when Sri Lanka announced its first sovereign default in 2022.

In March, the International Monetary Fund (IMF) had said it has reached a staff-level agreement with Sri Lanka for the next phase that would enable it access to USD 337 million from the nearly USD 3 billion bailout approved in 2023 for the island nation.

Two tranches of USD 330 million each were released in March and December 2023 even as the global lender has praised Colombo for its macroeconomic policy reforms, which it said, are starting to bear fruit.

The issue of direct private investment came during a meeting of Prime Minister Gunawardena and Chinese Ambassador to Sri Lanka Qi Zhenhong on Thursday when they discussed ways for the early implementation of the agreements and Memorandums of Understanding (MoUs) reached between the two countries during the former's official visit to Beijing in March.

A statement from the Prime Minister's Media Office said Gunawardena and Qi met at the Temple Trees, the official residence of the Sri Lankan prime minister.

During the talks with Ambassador Qi Zhenhong, the Prime Minister stated that in addition to the implementation of the MoUs, Sri Lanka would also welcome direct private investments from China as well as investments in agriculture, renewable energy, IT, education and water supply sectors to provide long term solutions to economic issues, the statement said.

Ambassador Qi said he was pleased to see the resilience of Sri Lanka to overcome difficulties and assured China's continuous support to Sri Lanka's current efforts at debt restructuring and meeting economic challenges, it added.

Earlier on March 30, a joint statement by the two countries as Gunawardena wrapped up his official weeklong visit to China, said that China will play a positive role in easing the financial difficulties of cash-strapped Sri Lanka and its bid to achieve debt sustainability while Colombo will accelerate the formulation of a Belt and Road Initiative (BRI) cooperation plan to advance Beijing's projects in the island nation.

On March 27, China and Sri Lanka had signed nine agreements as Gunawardena met Chinese President Xi Jinping and Premier Li Qiang in Beijing amid Colombo's efforts to restructure its to revive its bankrupt economy.

China is Sri Lanka's largest bilateral lender owning 52 per cent of the USD 40 billion external debt when Sri Lanka announced its first sovereign default in 2022.

In March, the International Monetary Fund (IMF) had said it has reached a staff-level agreement with Sri Lanka for the next phase that would enable it access to USD 337 million from the nearly USD 3 billion bailout approved in 2023 for the island nation.

Two tranches of USD 330 million each were released in March and December 2023 even as the global lender has praised Colombo for its macroeconomic policy reforms, which it said, are starting to bear fruit.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.