Star Health Q4 Profit Up 40% to Rs 142 Crore

By Rediff Money Desk, NEWDELHI Apr 30, 2024 12:51

Star Health and Allied Insurance reported a 40% increase in net profit to Rs 142 crore for the fourth quarter ended March 2024. The company's gross written premium also saw a significant rise.

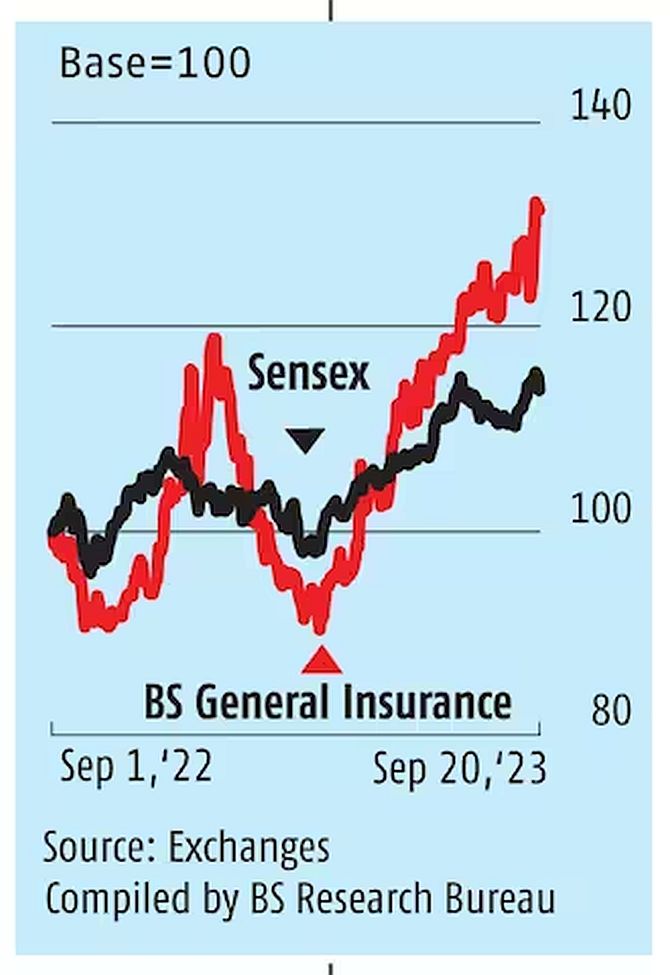

Illustration: Dominic Xavier/Rediff.com

New Delhi, Apr 30 (PTI) Star Health and Allied Insurance on Tuesday reported a 40 per cent increase in net profit to Rs 142 crore for the fourth quarter ended March 2024.

The standalone health insurer posted a net profit of Rs 102 crore during the same quarter of the previous year.

The company's gross written premium during the quarter rose to Rs 4,968 crore against Rs 4,199 crore in the year-ago period, Start Health said in a regulatory filing.

At the same time, the net premium also increased to Rs 4,570 crore as compared to Rs 3,993 crore in the same quarter a year ago.

The company posted a lower expense of management ratio of 30.7 per cent, against the regulatory requirement of 35 per cent, which offers an opportunity for growth, it said.

Underwriting profits grew robustly on the back of strong underwriting and risk management, the company said in a statement.

Star Health Insurance's market share was up 22 bps among general insurance companies to 5.26 per cent; while it continued to maintain its leadership in the retail health insurance sector with a 33 per cent market share, it said.

Cashless claims pay-out improved to 87 per cent of total claims in FY24 against 80 per cent in FY23, it said.

The company has further strengthened its distribution network with an addition of 16,000 agents in Q4FY24 and 75,000 agents in FY24, taking the overall number of agents servicing customers to 7,01,000.

The standalone health insurer posted a net profit of Rs 102 crore during the same quarter of the previous year.

The company's gross written premium during the quarter rose to Rs 4,968 crore against Rs 4,199 crore in the year-ago period, Start Health said in a regulatory filing.

At the same time, the net premium also increased to Rs 4,570 crore as compared to Rs 3,993 crore in the same quarter a year ago.

The company posted a lower expense of management ratio of 30.7 per cent, against the regulatory requirement of 35 per cent, which offers an opportunity for growth, it said.

Underwriting profits grew robustly on the back of strong underwriting and risk management, the company said in a statement.

Star Health Insurance's market share was up 22 bps among general insurance companies to 5.26 per cent; while it continued to maintain its leadership in the retail health insurance sector with a 33 per cent market share, it said.

Cashless claims pay-out improved to 87 per cent of total claims in FY24 against 80 per cent in FY23, it said.

The company has further strengthened its distribution network with an addition of 16,000 agents in Q4FY24 and 75,000 agents in FY24, taking the overall number of agents servicing customers to 7,01,000.

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 17.90 ( -3.35)

- 166585989

- Alstone Textiles

- 0.75 (+ 8.70)

- 47681821

- GTL Infrastructure

- 3.27 (+ 4.81)

- 44040612

- Visagar Financial

- 0.91 (+ 12.35)

- 29755394

- YES Bank Ltd.

- 23.70 (+ 0.77)

- 22163699

MORE NEWS

Indian Economy Growth: Exports, Manufacturing &...

Mumbai, June 30 (PTI) Healthy increase in the country's exports, improvement in the...

India Launches Anti-Dumping Probe on Glass...

New Delhi, June 30 (PTI) India has initiated an anti-dumping probe into the import of...

IBBI Launches Electronic Forms for Liquidation...

New Delhi, Jun 30 (PTI) To ease the compliance burden for insolvency professionals, and...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.