Banking Frauds Rise in FY24, Amount Drops 47%: RBI Report

India's banking sector saw a rise in fraud cases in FY24, but the amount involved decreased by 47%. RBI's annual report highlights key trends and initiatives to combat fraud.

Photograph: Kind courtesy Mikhail Nilov/Pexels.com

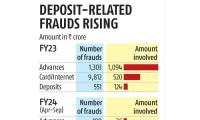

Mumbai, May 30 (PTI) The number of frauds in the banking sector went up to 36,075 in 2023-24 year-on-year, but the amount involved reduced by 46.7 per cent to Rs 13,930 crore, according to the Reserve Bank's annual report released on Thursday.

The RBI report also said that with an aim to curb frauds and enhance the payment experience further, the introduction of real-time payee name validation before the actual fund transfer will be explored in compliance with newly enacted The Digital Personal Data Protection Act, 2023'.

During 2023-24, the amount involved in frauds was Rs 13,930 crore, down from Rs 26,127 crore a year ago. The number of frauds increased to 36,075 during 2023-24 from 13,564 in the preceding financial year.

An assessment of bank group-wise fraud cases over the last three years indicates that while private sector banks reported maximum number of frauds, public sector banks continued to contribute maximum to the fraud amount, said the Annual Report for 2023-24.

"Frauds have occurred predominantly in the category of digital payments (card/internet), in terms of number. In terms of value, frauds have been reported primarily in the loan portfolio (advances category)," the report said.

While small value card/internet frauds contributed maximum to the number of frauds reported by the private sector banks, the frauds in public sector banks were mainly in loan portfolio.

Further, an analysis of the vintage of frauds reported during 2022-23 and 2023-24 shows a significant time-lag between the date of occurrence of a fraud and its detection.

"The amount involved in frauds that occurred in previous financial years formed 94 per cent of the frauds reported in 2022-23 in terms of value," the report said.

Similarly, 89.2 per cent of the frauds reported in 2023-24 by value occurred in previous financial years.

The RBI report also said that with an aim to curb frauds and enhance the payment experience further, the introduction of real-time payee name validation before the actual fund transfer will be explored in compliance with newly enacted The Digital Personal Data Protection Act, 2023'.

During 2023-24, the amount involved in frauds was Rs 13,930 crore, down from Rs 26,127 crore a year ago. The number of frauds increased to 36,075 during 2023-24 from 13,564 in the preceding financial year.

An assessment of bank group-wise fraud cases over the last three years indicates that while private sector banks reported maximum number of frauds, public sector banks continued to contribute maximum to the fraud amount, said the Annual Report for 2023-24.

"Frauds have occurred predominantly in the category of digital payments (card/internet), in terms of number. In terms of value, frauds have been reported primarily in the loan portfolio (advances category)," the report said.

While small value card/internet frauds contributed maximum to the number of frauds reported by the private sector banks, the frauds in public sector banks were mainly in loan portfolio.

Further, an analysis of the vintage of frauds reported during 2022-23 and 2023-24 shows a significant time-lag between the date of occurrence of a fraud and its detection.

"The amount involved in frauds that occurred in previous financial years formed 94 per cent of the frauds reported in 2022-23 in terms of value," the report said.

Similarly, 89.2 per cent of the frauds reported in 2023-24 by value occurred in previous financial years.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795