EPFO: Easier PF/Pension Withdrawal After Job Loss

x

EPFO increases the period for final settlement/withdrawal of PF & pension money after unemployment. New rules & benefits explained.

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Oct 14 (PTI) Unemployed members of retirement fund body EPFO will now be able to avail final settlement or full withdrawal of funds from provident fund as well as pension accounts after 12 months and 36 months of unemployment, respectively.

The decision to amend the scheme was taken by apex decision making body of the Employees' Provident Fund Organisation (EPFO), the Central Board of Trustees headed by Labour Minister Mansukh Mandaviya, in a meeting held on Monday.

Presently, the scheme provides for withdrawal of all funds from the provident fund as well as pension account after two months of continuous unemployment.

A senior official explained that the decision was taken to ensure social security benefits to the formal sector workers in the country who generally exit the ambit of the EPFO after two months of unemployment.

He explained that most of these unemployed youth are required to enrol again with the EPFO when they get another jobs and they lose chances of getting pension and other benefits as the account becomes pensionable only after combined service of 10 years or more.

The ministry in a statement on Monday said that it is also decided to change the period for availing premature final settlement of EPF from the existing 2 months to 12 months and final pension withdrawal from 2 months to 36 months.

The liberalization of partial withdrawals ensures members can meet immediate financial needs without compromising their retirement savings or pension entitlements.

According to the statement, a provision has been made for earmarking 25 per cent of the contributions in the members' account as minimum balance to be maintained by the member at all times.

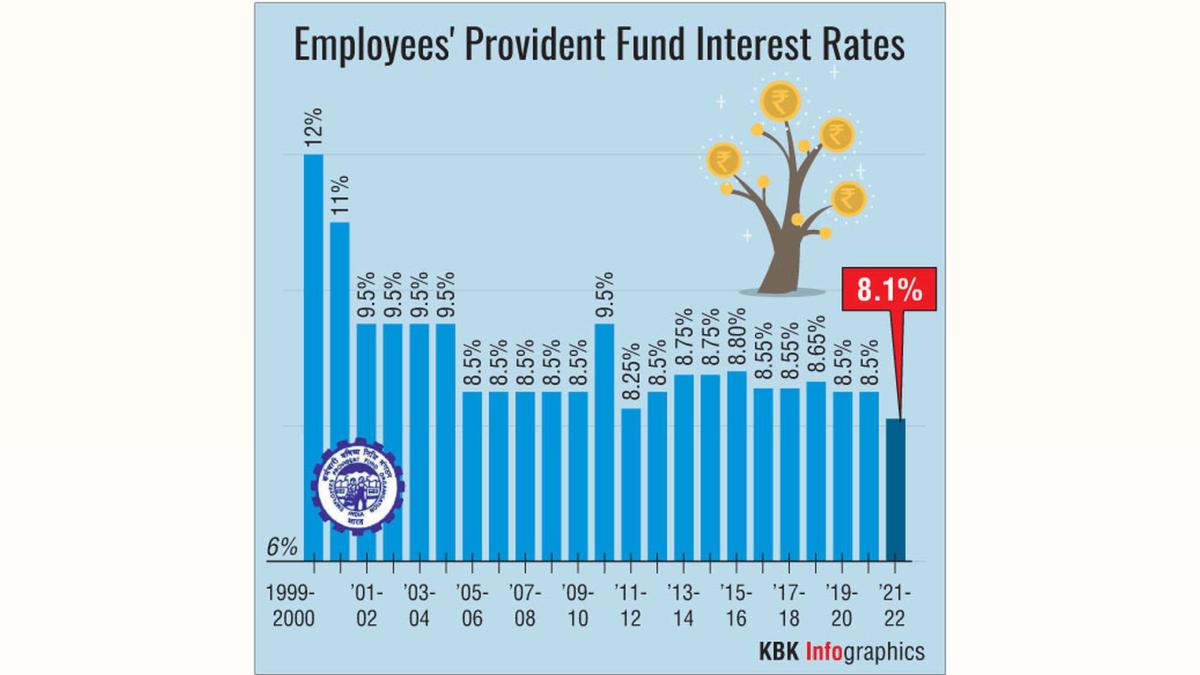

This will enable the member to enjoy high rate of interest offered by the EPFO (presently 8.25 per cent per annum ) along with compounding benefits to accumulate a high value retirement corpus.

This rationalization enhances ease of access while ensuring members maintain a sufficient retirement corpus, it has stated. PTI KKS 1.0.

The decision to amend the scheme was taken by apex decision making body of the Employees' Provident Fund Organisation (EPFO), the Central Board of Trustees headed by Labour Minister Mansukh Mandaviya, in a meeting held on Monday.

Presently, the scheme provides for withdrawal of all funds from the provident fund as well as pension account after two months of continuous unemployment.

A senior official explained that the decision was taken to ensure social security benefits to the formal sector workers in the country who generally exit the ambit of the EPFO after two months of unemployment.

He explained that most of these unemployed youth are required to enrol again with the EPFO when they get another jobs and they lose chances of getting pension and other benefits as the account becomes pensionable only after combined service of 10 years or more.

The ministry in a statement on Monday said that it is also decided to change the period for availing premature final settlement of EPF from the existing 2 months to 12 months and final pension withdrawal from 2 months to 36 months.

The liberalization of partial withdrawals ensures members can meet immediate financial needs without compromising their retirement savings or pension entitlements.

According to the statement, a provision has been made for earmarking 25 per cent of the contributions in the members' account as minimum balance to be maintained by the member at all times.

This will enable the member to enjoy high rate of interest offered by the EPFO (presently 8.25 per cent per annum ) along with compounding benefits to accumulate a high value retirement corpus.

This rationalization enhances ease of access while ensuring members maintain a sufficient retirement corpus, it has stated. PTI KKS 1.0.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005