Stock Markets Rise: SBI, Reliance Lead Gains - India News

By Rediff Money Desk, MUMBAI Feb 14, 2024 17:36

Indian stock markets ended higher for the second day, driven by energy, metal, and utility stocks. SBI and Reliance Industries led the gains. WPI inflation eased in January.

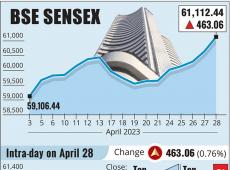

Mumbai, Feb 14 (PTI) Benchmark indices Sensex and Nifty reversed losses and closed higher for the second straight day on Wednesday following buying in energy, metal and utility stocks in the last hour of trade amid positive domestic inflation data.

The 30-share BSE Sensex rose by 267.64 points or 0.37 per cent to close at 71,822.83 points, extending gains for the second day. The index opened lower and fell further to a low of 70,809.84 points during intra-day trades.

Positive inflation data helped the index recover losses and hit a high of 71,938.59 points.

The broader NSE Nifty also gained 96.80 points or 0.45 per cent to end the day at 21,840.05 points.

"Nifty opened gap-down tracking the weak US markets however strong recovery in the select heavyweights not only pared losses but also helped the index to close around the day's high," Ajit Mishra, SVP - Technical Research, Religare Broking Ltd said.

State Bank of India was the biggest gainer in the Sensex pack, rising 4.24 per cent, followed by Tata Steel, Axis Bank, Maruti, NTPC, PowerGrid, ITC and Nestle India.

Reliance Industries jumped 1.15 per cent to end at Rs 2,962.60 apiece on BSE, taking its market valuation to a record of Rs 20 lakh crore.

Shares of SBI closed at Rs 743.35 apiece.

In contrast, Tech Mahindra, Sun Pharma, TCS, Infosys and HDFC Bank were among the laggards.

The wholesale price index (WPI)-based inflation eased to a three-month low of 0.27 per cent in January, mainly due to moderation of food prices, including vegetables. The WPI inflation was in the negative zone from April to October and had turned positive in November at 0.39 per cent.

"The domestic market staged a recovery from day's low, buoyed by renewed buying interest in banking stocks. Improving asset quality and the government's continued focus on fiscal prudence attracted PSU banks, yet concerns lingered regarding their elevated valuations," Vinod Nair, Head of Research, Geojit Financial Services said.

" The optimism was further supported by favourable inflation figures from the UK, contributing to a widespread recovery. However, IT shares experienced selling pressure following the release of higher-than-expected US CPI, prompting concerns over potential delays in interest rate cuts and its impact on client spending," Nair added.

Among sectoral indices, oil & gas gained 3.61 per cent, followed by energy (3.02 per cent), metal (1.97 per cent), power (1.81 per cent), utilities (1.63 per cent) and telecom (1.59 per cent).

Healthcare, IT and teck were the losers, declining up to 0.88 per cent.

BSE smallcap index inched up 1.16 per cent while midcap closed with a gain of 1.26 per cent.

In Asia, Japan's Nikkei 225 settled in the negative territory while Hong Kong's Hang Seng and South Korea's Kospi indices ended in the green.

China's financial markets are closed for the Lunar New Year holidays.

European markets were trading on a positive note in early deals.

The US market ended with significant losses in the overnight trade on Tuesday.

Global oil benchmark Brent crude rose 0.78 per cent to USD 82.64 a barrel on Tuesday.

In the previous session, Sensex surged 482.70 points or 0.68 per cent to settle at 71,555.19 points. Nifty climbed 127.20 points or 0.59 per cent to close at 21,743.25 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Tuesday as they purchased shares worth Rs 376.32 crore, according to exchange data.

The 30-share BSE Sensex rose by 267.64 points or 0.37 per cent to close at 71,822.83 points, extending gains for the second day. The index opened lower and fell further to a low of 70,809.84 points during intra-day trades.

Positive inflation data helped the index recover losses and hit a high of 71,938.59 points.

The broader NSE Nifty also gained 96.80 points or 0.45 per cent to end the day at 21,840.05 points.

"Nifty opened gap-down tracking the weak US markets however strong recovery in the select heavyweights not only pared losses but also helped the index to close around the day's high," Ajit Mishra, SVP - Technical Research, Religare Broking Ltd said.

State Bank of India was the biggest gainer in the Sensex pack, rising 4.24 per cent, followed by Tata Steel, Axis Bank, Maruti, NTPC, PowerGrid, ITC and Nestle India.

Reliance Industries jumped 1.15 per cent to end at Rs 2,962.60 apiece on BSE, taking its market valuation to a record of Rs 20 lakh crore.

Shares of SBI closed at Rs 743.35 apiece.

In contrast, Tech Mahindra, Sun Pharma, TCS, Infosys and HDFC Bank were among the laggards.

The wholesale price index (WPI)-based inflation eased to a three-month low of 0.27 per cent in January, mainly due to moderation of food prices, including vegetables. The WPI inflation was in the negative zone from April to October and had turned positive in November at 0.39 per cent.

"The domestic market staged a recovery from day's low, buoyed by renewed buying interest in banking stocks. Improving asset quality and the government's continued focus on fiscal prudence attracted PSU banks, yet concerns lingered regarding their elevated valuations," Vinod Nair, Head of Research, Geojit Financial Services said.

" The optimism was further supported by favourable inflation figures from the UK, contributing to a widespread recovery. However, IT shares experienced selling pressure following the release of higher-than-expected US CPI, prompting concerns over potential delays in interest rate cuts and its impact on client spending," Nair added.

Among sectoral indices, oil & gas gained 3.61 per cent, followed by energy (3.02 per cent), metal (1.97 per cent), power (1.81 per cent), utilities (1.63 per cent) and telecom (1.59 per cent).

Healthcare, IT and teck were the losers, declining up to 0.88 per cent.

BSE smallcap index inched up 1.16 per cent while midcap closed with a gain of 1.26 per cent.

In Asia, Japan's Nikkei 225 settled in the negative territory while Hong Kong's Hang Seng and South Korea's Kospi indices ended in the green.

China's financial markets are closed for the Lunar New Year holidays.

European markets were trading on a positive note in early deals.

The US market ended with significant losses in the overnight trade on Tuesday.

Global oil benchmark Brent crude rose 0.78 per cent to USD 82.64 a barrel on Tuesday.

In the previous session, Sensex surged 482.70 points or 0.68 per cent to settle at 71,555.19 points. Nifty climbed 127.20 points or 0.59 per cent to close at 21,743.25 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Tuesday as they purchased shares worth Rs 376.32 crore, according to exchange data.

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.