Tax Cut to Boost Growth: India's Budget Aims for 10.1% GDP

By Rediff Money Desk, New Delhi Feb 02, 2025 19:09

India's Finance Minister announced income tax cuts for the middle class, aiming to stimulate demand and propel growth in the next fiscal year.

Photograph: Anushree Fadnavis/Reuters

New Delhi, Feb 2 (PTI) Economic Affairs Secretary Ajay Seth on Sunday said the historic decision to give significant income tax relief will stimulate demand and propel growth in the next financial year for which the ministry has pegged the nominal GDP growth of 10.1 per cent.

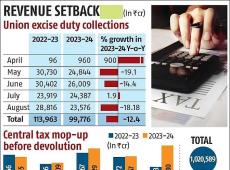

Finance Minister Nirmala Sitharaman on Saturday announced significant income tax cuts for the middle class. Individuals earning up to Rs 12.75 lakh in a year will not have to pay any taxes benefiting 1 crore taxpayers. However, the tax cuts will cost the exchequer about Rs 1 lakh crore.

The Union Budget has tried to address domestic headwinds through measures which can mitigate them, Seth told PTI in an interview.

"Very, very significant tax relief given to all taxpayers, and in particular to the middle class, is an attempt towards that direction, because some data is showing that consumption, as well as investment by the private sector is not to a level which requires or which is necessary for a higher growth path," he said.

"There are a few things which are beyond our control, like the geopolitics...but there are domestic factors which we can influence a lot better than what we can do anything about the external factors," he said.

So, the idea this budget tries to do is to have those measures in place, have those specific interventions in place, so that the domestic factors which can help in taking the growth rate to the upper limit 6.8 per cent, he said.

Asked if the Budget numbers are realistic, Seth said, 10.1 per cent nominal GDP is realistic.

The Economic Survey projected a growth rate of 6.3-6.8 per cent for 2025-26 on the back of a strong external account, calibrated fiscal consolidation and stable private consumption.

Finance Minister Nirmala Sitharaman on Saturday announced significant income tax cuts for the middle class. Individuals earning up to Rs 12.75 lakh in a year will not have to pay any taxes benefiting 1 crore taxpayers. However, the tax cuts will cost the exchequer about Rs 1 lakh crore.

The Union Budget has tried to address domestic headwinds through measures which can mitigate them, Seth told PTI in an interview.

"Very, very significant tax relief given to all taxpayers, and in particular to the middle class, is an attempt towards that direction, because some data is showing that consumption, as well as investment by the private sector is not to a level which requires or which is necessary for a higher growth path," he said.

"There are a few things which are beyond our control, like the geopolitics...but there are domestic factors which we can influence a lot better than what we can do anything about the external factors," he said.

So, the idea this budget tries to do is to have those measures in place, have those specific interventions in place, so that the domestic factors which can help in taking the growth rate to the upper limit 6.8 per cent, he said.

Asked if the Budget numbers are realistic, Seth said, 10.1 per cent nominal GDP is realistic.

The Economic Survey projected a growth rate of 6.3-6.8 per cent for 2025-26 on the back of a strong external account, calibrated fiscal consolidation and stable private consumption.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 7.34 (+ 1.10)

- 47198959

- Quadrant Televenture

- 0.37 (+ 2.78)

- 30470937

- Thinkink Picturez

- 0.33 (+ 3.13)

- 17035381

- GTL Infrastructure

- 1.57 (+ 1.29)

- 14581614

- Guj. Toolroom Lt

- 1.67 ( -3.47)

- 13296099

MORE NEWS

India, Qatar Sign MoU for Economic Cooperation

India and Qatar have signed an MoU to enhance economic cooperation, including...

Khadi Artisans Wages to Rise 20% from April: KVIC

Khadi and Village Industries Commission (KVIC) announces a 20% wage increase for Khadi...

Tata Technologies Announces Leadership Changes...

Tata Technologies announces key leadership changes to drive its growth strategy across...

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.