Domestic Air Passenger Traffic to Continue Growth in FY25: Report

India's aviation sector is expected to see continued growth in domestic air passenger traffic in FY25, with airlines projecting a net loss of Rs 3,000-4,000 crore. The report highlights the stable outlook despite challenges like supply chain issues and pilot shortages.

Mumbai, Jul 9 (PTI) The momentum in air passenger traffic is expected to continue and airlines' net loss is projected to be Rs 3,000-4,000 crore in the year ending March 2025, both trends similar to the previous financial year, a report said on Tuesday.

In June, the domestic air passenger traffic was estimated at 132.8 lakh, around 3.7 per cent lower than seen in May but about 6.3 per cent higher compared to the year-ago period.

Rating agency Icra said the outlook for the country's aviation industry is stable amid the continued recovery in domestic and international air passenger traffic, with a relatively stable cost environment and expectations of the trend continuing in FY2025.

"The momentum in air passenger traffic witnessed in FY2024 is expected to continue into FY2025, though further expansion in yields from the current levels may be limited," it noted.

According to its report, the pace of recovery in industry earnings is likely to be gradual owing to the high fixed-cost nature of the business and the net loss is expected to be Rs 3,000-4,000 crore this fiscal as seen in the previous financial year.

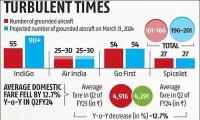

While mentioning about supply chain issues, Icra said it is estimated that 24-26 per cent of the total fleet of Indian airlines in operations was grounded by March 31, 2024.

"Considering the bulk recall of the engines globally by P&W and other existing issues with the original equipment manufacturer's (OEM's) engines, the testing by P&W is likely to take longer, around 250-300 days.

"This will result in increased operating expenses towards the cost of grounding, increased lease rentals due to additional aircraft being taken on lease to offset the grounded capacity, rising lease rates and lower fuel efficiency (due to replacement by older aircraft taken on spot lease), which will adversely impact an airline's cost structure," the report said.

However, healthy yields, high passenger load factor (PLF) and partial compensation available from engine Original Equipment Manufacturers (OEMs) would help absorb the impact to an extent.

In the current fiscal, the report said the industry has also faced challenges related to the availability of pilots and cabin crew, leading to several flight cancellations and delays. Such issues impact the capacity availability and add to customer grievances, it added.

In the first quarter of FY2025, domestic air passenger traffic was around 402.7 lakh with an annual 4.4 per cent growth.

"The airlines' ability to raise yields proportionate to their input cost increases will be key to expand their profitability margins," the report said.

In June, the domestic air passenger traffic was estimated at 132.8 lakh, around 3.7 per cent lower than seen in May but about 6.3 per cent higher compared to the year-ago period.

Rating agency Icra said the outlook for the country's aviation industry is stable amid the continued recovery in domestic and international air passenger traffic, with a relatively stable cost environment and expectations of the trend continuing in FY2025.

"The momentum in air passenger traffic witnessed in FY2024 is expected to continue into FY2025, though further expansion in yields from the current levels may be limited," it noted.

According to its report, the pace of recovery in industry earnings is likely to be gradual owing to the high fixed-cost nature of the business and the net loss is expected to be Rs 3,000-4,000 crore this fiscal as seen in the previous financial year.

While mentioning about supply chain issues, Icra said it is estimated that 24-26 per cent of the total fleet of Indian airlines in operations was grounded by March 31, 2024.

"Considering the bulk recall of the engines globally by P&W and other existing issues with the original equipment manufacturer's (OEM's) engines, the testing by P&W is likely to take longer, around 250-300 days.

"This will result in increased operating expenses towards the cost of grounding, increased lease rentals due to additional aircraft being taken on lease to offset the grounded capacity, rising lease rates and lower fuel efficiency (due to replacement by older aircraft taken on spot lease), which will adversely impact an airline's cost structure," the report said.

However, healthy yields, high passenger load factor (PLF) and partial compensation available from engine Original Equipment Manufacturers (OEMs) would help absorb the impact to an extent.

In the current fiscal, the report said the industry has also faced challenges related to the availability of pilots and cabin crew, leading to several flight cancellations and delays. Such issues impact the capacity availability and add to customer grievances, it added.

In the first quarter of FY2025, domestic air passenger traffic was around 402.7 lakh with an annual 4.4 per cent growth.

"The airlines' ability to raise yields proportionate to their input cost increases will be key to expand their profitability margins," the report said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795