West Bengal GSDP Growth, Fiscal Deficit Reduction: Economic Review

West Bengal's economic review highlights GSDP growth, reduced fiscal deficit, and improved public financial management. Read about key indicators and social initiatives.

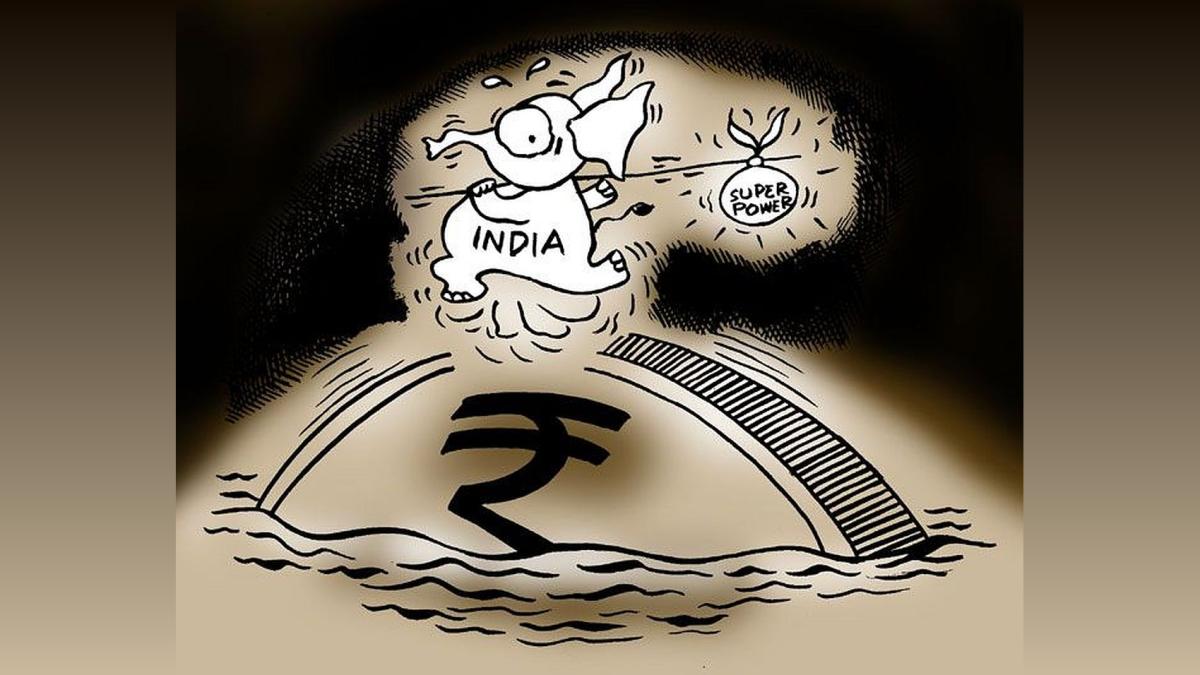

Illustration: Uttam Ghosh/Rediff.com

Kolkata, Feb 9 (PTI) West Bengal has witnessed increase in GSDP and reduction in debt and deficit indicators such as revenue deficit, fiscal deficit and debt-to-GSDP ratios, according to the Economic Review for 2023-24.

Revenue deficit as a per cent of GSDP reduced from 3.75 per cent in 2010-11 to 1.76 per cent in 2022-23, it said.

During the last few years, the West Bengal government has implemented significant public financial management reforms, resulting in improvement in the macro-fiscal parameters, according to the review which was presented on Thursday.

From 2010-11, the year when the present Trinamool Congress came to power, revenue deficit as a per cent of fiscal deficit decreased from 88.43 per cent to 54.63 per cent in 2022-23.

Debt stock of the state as a percentage of GSDP had been declining from 40.65 per cent in 2010-11 to 37.49 per cent in 2022-23.

Regarding the state's own tax revenue mobilisation, the review said it has increased from Rs 21,128 crore in 2010-11 to Rs 83,608 crore.

The review also said that asset-creating capital expenditure also showed an increasing trend from Rs 2,633 crore in 2010-11 to Rs 22,753 crore in 2022-23.

The West Bengal government has also taken initiatives to provide social protection to the vulnerable segments of society.

Expenditure on social services has increased from Rs 6,845 crore in 2010-11 to Rs 77,795 crore in 2022-23, the review stated.

Expenditure on agriculture and agri-allied sector increased from Rs 3,029 crore in 2010-11 to Rs 1,7265 crore in 2022-23. PTI dc

Revenue deficit as a per cent of GSDP reduced from 3.75 per cent in 2010-11 to 1.76 per cent in 2022-23, it said.

During the last few years, the West Bengal government has implemented significant public financial management reforms, resulting in improvement in the macro-fiscal parameters, according to the review which was presented on Thursday.

From 2010-11, the year when the present Trinamool Congress came to power, revenue deficit as a per cent of fiscal deficit decreased from 88.43 per cent to 54.63 per cent in 2022-23.

Debt stock of the state as a percentage of GSDP had been declining from 40.65 per cent in 2010-11 to 37.49 per cent in 2022-23.

Regarding the state's own tax revenue mobilisation, the review said it has increased from Rs 21,128 crore in 2010-11 to Rs 83,608 crore.

The review also said that asset-creating capital expenditure also showed an increasing trend from Rs 2,633 crore in 2010-11 to Rs 22,753 crore in 2022-23.

The West Bengal government has also taken initiatives to provide social protection to the vulnerable segments of society.

Expenditure on social services has increased from Rs 6,845 crore in 2010-11 to Rs 77,795 crore in 2022-23, the review stated.

Expenditure on agriculture and agri-allied sector increased from Rs 3,029 crore in 2010-11 to Rs 1,7265 crore in 2022-23. PTI dc

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 6.96 ( -1.69)

- 32087619

- Spicejet Ltd.

- 45.48 ( -6.38)

- 24487576

- Srestha Finvest

- 0.56 (+ 3.70)

- 15767473

- G G Engineering

- 1.00 ( 0.00)

- 13488004

- YES Bank Ltd.

- 16.20 (+ 0.31)

- 11982994

© 2025 Rediff.com India Limited. All rights reserved.

© 2025 Rediff.com India Limited. All rights reserved.